State Farm Life Insurance Review [2025]

In our State Farm insurance review, we discuss how you could qualify for State Farm insurance rates starting as low as $11/mo, or you may find cheaper quotes when you comparison shop online. State Farm offers term and whole policies and is preferred according to their A++ rating from A.M. Best.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Jul 11, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jul 11, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

State Farm Life Insurance Overview

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1922 |

| Current Executives | CEO – Michael L. Tipsord |

| Number of Employees | 56,788 |

| Total Sales/ Total Assets | $959,000,000,000 / $16,000,000,000 |

| HQ Address | One State Farm Plaza Bloomington, IL 61710 |

| Phone Number | 1-800-782-8332 |

| Company Website | www.statefarm.com |

| Premiums Written – Individual Life | $65,861,617 |

| Financial Standing | $100,900,000,000 |

| Best For | Strong Financial Ratings |

State Farm is most known for car insurance, so you may be asking yourself if State Farm offers life insurance. The answer is yes. This review will answer any questions you may have about choosing State Farm life insurance and will tell you what to look for when shopping for term life insurance quotes.

Shopping for life insurance isn’t something most of us look forward to, but knowing about the company and range of products you’re interested in will relieve some of your stress. Even if you have done the research, there are lots of questions you might still have, including — What is term life insurance? Why do I need life insurance protection? How much life insurance should I get? How do I find the best rates?

Even if you’ve already considered a life insurance provider, it’s smart to compare options. Doing so will help you discover the average cost of State Farm insurance, find cheap life insurance from State Farm, and secure the most affordable coverage they offer.

Let’s get started. Before jumping into our review, start comparing State Farm life insurance with other life insurance companies now with our FREE quote tool.

How can I get State Farm life insurance quotes?

When shopping for life insurance, it’s essential to conduct thorough research. This should involve understanding the fundamentals of insurance and comparing coverage and rates across various providers. Be sure to explore State Farm and term life insurance options, along with State Farm’s best life insurance policy and State Farm’s best whole life insurance to find the most suitable plan for your needs.

When deciding what insurance to buy, it would be smart to learn basic information about individual life insurance. Remember that you should buy a policy that will help replace the income that will be lost in the case of death, barring you don’t have a high mortality risk for any medical or vocational reason. You’ll need to identify how long you want to provide and if you need to replace your entire income or only a portion.

State Farm term life insurance quotes, along with State Farm life insurance quotes online, provide the financial assurance that your loved ones will be well cared for. Additionally, obtaining a State Farm cash value life insurance quote ensures that they have lasting security and peace of mind.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What are the average life insurance rates by age?

I am sure you are asking yourself, what is the average life insurance cost per month? The table below will help you find the average life insurance rate by your age.

State Farm Average Annual Life Insurance Rates

| Policy Holder Age, Marital Status, & Gender | State Farm Average Rates | Average Annual Rates |

|---|---|---|

| 25-Year-Old Single Female | $143.00 | $164.50 |

| 25-Year-Old Single Male | $164.00 | $183.61 |

| 35-Year-Old Married Female | $166.00 | $170.47 |

| 35-Year-Old Married Male | $175.00 | $190.40 |

| 45-Year-Old Married Female | $238.00 | $247.50 |

| 45-Year-Old Married Male | $239.00 | $274.59 |

| 55-Year-Old Married Female | $341.00 | $417.01 |

| 55-Year-Old Married Male | $396.00 | $543.23 |

| 65-Year-Old Single Female | $684.00 | $898.76 |

| 65-Year-Old Single Male | $955.00 | $1,308.00 |

Almost all of State Farm’s rates are under the average.

It’s important to note that there was an increase in rates. In 2019, many companies, including those offering State Farm term life insurance rates and State Farm’s cheap life insurance options, raised their policy premiums. This trend also affected State Farm final expense insurance, reflecting a broader industry shift.

