Life Income Joint and Survivor Settlement (Terms Explained)

Life income joint and survivor settlement option guarantees ensure a redistribution of policy payments. You can add different lfie insurance settlement options to both term and whole life insurance policies for as low as $10/month.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

With life insurance, there are difficult decisions to consider, not least of which things like your life income joint and survivor settlement option guarantees.

We will help you understand your options when it comes to life insurance settlement options. For example, we’ll answer important life insurance questions like what are life income joint and survivor settlement option guarantees, and how does this type of settlement compare with other types of life insurance settlements.

We’ll help you understand the difference between cash settlements and distributed settlements, as well as reveal why particular settlement options may end up costing you more. You can add them to both term and whole life insurance policies, starting as low as $10.02/month.

Read on to get the inside scoop on life income and joint survivor settlement option guarantees for term life or whole life insurance. But before you do, check out our instant quote tool to see how you can get affordable insurance today. Simply click on “Get Free Quotes” to access a customized life insurance quote instantly.

What are life income joint and survivor settlement options?

A life insurance settlement is simply the payment to a beneficiary from a life insurance company for the settlement of a claim. For example, a life insurance company just paid a $100,000 death benefit to a beneficiary. In its simplest form, a full cash payment settlement option is provided to the beneficiary in a lump sum upon settlement of the claim. Another term for cash payment settlement option is a lump sum payment, which provides the entire death benefit amount to the beneficiary at once.

However, over time, insurance companies found that paying the full amount to a beneficiary after a claim might not be in the best interest of the customer. They introduced alternative options to better suit the financial needs and preferences of the beneficiaries.

In short, the settlement options definition refers to the various ways of payout.

According to Quizlet, a settlement option for a life insurance policy can be tricky. However, they are offered by most insurance providers.

Quizlet is a useful tool for consumers to gain a better understanding of settlement options. By answering questions like “Which of the following settlement options in life insurance is known as straight life?” or “Which of the following statements regarding the taxation of modified endowment contracts is false?” the tool helps consumers learn about life insurance settlement option types.

Understanding how you can receive payments is an important component of managing your financial future. By understanding how much and how often you might receive payments, you can optimize your cash flow income for tax purposes and provide financial certainty in managing your household budget.

Let’s have a look at settlement types in a bit more detail to help you determine which options are right for you.

How do life income joint and survivor settlement option guarantees work?

Having a life income policy provides ease of mind if you are living on a fixed income and want to depend upon reliable cash flow for your remaining years.

In many cases, though, there might be co-beneficiaries of a policy. Typically, for these policies, if a policyholder dies, the policy will pay out the remainder of the cash value to the surviving beneficiary. This could create a headache for the surviving beneficiary with tax consequences and the loss of a reliable revenue stream. To avoid these issues, a fixed period annuity settlement option can be chosen, providing regular payments over a set period, thus helping to manage tax liabilities and maintain a steady income stream.

Life income joint and survivor settlement option guarantees ensure that if one of the beneficiaries dies, the surviving member will continue to receive a regular revenue stream that will be adjusted for a higher amount.

Additionally, the joint and survivor annuity also provides for the naming of an additional beneficiary who would receive the cashout of the policy if both beneficiaries die.

Life Insurance Settlement Options

Options for settling life insurance benefits payouts have an interesting history. Originally, life insurance settlements operated only as lump-sum cash payments.

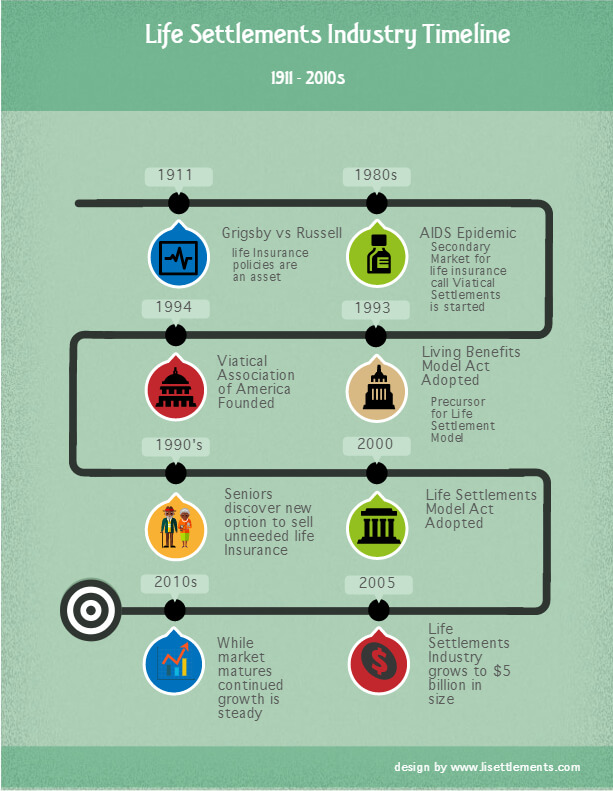

A complete timeline of the history of settlements is depicted in the image below.

