Erie Life Insurance Review [2025]

Erie insurance includes both term and whole insurance policies with a variety of options and riders, including guaranteed cash value. In our Erie insurance review, we discuss how rates are below the average and can be less than $19 a month for a 25-year-old female applicant.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Insurance Agent

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

121-Erie-Life-Insurance-Company-Overview-Table-Life-2020-03-25.csv

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1925 |

| Current Executive | President & CEO – Timothy G. NeCastro |

| Number of Employees | 5,547 |

| Total Sales / Total Assets | $8,030,700,000 / $21,178,200,000 |

| HQ Address | 100 Erie Insurance Place Erie, PA 16530 |

| Phone Number | 1-800-458-0811 |

| Company Website | www.erieinsurance.com |

| Premiums Written – Individual Life | $7,486,030 |

| Financial Standing | +9.92% From Previous Year |

| Best For | Strong Financial Ratings |

What is Erie Life Insurance Company?

This Erie life insurance review contains everything you need to know before deciding if this is the company for you. You might be asking: What is the best life insurance company? Is Erie insurance legit? Or even, does Erie have life insurance? Is Erie insurance cheap?

Maybe you’ve seen commercials for competing insurance companies, and you wonder, “Is Erie insurance better than State Farm?” Read on to learn about the types of term life insurance and other coverage offered by Erie to decide which company is right for you.

Before buying Erie life insurance, click on our FREE quote tool above, enter your ZIP code, and get free life insurance quotes today.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How can I shop for Erie Life Insurance quotes?

Does Erie offer life insurance? Yes, you need to shop around for life insurance quotes before deciding on one, and this guide will help you with that decision. Is affordable Erie life insurance available to you? Read on to find out.

Our price comparisons to the industry average below will help you make that call. Maybe even while shopping around for life insurance, you wonder: Who the cheap life insurance companies are?

A few states can be serviced for Erie Insurance. NY, California, Colorado, Evansville, and Indiana are popular searches for individuals, so if Erie isn’t servicing across the whole country (see below “About Erie Insurance”), they’re missing out.

Did you know that 61 percent of people don’t buy life insurance or more of it because they say they have other financial priorities?

We’ll get you the rates for Erie Life Insurance, so you know what you’re paying for. We’ll divide rates by age into smokers and non-smokers so you can see the difference between the two. We’ll also give you the average Erie life insurance rates by age and gender.

What are the average Erie Life Insurance rates by age?

Below is more information on national average non-smoker and smoker rates, grouped by age. The data in these tables are from the NAIC:

Average Erie Life Insurance Rates for Non-Smokers - Life

| Non-Smoker Age, Marital Status, & Gender | Erie Life Insurance Average Annual Rates | Average Annual Rates |

|---|---|---|

| 25-Year-Old Single Female | $152 | $164.50 |

| 25-Year-Old Single Male | $175 | $183.61 |

| 35-Year-Old Married Female | $178 | $170.47 |

| 35-Year-Old Married Male | $189 | $190.40 |

| 45-Year-Old Married Female | $253 | $247.50 |

| 45-Year-Old Married Male | $295 | $274.59 |

| 55-Year-Old Married Female | $440 | $417.01 |

| 55-Year-Old Married Male | $567 | $543.23 |

| 65-Year-Old Single Female | $945 | $898.76 |

| 65-Year-Old Single Male | $1,252 | $1,308.00 |

You can see Erie’s rates are on par with the national average.

Average Erie Premiums for Smokers - Life

| Smoker Age, Marital Status, & Gender | Erie Life Insurance Average Annual Rates | Average Annual Rates |

|---|---|---|

| 25-Year-Old Single Female | $226 | $248.90 |

| 25-Year-Old Single Male | $255 | $328.31 |

| 35-Year-Old Married Female | $268 | $289.34 |

| 35-Year-Old Married Male | $298 | $366.70 |

| 45-Year-Old Married Female | $475 | $494.59 |

| 45-Year-Old Married Male | $565 | $648.16 |

| 55-Year-Old Married Female | $1,050 | $999.43 |

| 55-Year-Old Married Male | $1,435 | $1,386.70 |

| 65-Year-Old Single Female | $2,531 | $2,267.36 |

| 65-Year-Old Single Male | $3,098 | $3,333.99 |

As you can see, smokers pay significantly more than non-smokers as age increases. If you’re thinking about quitting smoking, you’re already making progress in the right direction. If you quit, your life insurance rates should improve.