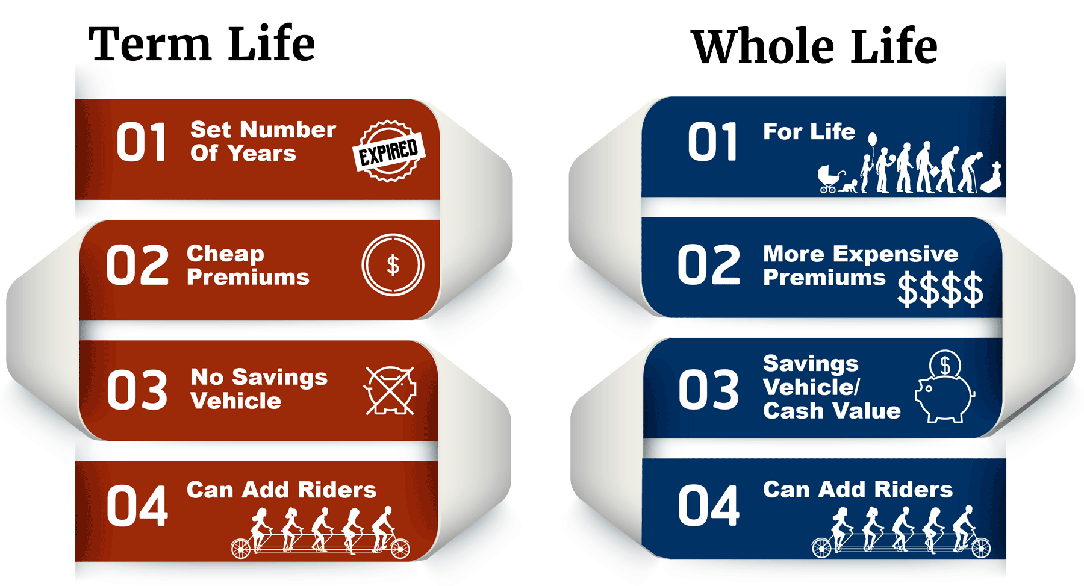

What types of insurance policies are offered by State Farm?

State Farm offers family life insurance options worldwide, so finding an agent nearby should be straightforward. Simply search online for “State Farm Life Insurance” along with your state. You can also explore universal life insurance with State Farm and get details on the cost of life insurance with State Farm.

Life insurance is akin to selecting from a diverse assortment of chocolates. With various options available, it’s essential to know how to look up a State Farm policy number and review State Farm burial insurance for seniors. Checking State Farm burial insurance reviews can also guide you in making the best choice.

Like their home insurance, the company’s life insurance branch is lesser-known. Although it is not as well-known as their car insurance, the life insurance branch of the company offers multiple types of life insurance coverage: term, whole, and universal coverage.

They offer return of premium and instant answer term life insurance. The company offers limited pay, single-premium, and final expense whole life insurance. They also have survivorship life insurance, joint, and universal life insurance.

All of these policies have different features depending on the type of policy.

.

Keep reading for a more thorough explanation of the differences and to get a basic description of coverages available.

State Farm Term Life Insurance

State Farm is one of the best term life insurance companies. Consumer reports usually rank it towards the top of their lists.

Term life insurance is insurance that’s offered for a specified set of time, called terms. Terms are often in 10-year, 20-year, 30-year, and 40-year chunks of time. The return of premium term life insurance is a level premium payment that’s available for 20 or 30 years.

If you outlive the term of the coverage, you will get all the premiums you paid back with term life insurance through State Farm.

The Instant Answer term life insurance will provide a death benefit of $50,000. It will provide a death benefit until the age of 50 or a maximum of 10 years. You can apply, get an underwriting decision, and purchase your policy on the same day.

There are many different types of life insurance to choose from.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

State Farm Whole Life Insurance

Whole life insurance, also called permanent life insurance, will cover you for your entire lifetime. You can get whole life insurance from State Farm.

Limited Pay whole life insurance is a type of life insurance that can be paid in full in 10, 15, or 20 years. This means that you could avoid paying premiums during retirement if you purchase the permanent policy young enough. This is a good policy for families and most adults.