The fundamental concept of separating the benefit component of a life insurance policy from the policy itself carries through to how settlement payments are structured for today’s insurance policy claims.

Default Life Insurance Settlement Options

There are two main ways the cash value of a benefit is paid out:

- The traditional process. A policyholder passes away, a claim is made, and the beneficiary receives the proceeds.

- The policyholder sells the policy benefit to a third party, who continues to make payments on the policy in exchange for a benefit payout at a later time.

We’ll cover the second way in more detail later in the article. First, let’s explore the different ways traditional life insurance claims are paid.

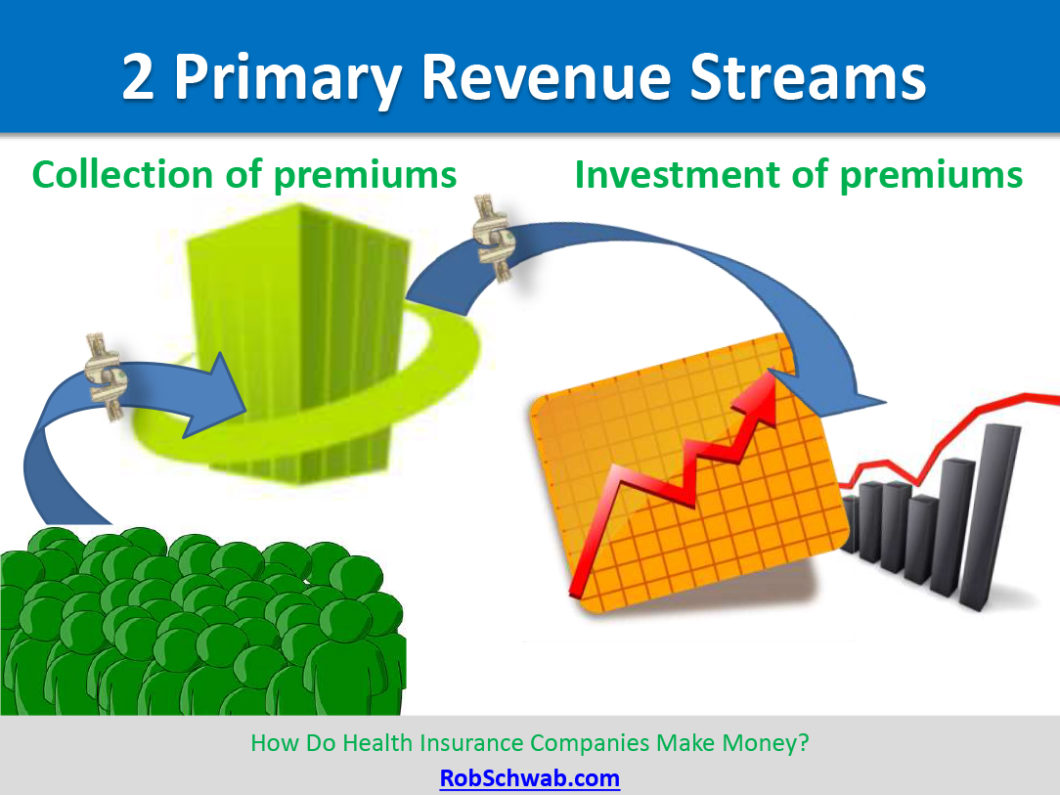

Life insurance companies don’t want to pay out large cash payments. Much of the cash an insurance company takes in from premiums is invested and the returns made from investments are what keep the insurance company profitable.

By offering claimants options with different timelines and amounts for payouts, insurance companies can hold more cash and invest for longer. Here are the main settlement option types:

- Lump sum – Lump sum payments are the most obvious. This is when all benefits due are delivered to a beneficiary in one payment. For example, if you have a claim on a $100,000 benefit, you receive the full $100,000 at one time.

- Specific Income – Insurance companies allow you to receive payments over time with interest. A beneficiary may opt to receive the benefits in specific amounts until all the benefits due plus interest earned on policy dividends are paid. There are two subtypes which of all the following best describe the fixed-period settlement option: fixed payment and fixed period.

- Fixed payment – The beneficiary chooses to receive five equal payments of $20,000. The insurance company will agree to pay $20,000 plus interest due to the policyholder over time until the full amount due is paid.

- Fixed period – With the fixed period settlement option, the beneficiary chooses a period of years they would like to receive income. For example, a beneficiary may want to receive income for 20 years on a $100,000 benefit claim. This means they will receive distributions of $5,000 plus interest each year until the benefit due is paid.

- Interest Income – Some beneficiaries may not need the benefit payment at the current time. If they are financially stable, the interest-only settlement option allows them to choose to receive only the interest that’s made on the benefit amount each year. The benefit might be paid at a later time to cover big items such as a child’s college tuition or might be passed on to a child to help their financial future.