Erie premium rates rival that of the industry average. In some cases, the Erie rates are more than the industry average, but they are generally less than the industry average (see: 25-year-old female smoker/non-smoker). The rates are higher in some cases, but they soon drop below the average (see: 65-year-old male smoker/non-smoker).

Even e-cigarettes can affect life insurance rates.

What types of life insurance policies are offered?

There are numerous life insurance policies available for adults, including term life insurance, permanent life insurance, and various types of universal life insurance. Let’s explore what Erie offers and how you can find the best life insurance rates.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Erie Term Life Insurance

Erie offers term life in a 10-, 15-, 20-, or 30-year plan to protect your loved ones.

Term life insurance quotes are best for people who need cost-effective protection for loved ones left behind.

They even state: “With Erie, it’s easy to get up to $90,000 worth of term life insurance coverage by answering a few medical questions. You’ll get an answer within 15 minutes.”

Erie also offers level term insurance. It provides life insurance for the period of time that best suits your needs. If you’d like, you can also convert your term policy to a permanent life plan, which provides coverage for your whole life.

Erie Whole Life Insurance

In addition to term life, Erie also offers whole life insurance, with premiums and coverage guaranteed to remain the same for your lifetime. If you’re trying to determine term vs. whole life insurance: what’s the difference? remember this:

Whole life is best for people who need protection for their families for their entire lives with guaranteed universal life insurance rates. An Erie whole life insurance policy offers the following:

- Guaranteed life insurance protection that won’t decrease

- Guaranteed cash value that can be borrowed to take advantage of future opportunities

- Payments are guaranteed not to change, regardless of changes in health

- Additional accelerated death benefit options for terminal illness included at no charge

Whole life is there for you, whether it’s for your children, whether you’re in your 30s and 40s, or age 50 and retirement age. Regardless, it’s there to support you.

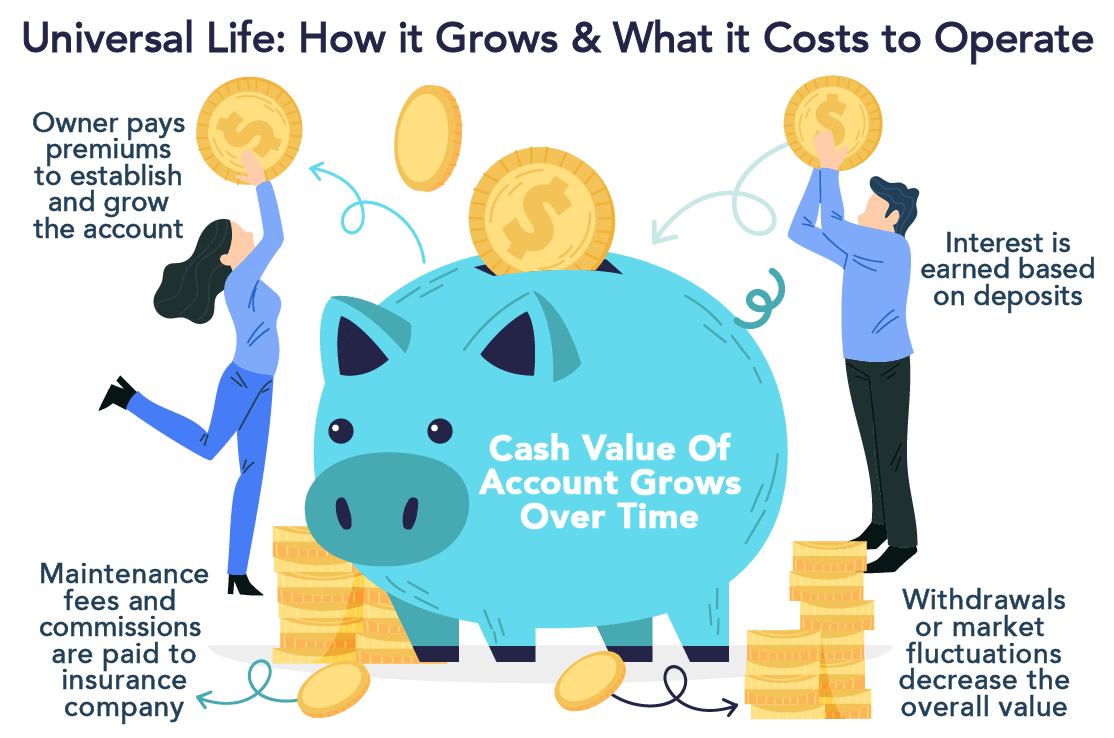

Erie Universal Life Insurance

Another type of permanent life insurance, guaranteed universal life insurance is also available through Erie. It protects your entire life and includes a policy cash value on the account with a flexible payment schedule.