Single-Premium whole life insurance is a type of insurance that will cover you for your life after you pay a single lump-sum premium. If you are asking, can I take money out of my life insurance, then yes. This coverage does offer a cash value along with lifetime coverage. The premium will be $15,000 and is available to ages 0–80.

Final Expense insurance is insurance that will pay a $10,000 death benefit for final and burial expenses.

State Farm Universal Life Insurance

Universal life insurance is a type of permanent insurance. It offers low premiums and an investment portion in your coverage.

The Survivorship universal life policy covers two people. The policy won’t pay out until both of the covered individuals die. It’s an affordable option that’s less expensive than buying two individual policies and is a great option for spouses who want to leave money for their children or grandchildren.

The coverage eligibility starts at 20 years of age until 90. If you reside in California, then the eligibility ages are 20 to 78. This policy offers coverage starting at $250,000. This is still a good option for seniors.

A joint universal life policy also covers two people. This type of coverage is very similar to survivorship universal life insurance except it will pay out the death benefit when the first of the two insured parties passes away.

State Farm Burial & Final Expense Life Insurance

Many people are unaware of the high costs associated with burials when evaluating coverage options, including State Farm burial insurance plans for seniors. Understanding how to buy life insurance from State Farm and exploring the State Farm life insurance cash value can help in planning for these expenses.

State Farm offers Final Expense insurance. This insurance is a death benefit that will be paid to the beneficiary for a funeral and final expenses. The policy amount is $10,000. You must be 50 to 70 years of age to qualify unless you live in New York. If you live in New York then the ages of eligibility are 50 to 75.

Many insurance companies will have you take a medical exam and fill out questions about your health. You can get life insurance with a medical condition or if there are conditions that are hereditary in your family will.

The VA’s website explains the government’s life insurance and how to gain access to that life insurance if you qualify.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What other State Farm life insurance products are offered?

State Farm is actually very famous for their car insurance. Many people are not aware that the company offers auto, home, and health insurance. The car insurance portion of the auto insurance company offers many policies and options.

If you are interested in refinancing your home or getting health insurance, while getting life insurance, then ask an agent if they have any bundles available. You can pay for multiple types of insurance, with one company, in one bill.

What are life insurance riders?

Most life insurance companies offer riders that you can pair with your traditional policy. Riders are supplemental insurance.

State Farm’s website only features their Flexible Care Benefit Rider.

This rider is for the event that you become chronically ill. If you are eligible, the rider will allow you to access a portion of the policy’s death benefit every month. The site says to contact an agent or start a quote to learn about additional riders.