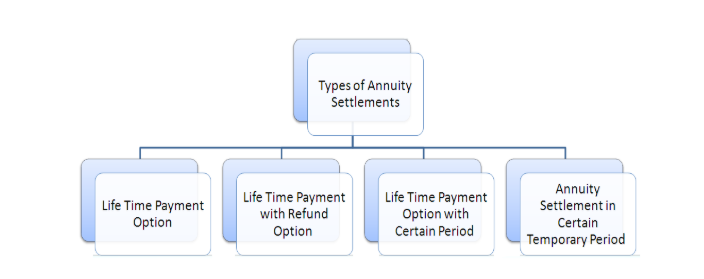

- Life Income Option – The insurance company agrees to make a periodic payment to the beneficiary for the remainder of their lifetime. According to CNN Money, the payments are structured in the same way as annuity settlement options.

In fact, annuities are structured very similarly to life income settlements. You can see the similar options that annuities pay settlements in the image below.

Based on the beneficiary’s life expectancy, insurers calculate how much and how long they would have to make payments for a life income benefit payout. Within the life income bucket, there are three options.

- Life income with period certain – Payments of a certain amount will be paid to the beneficiary for life. However, if the beneficiary dies before a predetermined period of time, a new beneficiary will receive the fixed payments for the remainder of the stated period.

- Joint and survivor – This is when two or more beneficiaries are named. Most commonly this can be a couple or siblings. Payments will continue to each of the beneficiaries at predetermined percentages. If a beneficiary dies, the survivor continues to collect full payments.

- Life refund – Payments continue to the beneficiary until the total payments made are equal to what would have been paid as a lump sum amount for the total original benefit amount.

Let’s take a closer look at what actually happens when your income payments are made. In 2018, life insurance benefits and claims totaled $784 billion. While policies structured with multiple beneficiaries make payouts more complicated than ever, some people are leaving valid policies left unclaimed — so much so that in 2017 almost $7.4 billion went unclaimed.

What are life income joint and survivor settlement guarantees for beneficiaries?

For the most part, insurance companies are required to return to a beneficiary or beneficiaries the full value of a benefit claim. It seems to make sense to receive a lump sum amount, so why would someone ever want to participate in any of the life income payment options?

What is a life insurance settlement option guaranteed? Well, for people who aren’t interested in investing their time or hiring professionals to manage money, receiving a large amount of money all at once isn’t such a great thing.

Additionally, when there are multiple beneficiary types like the ones listed below, which of the following has the right to change a settlement option in a life insurance policy, things can get pretty complicated:

- primary beneficiaries

- co-beneficiaries

- contingent beneficiaries

Instead, determining your own settlement type based on your own individual need may allow you to rely on your insurance company to grow your money at a defined interest rate while you collect reliable payments.

The table below provides a summary of the life insurance settlement options definitions with features that could benefit different beneficiary types.

Life Insurance Settlement Options

| Settlement Type | Best For | Duration of Payments |

|---|---|---|

| Lump Sum | Someone who can manage their own investments. | One payment is made for the full amount. |

| Interest Only | Someone who is financially stable and can leave the benefit amount to pass on to a new beneficiary. | Payments continue until the benefit amount is requested. |

| Specific Income – Fixed Period | Someone who wants to ensure income for a specific period of time. For example, a beneficiary might want income to last until his or her own retirement income is available. | Payments will last only for the duration of the period and payments will be divided equally for each period. |

| Specific Income – Fixed Payment | Someone who wants to receive a specific payment amount. For instance, someone might be investing money on their own over time and want money not ready to invest to continue to collect interest. | The amount of payments will be equal to the benefit amount / the fixed payment amount. |

| Life Income with Period Certain | Someone who wants to receive reliable income payments for their lifetime. | Payments will last until the beneficiary dies. |

| Life Income for Joint and Survivor | Multiple beneficiaries who want to ensure surviving beneficiaries continue to get life income payments | Payments will last until the last beneficiary dies. |

| Life Income with Refund | Someone who wants to extend payments as long as possible but ensure they get the full value of their fund paid even if the die early. Payments will continue on to a new beneficiary. | Payments will be made until the value of payments equal the value of the benefit amount. |

Let’s take a look at a few real-world scenarios to determine how long the beneficiaries will receive payments under any single life settlement option.

All of the following are true regarding a decreasing policy term except where coverage has ended for the policy, or the policyholder utilized all of the benefits of the policy before passing on.

Scenario 1 – Life Income with Period Certain

Tom is the 67-year-old beneficiary of his brother’s life insurance policy. The benefit amount is $500,000. Tom is collecting Social Security and a small pension to cover his monthly expenses. He is in great health and very active, but he does have high blood pressure, which he manages with medication. His brother and father both passed away from heart attacks, but unlike Tom, both were smokers.

Tom wants to move to a slightly more expensive condo community and wants to take out a 15-year mortgage. His payments will be about $3,000 per month more than his current rent expense.

To ensure that his mortgage can be paid, he requests that the benefit payments from the insurance company be sent to him in payments of $4,000 per month for 15 years.

At the end of the 15 years, he will take a lump sum payment of any remaining benefit amount plus interest.