According to Erie’s website, universal life insurance is ideal for:

- Income replacement

- Estate planning

- College expense planning

- Inheritance or wealth transfer

- Charitable giving

- Paying off mortgage or debt

- Deferred compensation

- Retirement income planning

- Business continuation coverage

- Key person coverage (for the sudden loss of a key executive or employee)

Universal life offers many options, as do whole life and term life.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Other Erie Life Insurance Products

Erie doesn’t specifically have a single insurance policy called “burial and final expense life insurance,” but by definition, its term policies (and other policies) can cover any final expenses that the passed family may face. For more information, see our complete guide to burial insurance.

Erie also offers personal catastrophe liability coverage (or personal umbrella insurance), giving you an extra layer of protection if something tragic happens.

Erie offers identity theft recovery coverage as well. Identity theft is frighteningly common. Erie also offers a Medicare supplement insurance, covering costs that Medicare might not.

Erie Life Insurance Riders

According to Erie’s site, long-term care accelerated death benefit rider is a Universal Life or Whole Life add-on that provides valuable coverage that may cost less than you think. This is a unique life insurance rider that doesn’t require underwriting.

When signing up for it, you provide age and gender but not specific medical conditions during the application process. This relatively new rider is easy to purchase as part of a life insurance policy from Erie Family Life Insurance Company.

How can I get an Erie quote online?

You might be wondering how to get life insurance quotes online. With Erie, they make it simple. You can always call an Erie Insurance company agent, but you can also use their “Get a Quote” feature on their site. Let’s dive into how to navigate to that:

First, go to ErieInsurance.com and click “Insurance.”

Then navigate to “Life & More” > “Life Insurance.” It guides you to this page, where “Request a Quote” is an option.

Click “Request a Quote.” It will take you to a life insurance quote form that you fill out with your information — your name, preferred contact format, email, phone, and message. Their response to you submitting the form is to please allow 24-48 hours for a response.

The website makes requesting more information for a quote fairly simple.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How do I cancel Erie Insurance or my life insurance policy?

Can you cancel your life insurance policy? If you need to, then yes, you can. The best way to cancel a policy is to call Erie Insurance at 1-800-367-3743.

How can I make a claim with Erie?

There are some reasons life insurance won’t pay out, but if your claim is covered by your policy, there should be nothing to worry about.

Erie can handle auto, home, and business insurance claims online on their site, but Erie instructs you to contact them directly for a life insurance policy claim. According to their website, here are the steps to making a life insurance claim with Erie.

To start a claim under a life insurance policy or an annuity contract, the beneficiaries must contact the policy owner’s Erie Insurance agent or Erie Family Life at 1-800-458-0811, option 3.

Erie will ask you to provide the following documents:

- A life insurance claimant’s statement or an annuity claimant’s statement

- A certified copy of the insured’s death certificate

- A notarized signature on the claim form or a clear copy of your driver’s license or state-issued identification for signature certification

- The original insurance policy or the annuity contract, if available

You’ll also be asked to provide the insured’s full name and state of residence, date of birth, date of death, policy issue date, and other details.

Submit your documents. Please mail all the documents to:

Erie Family Life Insurance Company

100 Erie Insurance Place

Erie, PA 16530

If you have questions during the process, you’ll want to contact Erie Family Life or your local Erie agent.

How is the customer experience?

The NAIC has a Complaint Index where they rank the national average of complaints (n=1.0) and calculate the number of complaints they’ve received over a single year. Here are the last three years, beginning with 2017:

Erie Life Insurance NAIC Complaint Index

| Years | NAIC Complaint Index |

|---|---|

| 2024 | .60 |

| 2023 | .77 |

| 2022 | 1.11 |

As you can see, Erie made major progress between 2017 and 2018, where their Complaint Index dropped a whole 0.57 points; they dropped by more than half of the national average for complaints.

Unfortunately, their Complaint Index increased between 2018 and 2019, but they’re still technically below the national average of complaints, sitting at 0.99. It’ll be interesting to see where they land after 2020.