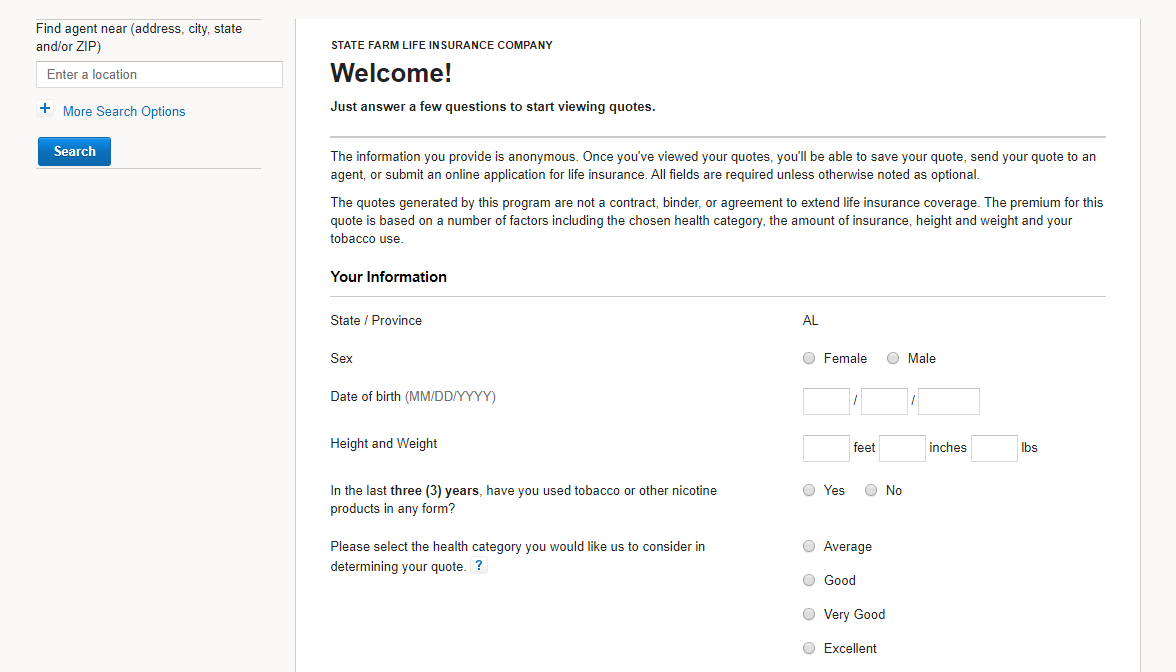

How can I get a State Farm life insurance quote online?

Go to the company’s home page at www.statefarm.com.

Find the header that says Get A Quote and click it.

Choose Life as your product. Also, pick the state you live in from the drop-down box.

Press Start A Quote.

This page will complete your life insurance quote pre-check. You will simply be entering basic information.

First, select your birth month. Then, choose your birth date. Next, select the year you were born.

Now, click continue. Fill out your basic information.

This page will have you answer demographics to give you a quoted rate for the plans available to you.

The bottom part of the application is a breakdown of the amount of coverage you will need.

Fill out the coverage amount you’ll need. The site offers a coverage tool for a detailed estimate of your monthly premiums.

Click Get Quote when you’re finished with the form.

Get your life insurance options and your quoted rates. This format gives you a visual comparison of all the different policy quotes at once.

If you would like to compare life insurance options, then just click the Compare Policy box under the plans you’re interested in.

Customize your policy. If you pressed Select and Continue, then the next page will allow you to customize your policy. You simply have to press the Select and Continue button.

If you chose to compare policies, then the site will bring you to a page that shows you the policy options that you were interested in, side by side.

If you want further information about a specific policy then press Select and Continue under that policy.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