Scenario 2 – Joint & Survivor Life Income Annuity

Geoffrey and Dolores are a retired couple ages 72 and 68, respectively. They live entirely off of Geoffrey’s pension income and Social Security. Geoffrey and Dolores have also been looking after his cousin, who had health issues for several years. When Geoffrey’s cousin passes away, he leaves Geoffrey and Dolores a life insurance benefit of $300,000. The couple decides to receive joint and survivor life income payments.

Initial payments of $3,000 per month are paid to Geoffrey and $1,000 per month is paid to Dolores.

After two years, Geoffrey passes on. The life income payments are set up to transfer in full to Dolores, who now receives the full $4,000 per month. If Dolores passes on before the full benefit amount is paid, she has named her granddaughter as a beneficiary to receive any unpaid benefits.

Scenario 3 – Life Income with Refund

Harry is a 55-year-old approaching retirement when his father passes. His father leaves him $500,000 in benefits from his life insurance policy.

Harry is financially stable but has some health complications that require routine medical procedures that are quite expensive. He opts to receive life income payments with a cash refund to help meet his expenses.

Unfortunately, due to complications with Harry’s illness, he passes away at age 62. Over the seven years, his life income payments returned only $100,000 in payments to him. The remaining $400,000 of benefit is refunded to his own beneficiary, his adult daughter, as a lump sum payment.

As you begin to consider life insurance options and settlement types, you may wonder whether there is a better solution for your life insurance needs. If you would like to receive a free comparison quote, simply use our instant quote tool at the top of this page and see how much you can save.

Understanding Life Insurance Settlement Options

In the world of life insurance, selecting the appropriate settlement option is crucial for both the insured and beneficiaries. One of the options available is the settlement option provision, which allows beneficiaries to choose how they would like to receive the policy proceeds. For example, if a life insurance beneficiary has chosen a settlement, they may opt for the life income option life insurance, which provides a steady income for the rest of their life. Another common choice is the interest only life settlement option, where the beneficiary receives only the interest generated by the death benefit, leaving the principal amount intact. The interest settlement option is ideal for those who want a stable income without touching the principal. Similarly, the fixed amount settlement option allows for payments of a predetermined amount until the proceeds, plus interest, are exhausted. These options offer flexibility and financial planning opportunities, helping beneficiaries manage their inheritance wisely.

A unique aspect of life insurance policies is the availability of life policy settlement options that cater to different needs. For instance, joint life vs joint and survivor policies offer varying degrees of protection for multiple beneficiaries. The joint life and survivor policy continues to provide payments after the first death, ensuring financial stability for the surviving beneficiary. A popular choice among these is the joint and survivor annuity, where payments continue until both insured individuals have passed away. In some cases, the type of settlement option which pays throughout the lifetimes of two or more beneficiaries is called a joint and 2/3 survivor option. In this scenario, the surviving beneficiary receives two-thirds of the payment amount. This is especially beneficial for couples who want to ensure continued support for the surviving spouse. Understanding these options, including life stage option in HDFC Life, can help policyholders make informed decisions about their life insurance coverage and the distribution of their benefits.

What are life insurance cash settlements?

A whole separate industry of life insurance settlements was spurred out of the 1990s by a generation of seniors who realized they could sell their life insurance policies for immediate cash needs. Recognizing the popularity of a new product, the National Conference of Insurance Legislators adopted the Life Settlements Model Act.

Insurance companies adopted the strategy of purchasing policies back from older Americans for a lump cash payment.

The new owner, the insurance company, would continue to service the policy by making premium payments until the policyholder passed away. At that time, the insurance company would collect all the benefits.

Eventually, a secondary market was born from the opportunity to purchase policies from older living policyholders. Why older policyholders? Purchasers of policies would weigh the value of the benefit against the number of potential premiums.

For someone who is further along in life, the buyers are betting on having to make fewer premium payments.

With the potential to purchase these policies, a whole new industry of buyers grew to become a middle agent between seniors and life insurance companies. Today, multiple buyers might bid on a policy, providing the opportunity for the seller to obtain a better price.

Understanding Life Insurance Settlement Options

In life insurance, life insurance settlement options provide various methods for distributing the death benefit to beneficiaries. One such option is the interest only life insurance settlement option, where the insurer pays only the interest earned on the policy’s death benefit to the beneficiary, allowing the principal amount to remain intact. This can be a practical choice for beneficiaries who wish to preserve the principal for future use. Another popular choice is the life income settlement option, which provides the beneficiary with regular payments throughout their lifetime, ensuring a steady income stream. The type of settlement option which pays throughout the lifetimes of one or more beneficiaries, such as the life income joint and survivor settlement option guarantees, provides financial security for the beneficiaries’ lifetimes. This option is especially valuable for couples, as it ensures that the surviving spouse continues to receive payments even after the other’s death.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Joint Life Income and Its Guarantees

For couples looking for long-term financial stability, joint life income is a valuable settlement option. Joint and survivor life insurance ensures that both partners are covered under one policy, with the life income joint in survivor settlement option guarantees providing payments as long as either is alive. This setup is ideal for couples who rely on each other’s income, as it offers continued financial support. The fixed period option and the interest only settlement option are other alternatives that cater to different financial needs. The former provides payments for a specified number of years, regardless of the beneficiary’s lifespan, while the latter focuses on providing regular interest payments.