The best customer experience reviews can be found on Erie’s website. Michael U. of Blairsville, Pennsylvania had this to say: “Last month, I had to file a claim. My agent Carol was prompt, courteous, professional, and realistic. I’ve been a customer since 1974. I’d recommend Erie to anyone because Carol isn’t the exception — she is the norm.”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Erie’s Programs

Erie has a few programs to give back to the community. The first is Erie Agents Giving Back, where Erie agents have established partnerships in their communities to support first responders and those on the front lines of the COVID-19 pandemic.

Read our review of the states most and least prepared for COVID-19 to see how your state compares.

Their site says: “Through Erie Agents Giving Back, we’ve unlocked additional funding to help continue their good work in communities throughout Erie’s footprint. Erie is reimbursing agents up to $1,000 and matching additional activities at 50 percent.”

Every November for the last 33 years, Erie has participated in the Thanksgiving Dinner Drive. This event was previously helmed by Erie Insurance retiree Rick Hinman, who earned the nickname “The Turkey Man” as he organized increasingly more donations over nearly 30 years to nonprofits until he stepped down from this position.

Both programs show how Erie as a company wants to give back and make their respective communities better. We here at QuickQuote think this is an exemplary and selfless effort.

Design of the Erie Website/App

Does Erie insurance have an app? If you’re wondering how best to conduct business with Erie, the Erie Insurance login and the option for an Erie one-time payment online are available on their website, which you don’t want to have to dig too deeply find.

Erie has some auto-based apps but nothing for life insurance. They have the following apps on the Apple App Store and Google Play Store:

- ERIE YourTurn – A program based on rewards-driven telematics that helps you track good driving behaviors and patterns.

- ERIE EnRoute – This Erie Insurance app is built for commercial auto drivers to track driving patterns, improve safety, and potentially reduce insurance costs.

You can make an Erie life insurance payment online. You can also find important life insurance forms, such as the Erie life insurance beneficiary change form. Choosing a life insurance beneficiary is a personal decision and you can change the beneficiary as needed or desired.

What’s the history of Erie Life?

The Erie Life Insurance Group was founded in 1925. The company headquarters are in Erie, Pennsylvania. Erie services 12 states and Washington, D.C. You might be wondering, is there Erie auto insurance? Yes, Erie offers auto and home insurance, business insurance, and life insurance.

Erie Life is ranked number 381 on the list of Fortune 500’s companies.

Erie Life is a smaller life insurance company, much smaller than powerhouses like MassMutual or John Hancock, but they still landed on the Fortune 500 list.

Read more: Pennsylvania Life Insurance

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Erie’s Ratings

Insurance companies are rated by agencies like A.M. Best and the Better Business Bureau (BBB). What is Erie Insurance rating? The A.M. Best rating for Erie Insurance is a score of A+ (Superior). Erie was awarded an A+ (the highest grade available) with the BBB. We looked at Erie reviews. BBB ranked Erie well with that A+ grade.

Both rating systems are outlined in the below table for ease of reference since not all the scales are the same.

A.M. Best and Better Business Bureau (BBB) Rating Scales

| A.M. Best Ratings | Better Business Bureau (BBB) Ratings |

|---|---|

| A++ (Superior) | Erie's Rating – A+ |

| Erie's Rating – A+ (Superior) | A |

| A (Excellent) | A- |

| A- (Excellent) | B+ |

| B++ (Good) | B |

| B+ (Good) | B- |

| B (Fair) | C+ |

| B- (Fair) | C |

| C++ (Marginal) | C- |

| C+ (Marginal) | D+ |

| C (Weak) | D |

| C- (Weak) | D- |

| D (Poor) | F |

These ratings are great. They’re highly ranked on their respective scales.

Erie’s Market Share

Erie Life isn’t a huge company, but it’s large enough to make the National Association of Insurance Commissioners’ Top 125. Here’s a breakdown of Erie’s market share compared to the competition:

Top 10 Life Insurance Companies and Erie Life by Market Share (NAIC)

| Rank | Companies | Direct Written Premium | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual | $10,517,115,452 | 6.42% |

| 2 | Metropolitan Group | $9,821,445,953 | 6.00% |

| 3 | New York Life | $9,295,848,300 | 5.68% |

| 4 | Prudential | $9,128,805,060 | 5.57% |

| 5 | Lincoln National | $8,769,303,174 | 5.36% |

| 6 | MassMutual | $6,854,713,057 | 4.19% |

| 7 | Aegon | $4,809,856,650 | 2.94% |

| 8 | John Hancock | $4,640,905,017 | 2.83% |

| 9 | State Farm | $4,633,004,963 | 2.83% |

| 10 | Minnesota Mutual | $4,422,100,028 | 2.70% |

| 91 | Erie Life | $180,102,083 | 0.11% |

The information above is from the NAIC. As you can see, the percentage of market share is much smaller for Erie than for massive companies like State Farm or New York Life, but it still ranks on the Top 125 list.