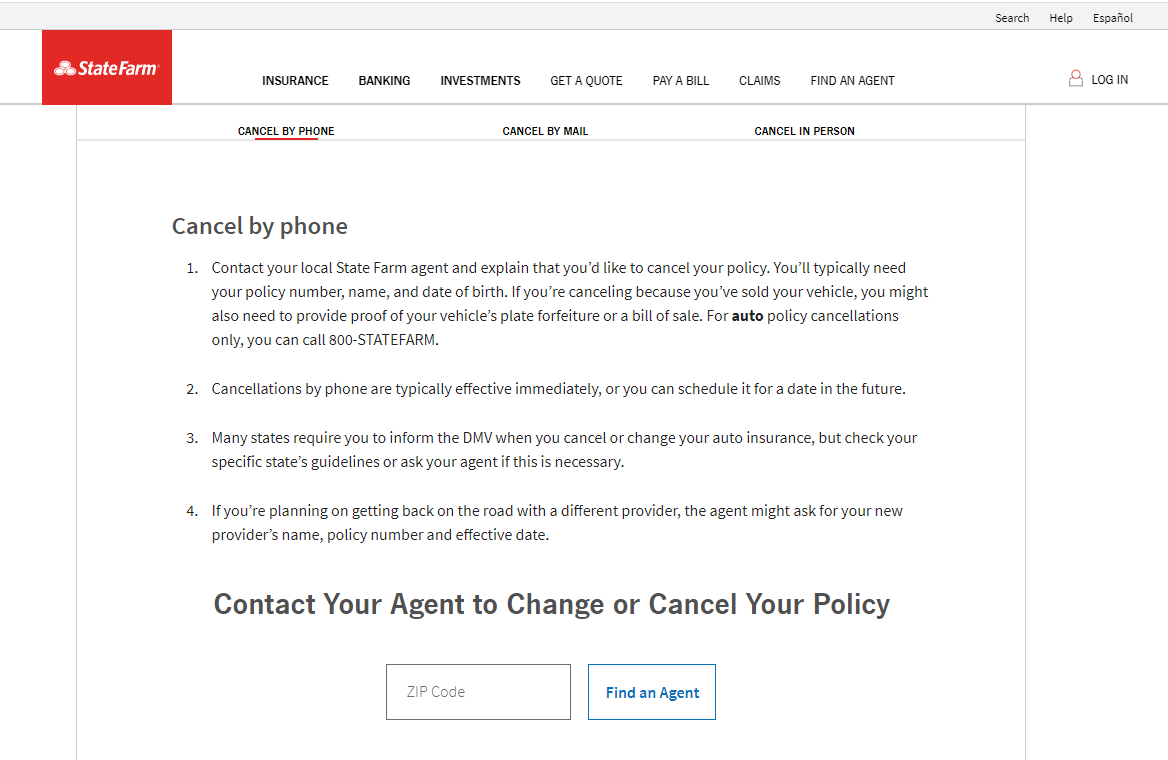

How can I cancel my State Farm life insurance policy?

Canceling your policy is very easy. They offer you a wide range of options to choose from when canceling.

How to Cancel

The insurer has made it fairly easy to cancel if your life insurance plans or needs change.

Go to the homepage. The website can be found at www.statefarm.com. The homepage has recently changed.

Scroll to the bottom of the page. You want to find the box at the bottom that has hyperlinks to many parts of the site.

Find the heading that says Customer Care Center. Now, find Manage Your Account.

Click Manage Your Accounts it will be under the Customer Care Center heading. Scroll down the page until you find the heading “Have More Questions?” then click “How to cancel your policy.” Clicking will take you to a new page.

This page gives you multiple options on how to cancel your insurance policy. The first option is to Cancel By Phone. The life insurance phone number is located in the table at the top of the page.

The next option is to Cancel By Mail followed by Cancel In Person. This option also allows you to find an agent in your area by typing in your zip code and clicking Find an Agent.

How can I make a claim?

If you want to make a claim, then go to www.statefarm.com.

Find the heading named Claims and click it. A box will pop-up and ask if you would like to File a Claim or Track a Claim.

It will take you to a new page.

Click Start a Claim and choose Life as your claim type. You’ll need the insured party’s name, date of birth, state of residence, your policy number, and the date and cause of death of the insured party.

If you’re experiencing issues with your State Farm life insurance claim status, you can use the live chat feature for assistance. Look for the red bubble labeled “Chat” to access this option. Simply click the button to get help with the State Farm life insurance application process or any claim-related concerns.

What are the State Farm life insurance reviews from customers?

The NAIC Complaint Index will give you information about the number and types of complaints that are made about a company. The NAIC has provided 55 complaints against State Farm life insurance.

J.D. Power’s highest award that they give is the Among the Best Award. This is the award that J.D. Power gave State Farm in 2018. State Farm is still in the top-ranking life insurance companies, according to J.D. Power.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What programs are offered?

State Farm Life Insurance Company provides numerous resources on their website to educate you about life insurance. They offer a variety of tools to assist you in your research, including a State Farm life insurance calculator and links to valuable information, helping you make an informed decision. Additionally, their site features a State Farm car insurance calculator for broader insurance needs.

When it comes to programs, it seems that the company offers more information about car insurance.

Are the website and app easy to use?

The design of the website is very user-friendly. It’s as easy as filling out the information inside of the box and receiving an immediate quote.

The headers at the top of the site make it easy to find what you’re looking for.

For life insurance, click Life. This will give you access to all of the information and tools related to life insurance.

What is the history of State Farm life insurance?

The insurer was founded on June 7, 1922. It was started by a retired insurance agent named George Jacob Mecherle as a single-line automobile insurance agency. They now own five lines of business.