Life insurance settlement option policies offer flexibility and customization, allowing policyholders to choose the best method for distributing benefits. Understanding what are settlement options in life insurance is crucial for selecting the right approach. For instance, the life income settlement option of an insurance policy ensures lifetime benefits for the beneficiary, offering peace of mind and financial stability. Whether choosing a life income joint and survivor settlement option with guarantees as explained on Quizlet or a different plan, the right settlement options in life insurance can significantly impact a beneficiary’s financial future.

How Much You Can Receive for Selling Your Policy

The amount you can get for selling a life insurance policy depends on a few factors. Primarily, the buyers are betting on you to have a shorter life expectancy. The longer you live, the longer they’ll have to pay premiums to service the policy.

If you’re selling your policy, you’ll likely work with a broker who will bid your policy to different buyers and return the highest offered amount to you. (For more information, read our “How to Sell Your Life Insurance Policy“).

Because of tax consequences, you may not get the best value for your policy by selling the policy outright. Before you sell, you’ll want to understand what your options might be.

When a Life Insurance Cash Settlement Is a Good Idea

Life insurance settlements are big business — so much so that, at times, brokers can be accused of convincing their elderly policyholders to sell policies against their best interests. Sometimes, it does make sense for an individual to sell a policy, though.

Here are some situations where you would benefit from selling a policy:

- You need a large sum of money now for an emergency.

- You no longer have beneficiaries that will need the money after you die or have other reasons you no longer require life insurance.

- You’re unable to fund your retirement by other means.

The key thing to note is that in all of the scenarios, you only would sell your policy if you absolutely no longer need it and you need a large sum of cash now.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

When a Life Insurance Cash Settlement Is a Bad Idea

Selling a life insurance settlement should be an action of last resort. This is because even in a strong secondary market, the cash you receive will be considerably less than the benefit value. If you’re considering cashing in the policy, be wary of the options and consequences below before you do.

- Investigate other options to cash in on the value of your policy –

- Taking a loan out against a policy’s cash value will allow you to raise cash without suffering immediate tax liability. However, you’ll need to continue to make premium payments. Your loan can be paid off from the benefit amount in the policy when you pass on, so if you choose this option, you should ensure that you no longer need to leave the benefit for your beneficiaries.

- Surrendering the policy to withdraw any cash value. If you simply cancel the policy, any value in the policy will be returned to you minus plan expenses plus interest. You should be aware that any gains made on your policy from interest or appreciation are taxable as income.

- You’re unaware of the tax handling on the policy – When you receive the proceeds of a cash settlement, you’re selling an asset. This means that the full value you receive will be taxable as income. This could be a considerable amount since the full sale price of the policy is taxable.

- You can’t afford to continue making premium payments – If you can no longer make premium payments, look at other options before you sell. Speak to the policy beneficiaries and see if they might want to continue making premium payments now in exchange for receiving the benefit payment later.

- What is the benefit of choosing an extended term as a non-forfeiture option? – This takes a little bit of planning, but choosing an extended-term option will allow you to stop paying premium payments without forfeiting the cash value equity in the plan.

If you sell your life insurance policy and receive a cash settlement, you have to opportunity to reconsider and reinstate your policy. What is the primary advantage to the policy owner in the reinstatement of a life insurance policy? By keeping your policy active, you keep the cash value of the policy available for you to use as well as for beneficiaries to benefit from tax-free.

Although the sound of a large cash settlement might seem appealing, take your time to weigh all the alternatives and options before you make a bad decision.

Read more: Life Insurance Non-Forfeiture Option (Terms Explained)

Alternatives to a Cash Settlement

Because of tax consequences, you may not get the best value for your policy by selling the policy outright. If you are trying to get cash for your policy, you can consider the following options:

- Surrender your policy and have any cash value returned to you

- Borrow against the cash value of your policy

- Consider speaking to your named beneficiaries. Beneficiaries have a vested interest in the policy, so understanding how they could be affected by the sale of a policy could help drive different perspectives.

As you consider the options of cashing in your life settlement versus other avenues, consult with other advisors who might be able to help.

Top 10 Life Insurance Companies by Market Share

When it comes to shopping for life insurance, the first step is to get a sense of what companies are out there. The top 10 insurers by market share are listed in the following table.

Top 10 Life Insurance Companies by Market Share

| Ranking | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual Life Insurance Co. | $10,517,115,452 | 6.42% |

| 2 | Metropolitan Group (MetLife) | $9,821,445,953 | 6.00% |

| 3 | New York Life Insurance Group | $9,295,848,300 | 5.68% |

| 4 | Prudential Financial Inc. | $9,128,805,060 | 5.57% |

| 5 | Lincoln National Corp. | $8,769,303,174 | 5.36% |

| 6 | Massachusetts Mutual Life Insurance Co. | $6,854,713,057 | 4.19% |

| 7 | Aegon US Holding Group (Transamerica) | $4,809,856,650 | 2.94% |

| 8 | John Hancock Life Insurance Co. | $4,640,905,017 | 2.83% |

| 9 | State Farm Mutual Automobile Insurance | $4,633,004,963 | 2.83% |

| 10 | Minnesota Mutual | $4,422,100,028 | 2.70% |

Next, you’ll need to compare rates.