Check out our State Farm life insurance review to see how State Farm compares to Erie’s life insurance.

Let’s dive deeper into their market share over the years, based on data from the NAIC:

Erie Life Insurance NAIC Rankings

| Year | Rank | Direct Written Premiums | Market Share |

|---|---|---|---|

| 2018 | 91 | 180,102,083 | 0.11% |

| 2017 | 91 | 172,395,458 | 0.11% |

| 2016 | 90 | 159,229,914 | 0.10% |

As you can see, Erie hovers around numbers 90 and 91, with their market share switching between 0.11 percent and 0.10 percent. Trends show that Erie has remained constant in ranking and market share value over the years.

Erie’s Online Presence

It’s common for insurance companies to use social media, and Erie is no exception. Erie has a Facebook page, LinkedIn account, Twitter feed (seen below), and a YouTube page.

It’s great that they make themselves accessible with quick blurbs containing the Erie claims phone number for claim questions on their Twitter page.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Erie in the Community

Erie’s webpage has an entire section describing its efforts to give back to the Erie, Pennsylvania, community. Their site says: “Our employees and agents build homes, feed families, and tutor young students.” Businesses that help the community are always refreshing to discover. Erie’s efforts to give back focus on the following three areas:

- Community building

- Safety

- Environmental responsibility

These are great areas of focus for a business. For community building, they support the United Way. They support disaster relief by organizations like the American Red Cross for safety. And for environmental responsibility, they plant community gardens. Erie has volunteered with Habitat for Humanity in the past, as recognized on the cover of an Insurance Information Institute publication.

Erie’s Employees

Erie Life Insurance’s employee reviews are fantastic, 4.1 out of 5 stars on Glassdoor. Eighty-seven percent would recommend them to a friend, and 98 percent approve of the CEO. Benefits are ranked at an even higher 4.6 out of 5 stars on Glassdoor. It sounds like, based on their employee reviews on Glassdoor, the Erie Insurance benefits are very good. A North Carolina employee states: “Fantastic benefits, health, dental vision, etc.”

According to this Penn State press release, Erie insurance is also expanding its office space, where 200 Erie employees will be based in Penn State’s Knowledge Park.

Read more: North Carolina Life Insurance

Awards and accolades:

According to its website, Erie is ranked high in the industry. Erie’s awards are the:

- 12th largest auto insurer in the country

- Ninth largest home insurer

- 12th largest business insurer

Erie also was awarded in 2018:

- Customer Satisfaction with the Auto Insurance Purchase Experience, J.D. Power, 2018

- Erie Family Life – A (Excellent), A.M. Best, 2018

- Erie Insurance Group – A+ (Superior), A.M. Best, 2018

- Ward’s 50 Property-Casualty Top Performers, Ward’s 50, 2018

- Fortune 500 (378), Fortune, 2018

- Confirmit ACE Award, Confirmit, 2018

- Best Employers for Healthy Lifestyles, National Business Group on Health, 2018

We’re particularly impressed by the Best Employers for Healthy Lifestyles. Reviews boast a good work/life balance, and images of the workplace offer a peek into their on-site gym.

What Are the Pros & Cons of Erie Life Insurance?

So, is Erie life insurance good? All insurance companies have pros and cons; here, we discuss them.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Pros of Erie Life Insurance

- Erie’s premium rates rival the industry average rates and, in some cases, are less than the industry averages.

- Erie has phenomenal ratings on Glassdoor; 4.1 out of 5 stars and 4.6 out of 5 stars, respectively.

- Erie treats its employees well. They offer great benefits and reviews which make the employees sound satisfied. They even have a gym in their Erie, Pennsylvania location.

- Erie likes to give back to its community with its annual November Thanksgiving Dinner Drives and other programs.

- Erie’s website is very easy to navigate.

- Erie has great ratings with the BBB and with A.M. Best.

As seen in the charts above, we were impressed with Erie’s rates compared to how much life insurance costs from its competitors.