Mecherle’s dream was to do the right things and operate his company fairly. The company states that they still follow his vision today, having passed many seat belt laws and fighting for driver safety.

State Farm is a highly recognized and widely utilized life insurance provider. In addition to their insurance services, which include handling State Farm life insurance claims and offering a State Farm policy number search, the company has expanded into the banking sector. When was State Farm founded? This expansion reflects their longstanding presence and evolution in the financial services industry.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Are State Farm life insurance reviews and ratings positive?

There are multiple life insurance company rating websites that you can check to see how reliable the company you’re interested in is.

Comparing credit ratings can be useful when comparing companies. It can help you answer the question, “What is the best life insurance company?” State Farm has very good ratings.

A.M. Best gave an A++ rating. The Better Business Bureau (BBB) rated the company with an A+. Moody’s has rated the insurer with an Aa. Standard & Poor’s (S&P) rating system gave them an AA.

What is the State Farm’s market share?

The market share as of 2018 was 6.42 percent. In 2017, the company’s market share was 6.38 percent. In 2016, the company had a market share of 6.48 percent.

The company’s market share was highest in 2016.

Top 10 Life Insurance Companies by Market Share (NAIC)

| Companies | Market Share 2018 | Market Share 2017 | Market Share 2016 |

|---|---|---|---|

| Northwestern Mutual | 6.42% | 6.38% | 6.48% |

| Metropolitan Group | 6.00% | 7.37% | 7.65% |

| New York Life | 5.68% | 5.70% | 5.61% |

| Prudential | 5.57% | 5.48% | 5.49% |

| Lincoln National | 5.36% | 4.55% | 4.44% |

| MassMutual | 4.19% | 4.37% | 4.27% |

| Aegon | 2.94% | 2.89% | 2.96% |

| John Hancock | 2.83% | 2.80% | 2.93% |

| State Farm | 2.83% | 2.76% | 2.82% |

| Minnesota Mutual Group | 2.70% | 2.52% | 2.51% |

The market share of a company is the total industry sales over a fiscal year divided by the company’s total revenue of sales.

State Farm’s position for the future looks promising.

Read more: MassMutual Life Insurance Review

How is State Farm’s online presence?

The insurer has 2.15 million people who’ve liked their Facebook page. They post multiple times a week. The company also posts video content regularly.

The company’s YouTube page has 170,000 subscribers and its page has many videos.

State Farm’s Twitter page has 102,900 followers. They tweet multiple times a week. They also have a State Farm Latino Twitter that’s in Spanish.

State Farm’s LinkedIn account has 325,724 followers. The company LinkedIn profile posts almost every day. They also have a company Instagram account. The company’s Instagram account has 58,100 followers. There are 659 posts.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Does State Farm life insurance run commercials?

There are many commercials. You can find them on the insurer’s official YouTube account. The company has a new Jake from State Farm, and he is featured often on their website and commercials.

The company motto is, “Like a good neighbor, State Farm is there.” You’ll hear the company motto often in its commercials.

They have recently had Chris Paul, Terry Crews, Alfonso Ribiero, and Aaron Rodgers in the company’s commercials.

There are even commercials in Spanish.

Is State Farm involved in the community?

The business is extremely active in the community. They have multiple company grants, foundations, and initiatives that they use to help.

The Good Neighbor Citizenship® company grants fund organizations and institutions. Their State Farm Companies Foundation has a matching gift program. This program was started to encourage associates to support higher education and charitable organizations.

The business serves many different communities. They have designated initiatives to attempt to serve the African-American, the Asian and Pacific Islander, the Hispanic, and the LGTBQ communities.

What are the State Farm life insurance reviews from employees?

State Farm is actually considered one of the best life insurance companies to work for. There are reviews from employees on Indeed, PayScale, and Glassdoor.

Indeed has rated the work-life balance is rated 3.6 of 5. PayScale has a lot of ratings. They have an overall company rating of 3.3 out of 5. Glassdoor has given them a ranking of 3.2 out of 5.

Reviews seem generally average across the board.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

State Farm Life Insurance Review: What are the pros & cons?