Is there a sample of monthly life insurance rates?

The table below provides average rates from the 10 leading life insurance providers grouped by age and gender for different coverage amounts.

The average will give you a sense of how much you’ll pay in insurance each month.

Average Monthly Life Insurance Rates for Top 10 Insurers by Age, Gender & Policy Amount

| Age | $100,000: Male Average Monthly Life Insurance Rates | $100,000: Female Average Monthly Life Insurance Rates | $250,000: Male Average Monthly Life Insurance Rates | $250,000: Female Average Monthly Life Insurance Rates | $500,000: Male Average Monthly Life Insurance Rates | $500,000: Female Average Monthly Life Insurance Rates |

|---|---|---|---|---|---|---|

| 25 | $11 | $10 | $22 | $13 | $23 | $19 |

| 30 | $11 | $10 | $15 | $13 | $24 | $19 |

| 35 | $11 | $10 | $15 | $13 | $24 | $19 |

| 40 | $13 | $11 | $18 | $15 | $29 | $24 |

| 45 | $15 | $13 | $22 | $20 | $36 | $33 |

| 50 | $19 | $17 | $30 | $27 | $54 | $47 |

| 55 | $25 | $21 | $43 | $34 | $79 | $62 |

| 60 | $36 | $27 | $71 | $51 | $135 | $95 |

| 65 | $51 | $38 | $110 | $75 | $213 | $144 |

Beyond the companies and rates, every individual will have particular needs when it comes to insurance. Shopping with larger insurers is a good starting place.

If you trying to decide which is better for you, term or permanent life insurance, good news: Many of the larger insurers offer a wide range of products ranging from affordable term life insurance options to flexible whole life and universal life insurance. Most people wonder if they need life insurance.