Cons of Erie Life Insurance

- Erie only services the Midwest and a few Eastern states (12 plus Washington, D.C. in total).

- Erie does not have a life insurance app for your phone.

- While not over the 1.0 threshold, their Complaint Index is still rather high at 0.99.

- Although you can request a quote online, you’ll need to speak with a representative to get the actual premium quote.

It’s too bad that Erie doesn’t offer an online experience of receiving a quote.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Erie Life Insurance: What’s the bottom line?

From their low rates to their high BBB and A.M. Best ratings, Erie impressed us. In our anecdotal experience, Erie Life Insurance’s customer service was fantastic as we reached out to Erie for specific premium quotes, and they provided a wealth of information. They even have an Erie Life Insurance calculator on their website.

Now that you’ve read our review don’t wait. Click on our FREE quote tool below to help you shop for insurance quotes. Get started today by entering your ZIP code to begin your research.

Frequently Asked Questions

What types of insurance policies are offered by Erie?

Erie offers term insurance, whole insurance, and guaranteed universal insurance policies.

How can I shop for Erie Insurance quotes?

To shop for Erie Insurance quotes, you can use their online quote tool or contact an agent for assistance.

What are the average Erie Insurance rates by age?

The average rates for Erie Insurance vary by age and whether the applicant is a smoker or non-smoker. It is best to obtain a personalized quote to get accurate pricing information.

How do I cancel my insurance policy with Erie?

To cancel a insurance policy with Erie, you need to call their customer service at 1-800-367-3743.

How can I make a claim with Erie Insurance?

To make an insurance claim with Erie, the beneficiaries need to contact the policy owner’s Erie Insurance agent or Erie Family at 1-800-458-0811, option 3. They will provide the necessary documents and guide you through the claims process.

How is Erie Insurance rated?

Erie Insurance consistently receives high ratings for its customer service, claims handling, and overall satisfaction. Independent rating agencies and customer reviews frequently commend Erie for its reliability and competitive pricing.

How much is Erie car insurance?

The cost of Erie car insurance varies depending on several factors including the driver’s location, driving history, type of vehicle, and coverage options chosen. To get an accurate quote, you can use Erie Insurance’s online quote tool or contact their customer service.

How to cancel Erie Insurance policy?

To cancel an Erie Insurance policy, you should contact your local Erie Insurance agent or call their customer service directly. They will guide you through the cancellation process and any potential fees or refunds associated with it.

Does Erie Insurance cover California?

Yes, Erie Insurance offers car insurance coverage in California. For specific details about Erie car insurance in California and to get a quote, you can visit their website or contact their customer service.

When was Erie Insurance founded?

Erie Insurance was founded on April 20, 1925.

Does Erie Insurance cover South Carolina?

No, Erie Insurance does not currently offer coverage in South Carolina.

Does Erie Insurance have health insurance?

No, Erie Insurance does not offer health insurance. They primarily focus on auto, home, business, and life insurance.

What is Erie Auto Plus?

Erie Auto Plus is an optional add-on package for auto insurance that provides additional benefits and coverages, such as increased coverage limits, waived deductible for certain situations, and enhanced rental car coverage.

What is Erie Secure?

Erie Secure is a package of comprehensive coverage options for home insurance offered by Erie Insurance. It includes various levels of protection and additional features to safeguard your home and belongings.

What is Erie Insurance one-time payment?

Erie Insurance allows policyholders to make a one-time payment for their insurance premiums through their online payment portal or by contacting customer service.

What is the average cost of Erie Insurance?

The average cost of Erie Insurance policies can vary widely based on factors such as the type of insurance, coverage levels, and individual circumstances. To get an accurate estimate, it’s best to request a quote directly from Erie Insurance.

What are the reviews on Erie Insurance?

Reviews on Erie Insurance are generally positive, with customers praising the company’s customer service, competitive rates, and efficient claims processing. Independent review sites and rating agencies also rate Erie highly.

Is Erie a good insurance company?

Yes, Erie is considered a good insurance company. It has high customer satisfaction ratings, strong financial stability, and a reputation for excellent customer service and competitive pricing.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Rachael Brennan

Licensed Insurance Agent

Rachael Brennan has been working in the insurance industry since 2006 when she began working as a licensed insurance representative for 21st Century Insurance, during which time she earned her Property and Casualty license in all 50 states. After several years she expanded her insurance expertise, earning her license in Health and AD&D insurance as well. She has worked for small health in...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.