Let’s take a look at the pros and cons.

What are the pros?

They are a very well-known and trusted company and consistently rank among the top 10 insurance companies.

They are also very philanthropic and do a substantial amount of volunteer work and donating to the community. They have a stable looking financial outlook and offer very low life insurance premiums. They did write more premiums in 2018 than in 2017.

What are the cons?

One con is that the company market share did decrease. The company would seem more financially stable if its numbers had not dropped.

Not all of the policies can be adjusted or changed unless you go in person.

Many people like the availability of being able to do everything online and there are specific issues that have to be dealt with in person and with an agent.

There are some states that the company does not sell in or that they offer policies for a smaller amount of ages.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What’s the bottom line?

State Farm is a very well known and respectable company. They are extremely involved in the community, and they are financially stable. Now that you’ve learned about this company, are you ready to compare other companies?

Don’t wait! Now that you’ve read our review, click our FREE quote tool below to get quotes from top life insurance companies.

Frequently Asked Questions

What do I need to do to change my beneficiary?

The company doesn’t allow you to change a beneficiary online. You’ll have to make an appointment with a local agent, and they will help you.

Will the company still pay if the cause of death is suicide?

In the fine print, it does say that there may be limitations on payment in the case of suicide within the first two policy years. Call your insurance agent to discuss if the policy can be paid out. They should know all of the payout options.

Can I combine my auto insurance, insurance, and homeowner’s insurance?

Yes, most companies will let you bundle different types of insurance together. You should make sure that this will be a cheaper option than buying them separately. Bundles may save you money, but they may not.

Does State Farm offer any no medical exam insurance policies?

Yes, the business does offer insurance that has a no medical exam term feature. The no medical exam policy that it offers is the Instant Answer Term Insurance policy.

Can I change my insurance policy?

State Farm will adjust many types of insurance policies. You must contact your local insurance agent to make sure that your policy can be changed.

What happens if I apply online and my application is rejected?

If your application is rejected and you applied online, then the application will be sent to an agent. You can contact a local agent to continue the application process.

How does State Farm Insurance work?

It is as easy as going to your local State Farm Agency or signing up or inquiring online. The company will ask for basic information, a medical exam, and you will pay them a monthly, or one-time sum, for a policy that your beneficiaries will receive when you die. For more detailed instructions, read the article above.

What is the cost of a $500,000 State Farm term insurance policy?

A $500,000 term policy would be more expensive than a whole policy of the same amount. The amount you will pay each month largely depends on the amount of the policy you purchase and how long the term is.

Does State Farm offer life insurance?

Yes, State Farm offers life insurance. They provide various types of life insurance policies, including term life insurance and whole life insurance, to meet different needs and preferences.

Does State Farm offer whole life insurance?

Yes, State Farm offers whole life insurance. Whole life insurance provides coverage for the insured’s entire lifetime and includes a cash value component that grows over time.

Does State Farm offer term life insurance?

Yes, State Farm offers term life insurance. This type of policy provides coverage for a specified term, typically 10, 20, or 30 years, and does not accumulate cash value.

How much does State Farm life insurance cost?

The cost of State Farm life insurance varies depending on factors such as the type of policy, coverage amount, the insured’s age, health, and other underwriting factors. It’s best to get a personalized quote from State Farm for an accurate estimate.

Is State Farm good for life insurance?

State Farm is generally considered a reputable provider of life insurance with a strong financial rating and customer service. However, whether it is the best choice for you depends on your specific needs and preferences. It’s advisable to compare State Farm’s offerings with other insurers to find the best fit for your life insurance needs.

How does American National Insurance compare to State Farm?

American National Insurance and State Farm are both well-established insurance providers, but they differ in various aspects such as product offerings, customer service, and pricing. State Farm is a larger company with a more extensive network of agents and a wider range of insurance products, including auto, home, and life insurance. American National is smaller but often offers more personalized service. The choice between the two depends on individual needs, preferences, and the specific insurance product in question.