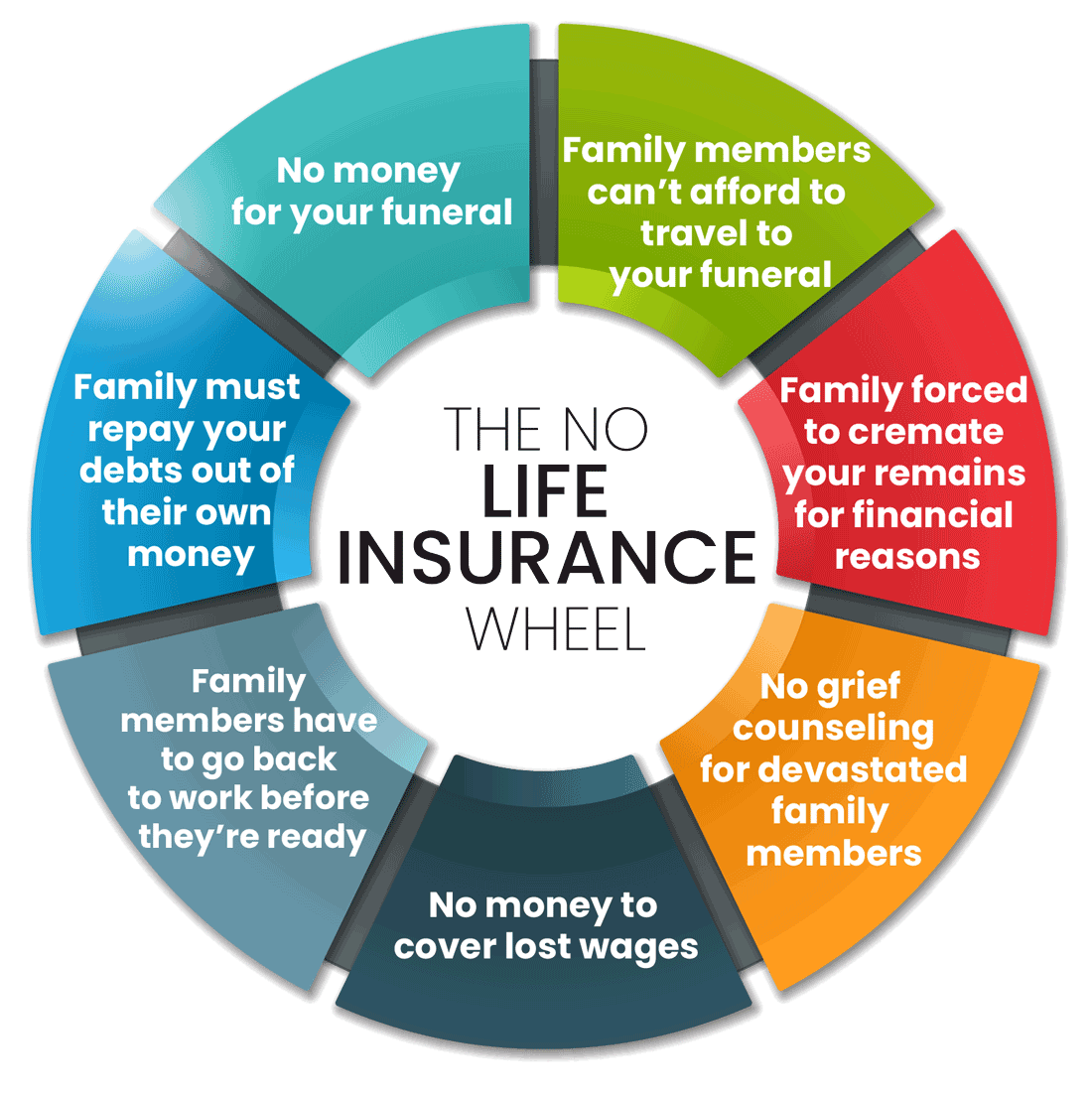

If you’re still not convinced of why you need life insurance, take a look at the consequences of not having a policy.

In your search for a good insurance provider, you’ll have to go deeper than just comparing rates and programs. Your insurance needs are likely to change over time. The best life insurance for 30-year-olds may not be the same for those ready to retire.

A good insurance provider will help you understand how to set up a complete insurance profile that will give you the flexibility you need.

When you’ve finally determined a policy type and provider, it’s time to purchase a policy. At the time of purchase, you may want a lesson in life insurance beneficiaries so you can make the best choice.

According to the Insurance Information Institute, you should also set a reminder to revisit your plan every year and every time you have a life change, expecting that your insurance needs and your beneficiaries might change over time.

As you change your beneficiaries and make adjustments to your policy over time, you can also review your settlement options. Although most benefit payment options are determined by the beneficiary, if your beneficiaries are not yet adults, you might want to set settlement options on their behalf.

Case Studies: Exploring Life Income Joint and Survivor Settlement Options

Case Study 1: Tom’s Life Income With Period Certain

Tom, a 67-year-old beneficiary, received a life insurance benefit of $500,000 from his brother’s policy. He wanted to move to a more expensive condo community and take out a 15-year mortgage.

To ensure he could cover his mortgage payments, Tom chose a life income settlement with a period certain of 15 years. He receives monthly payments of $4,000 for 15 years. At the end of the term, any remaining benefit amount plus interest will be paid to him as a lump sum.

Case Study 2: Geoffrey and Dolores’ Joint & Survivor Life Income Annuity

Geoffrey and Dolores, a retired couple ages 72 and 68, received a life insurance benefit of $300,000 from Geoffrey’s cousin. They decided to opt for a joint and survivor life income settlement. Initially, Geoffrey receives $3,000 per month, and Dolores receives $1,000 per month.

After Geoffrey passes away, Dolores receives the full $4,000 per month. They named their granddaughter as a beneficiary to receive any unpaid benefits if Dolores also passes away before the full benefit amount is paid.

Case Study 3: Harry’s Life Income With Refund

Harry, a 55-year-old nearing retirement, inherited a life insurance benefit of $500,000 from his father’s policy. Due to his health complications requiring expensive medical procedures, Harry chose a life income settlement with a refund.

Unfortunately, Harry passed away at age 62. Over seven years, he received $100,000 in life income payments. The remaining $400,000 was refunded to his adult daughter as a lump sum payment.

Life Income Joint and Survivor Settlement Option Guarantees: The Bottom Line

If you’re in the market for a life insurance policy, you’re probably just focused on finding a great rate. To get that great rate, you’re probably comparing multiple providers and doing everything you can to complete a shining medical exam.

You’re also likely guessing at how much insurance you’ll need. If you’re like most of us, once you purchase the policy, you probably file the policy away in the vault and forget to reevaluate for long after.

However, your life insurance needs will change in time. Knowing and understanding and evaluating your policy every few years is as important as reevaluating your 401(k) and retirement plans.

As your policy matures and grows in value, understanding settlement options will become increasingly important for you and your beneficiaries.

Is it better to cash out now, or are you losing value by selling your policy? What possible options do you have to keep your policy if you find yourself in dire need of cash?

After reading this article, we hope that you now understand the importance of a settlement strategy for your life insurance policy as well as the options and flexibility your beneficiaries will have when filing a claim.

If you’re ready to compare an existing policy with current policy rates and offers, or are shopping for the first time for term life or whole life policy with life income and joint survivor settlement option guarantees, jump in by getting an instant rate right now. Try our life insurance quote tool and get an instant quote in seconds.

References:

- https://money.cnn.com/retirement/guide/annuities_basics.moneymag/index.htm

- https://www.iii.org/publications/a-firm-foundation-how-insurance-supports-the-economy/supporting-businesses-workers-communities/life-insurance-payouts

- https://www.lisa.org/resources/

Frequently Asked Questions

What are life income joint and survivor settlement options?

Life income joint and survivor settlement options refer to a type of life insurance settlement where the beneficiary receives regular payments for a lifetime. If one beneficiary passes away, the surviving beneficiary continues to receive the payments.

How do life income joint and survivor settlement option guarantees work?