What is the best life insurance option for seniors offered by State Farm?

State Farm offers several life insurance options for seniors, with term life and whole life policies being popular choices. For seniors specifically, State Farm’s Final Expense policy, which is designed to cover funeral and burial costs, may be the most suitable. The best option will depend on the senior’s health, financial situation, and coverage needs.

What is State Farm’s best whole life insurance policy?

State Farm’s best whole life insurance policy is often considered to be their standard Whole Life insurance. This policy provides lifelong coverage, builds cash value over time, and offers level premiums. The policy is customizable with various riders, making it a versatile choice for those seeking permanent coverage with financial growth potential.

Does State Farm offer burial insurance for seniors to cover final expenses?

Yes, State Farm offers a Final Expense policy, which is a type of burial insurance designed for seniors. This policy helps cover the costs associated with funerals, burials, and other final expenses, providing peace of mind and financial security for the policyholder’s family.

How can I obtain a change of beneficiary form for State Farm life insurance?

To obtain a change of beneficiary form for State Farm life insurance, you can contact your State Farm agent directly, visit a local State Farm office, or access the form through the State Farm website by logging into your account. Once completed, the form can be submitted to State Farm for processing.

What personalized coverage options does State Farm offer for life insurance?

State Farm offers various personalized coverage options for life insurance, including term life, whole life, and universal life policies. Customers can choose coverage amounts, policy terms, and add riders such as accidental death benefits, waiver of premium, or child term riders to tailor their policy to their specific needs.

How can I get a personalized price for State Farm life insurance?

To get a personalized price for State Farm life insurance, you can request a quote online through the State Farm website, speak with a State Farm agent, or visit a local State Farm office. The quote will consider factors like your age, health, coverage amount, and policy type to provide an accurate premium estimate.

How can I get a quote for State Farm permanent life insurance?

To get a quote for State Farm permanent life insurance, you can visit the State Farm website and use their online quoting tool, contact a State Farm agent, or visit a local State Farm office. The quote will reflect your specific needs and preferences, such as the desired coverage amount and any additional riders.

Does State Farm offer accidental death insurance?

Yes, State Farm offers accidental death insurance as a rider that can be added to their life insurance policies. This coverage provides an additional payout if the insured person dies as a result of an accident, offering extra financial protection to the policyholder’s beneficiaries.

What does the State Farm final expense policy cover?

The State Farm Final Expense policy is designed to cover the costs associated with funerals, burials, and other end-of-life expenses. It provides a modest death benefit, typically ranging from $10,000 to $15,000, ensuring that these costs are managed without burdening the policyholder’s family.

What are the ratings for State Farm life insurance?

State Farm life insurance generally receives high ratings for financial strength, customer service, and overall satisfaction. Companies like A.M. Best often rate State Farm with an “A++” (Superior) for financial stability, indicating the company’s strong ability to meet its policyholder obligations. Customer satisfaction ratings are also typically positive, though individual experiences may vary.

What term life insurance options does State Farm offer?

State Farm offers various term life insurance options, including Select Term, which is available in 10, 20, or 30-year terms. These policies provide a straightforward, affordable option for those seeking temporary coverage with the flexibility to convert to a permanent policy if needed.

What types of life insurance does State Farm provide?

State Farm provides several types of life insurance, including term life, whole life, and universal life insurance. Term life offers coverage for a specific period, whole life provides lifelong coverage with cash value, and universal life offers flexible premiums and death benefits, combining elements of term and whole life.

How do I file a death claim for State Farm life insurance?

To file a death claim for State Farm life insurance, you can contact your State Farm agent, visit a local State Farm office, or call State Farm’s customer service line. You will need to provide the policy number, the death certificate, and any other required documentation to begin the claims process.

What payout options are available with State Farm life insurance?

State Farm life insurance offers several payout options for beneficiaries, including a lump-sum payment, installment payments over a set period, or interest-only payments where the beneficiary receives interest on the death benefit until they decide to withdraw the principal. These options provide flexibility in managing the payout according to the beneficiary’s financial needs.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.