With life income joint and survivor settlement options, if one beneficiary dies, the surviving beneficiary continues to receive regular payments. It ensures a reliable revenue stream for the surviving beneficiary and may also include an additional beneficiary if both beneficiaries pass away.

What are life insurance cash settlements?

Life insurance cash settlements involve selling a life insurance policy for an immediate lump sum of cash. The policyholder receives a payment upfront, and the insurance company takes over the policy and pays the premiums until the policyholder’s death.

When is a life insurance cash settlement a good idea?

A life insurance cash settlement may be a good idea if the policyholder no longer needs the coverage, needs a large sum of cash immediately, or wants to use the funds for other financial purposes. It is important to carefully consider the options and tax consequences before selling the policy.

When is a life insurance cash settlement a bad idea?

Selling a life insurance cash settlement should be a last resort. It is generally not advisable if the policyholder still needs the coverage, has dependents relying on the policy’s benefits, or if the cash settlement amount is considerably less than the policy’s benefit value. Consider all options and consequences before making a decision.

Which life insurance settlement option pays lifetime benefits to two or more people?

The settlement option that pays lifetime benefits to two or more people is typically known as a joint and survivor annuity or a joint life and survivor policy. This option provides payments throughout the lifetimes of both insured individuals, ensuring that the surviving person continues to receive benefits even after the first insured person passes away.

What is a life income settlement option?

The life income settlement option is a payout method in which the beneficiary receives payments for the rest of their life. The amount of the payment depends on factors like the beneficiary’s age and the amount of the policy’s death benefit.

Which life insurance settlement option pays lifetime benefits?

The life income option or life income settlement option pays lifetime benefits. This option guarantees that the beneficiary receives payments for as long as they live.

What does the life income option offer?

The life income option offers guaranteed, periodic payments to the beneficiary for the duration of their lifetime. The payments are typically calculated based on the age and gender of the beneficiary and the amount of the death benefit.

What is a life income fund?

A life income fund is a financial product that provides a stream of income to the beneficiary for life, similar to an annuity. The fund is usually composed of the death benefit from a life insurance policy and potentially other investments, providing a steady income stream.

Which life insurance settlement option guarantees payments?

The life income option, fixed amount settlement option, and interest only life settlement option are among the settlement options that guarantee payments to beneficiaries, though the payment structure and duration vary.

How are settlement options paid?

Settlement options can be paid in various ways, including lump-sum payments, periodic payments (such as monthly, quarterly, or annually), and specific payout plans like the fixed amount settlement option or interest only option life insurance. The choice depends on the settlement option selected by the policyholder or beneficiary.

How do health insurance companies make money?

Health insurance companies make money through premiums paid by policyholders, investments of the collected premiums, and managing the difference between the premiums received and the claims paid out. They also earn profits through co-pays, deductibles, and network agreements with healthcare providers.

How do insurance companies make a profit?

Insurance companies make a profit by collecting premiums, investing those premiums, and ensuring that the claims paid out are less than the total amount collected. They also generate revenue from additional fees and investment income.

How does an insured typically decide which settlement option to choose for his/her beneficiary?

The insured typically decides on a settlement option based on the beneficiary’s financial needs, life expectancy, and preferences for receiving the death benefit. They may also consider the tax implications and the desire for steady income versus a lump sum.

How does joint life insurance work?

Joint life insurance covers two people under a single policy. It can be structured to pay out upon the first death (first-to-die) or after the second death (second-to-die). The latter is often used for estate planning purposes, providing benefits to beneficiaries after both insured individuals have passed away.

How does life settlement work?

A life settlement involves selling a life insurance policy to a third party for a lump sum that is typically greater than the cash surrender value but less than the death benefit. This process, known as a life settlement definition, entails that the buyer becomes the new policy owner, pays the premiums, and collects the death benefit when the insured person passes away.

How long is an insurance company allowed to defer policy loan requests?

An insurance company can generally defer policy loan requests for up to six months. This period allows the insurer to manage its cash flow and investments while ensuring the policyholder can access the loan in a reasonable timeframe.

How long will the beneficiary receive payments under the single life settlement option?

Under the single life settlement option, the beneficiary receives payments for their lifetime. Once the beneficiary passes away, the payments cease, regardless of whether the total amount received equals the original death benefit.

How to pass life insurance medical exam?

To pass a life insurance medical exam, it’s advisable to prepare by getting a good night’s sleep, staying hydrated, avoiding alcohol and nicotine for a few days prior, and maintaining a healthy diet. It’s also helpful to disclose any medications you’re taking and follow any specific instructions provided by the insurance company.

An insured has chosen joint and 2/3 survivor as the settlement option. What does this mean to the beneficiaries?

When an insured selects the joint and 2/3 survivor settlement option, it means that the policy is structured to provide income for two or more beneficiaries. Specifically, after the first insured person passes away, the surviving beneficiary will continue to receive payments, but at a reduced rate—typically two-thirds of the original payment amount. This option ensures that the surviving beneficiary continues to receive financial support, albeit at a lower level, for the remainder of their life. This setup is often used by couples to provide ongoing financial security to the surviving partner.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Life Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.