10 Common Body Parts You Can Insure [2025]

The heart, eyes, and legs are the three body parts Americans want to protect the most. Body part insurance is a rare insurance policy that allows you to insure a specific body part, with coverage sometimes worth millions of dollars.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 30, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 30, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Six organs and four other body parts make up the top 10 body parts people want to insure most

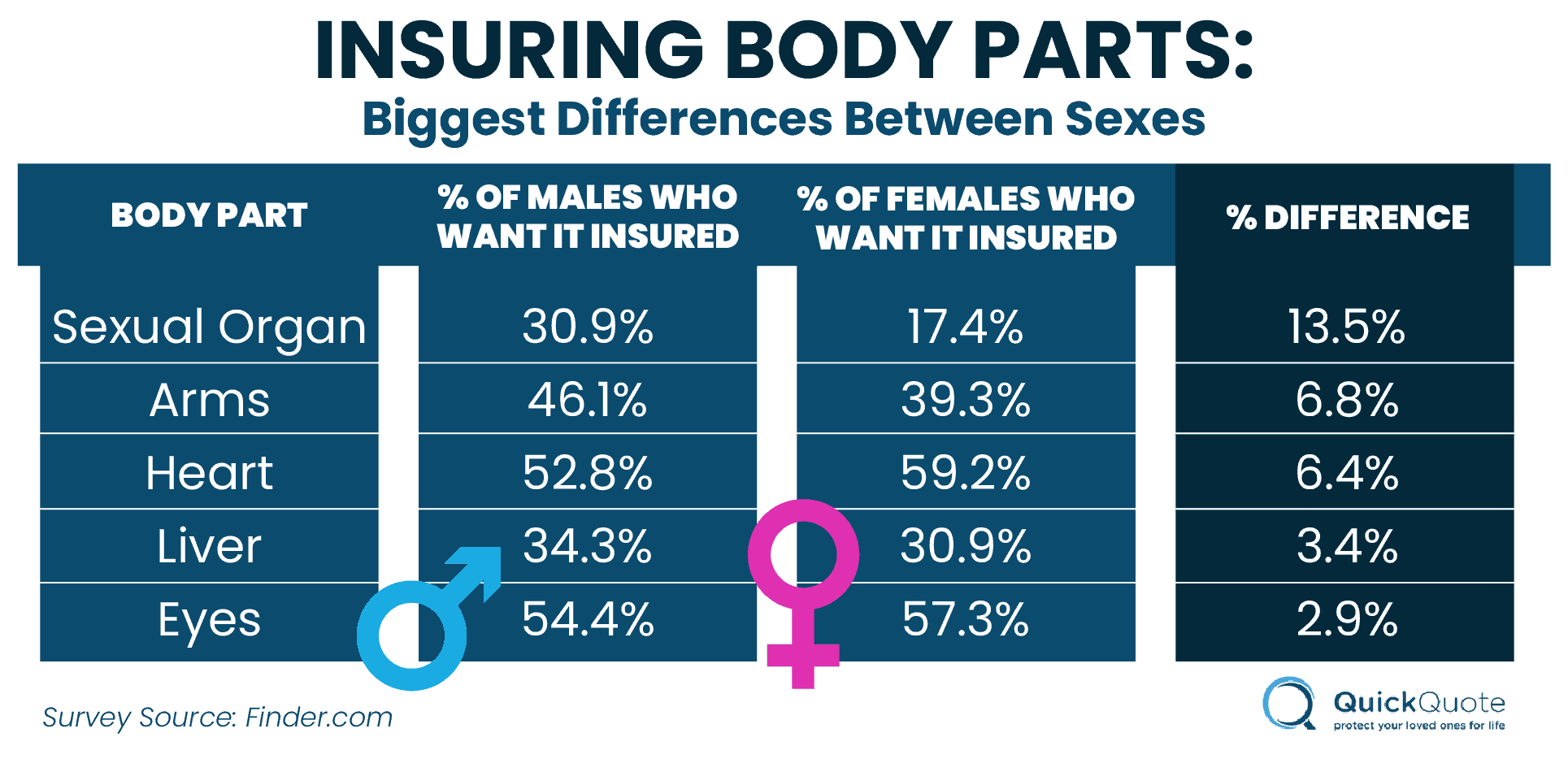

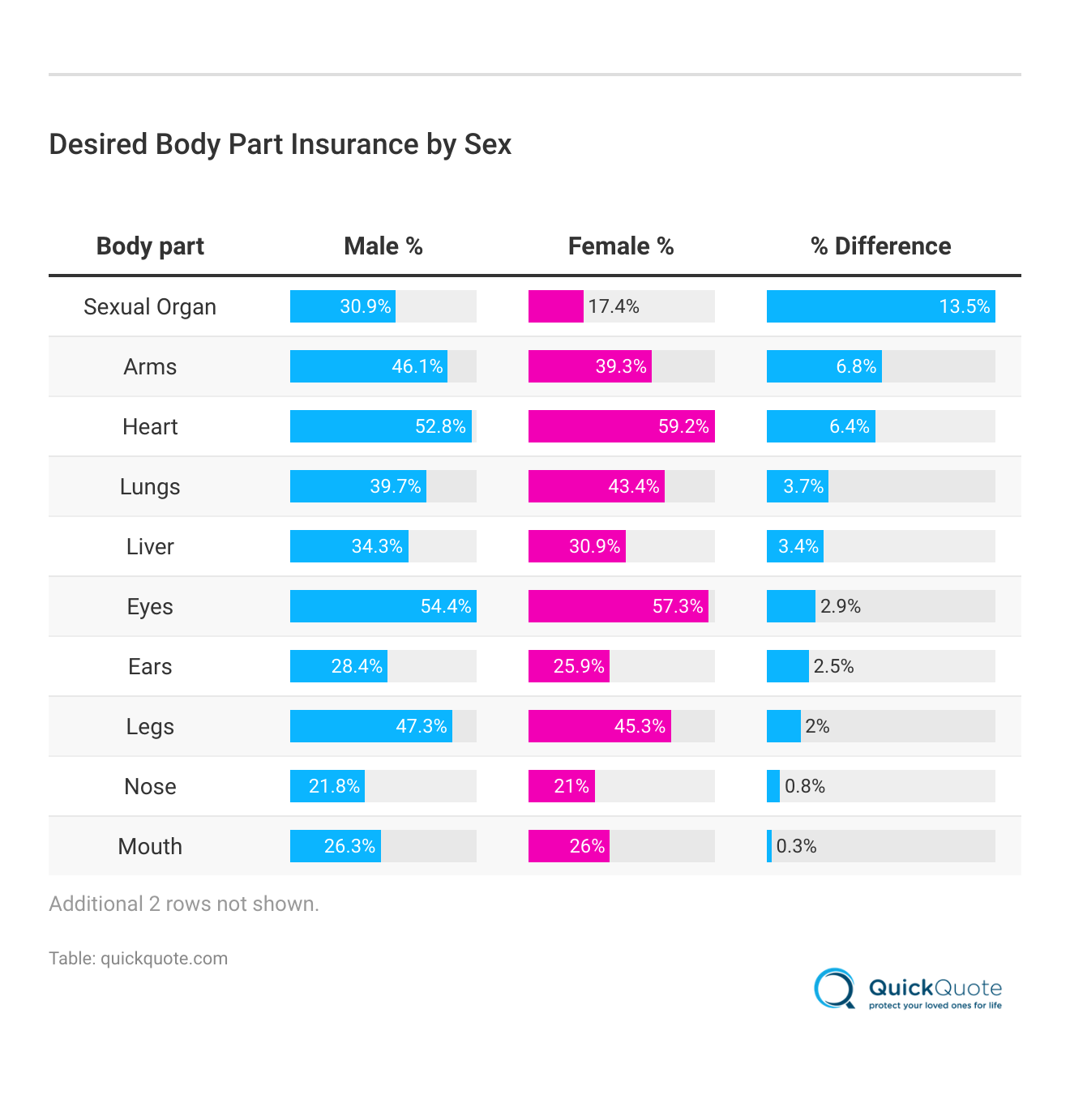

- Sexual organs are the body parts with the widest split between sexes

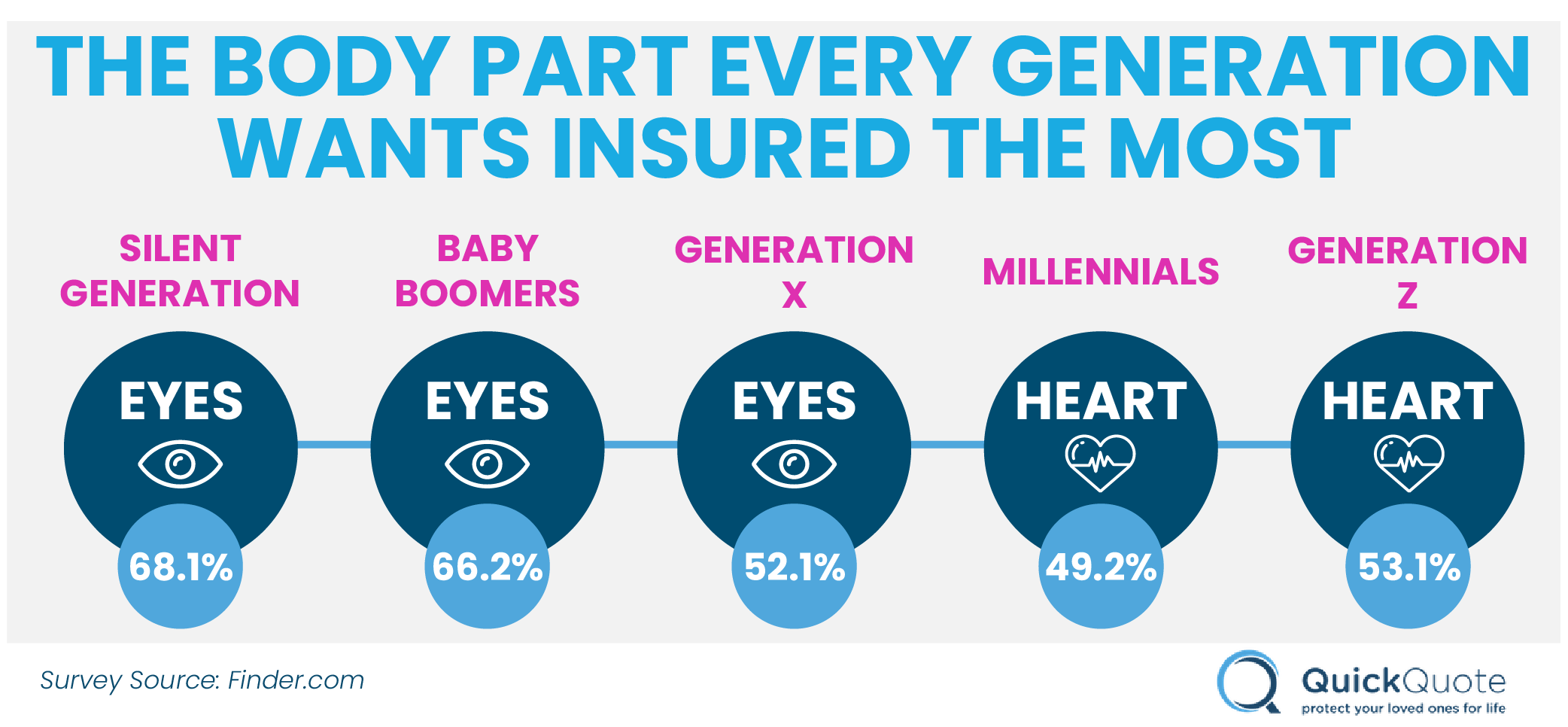

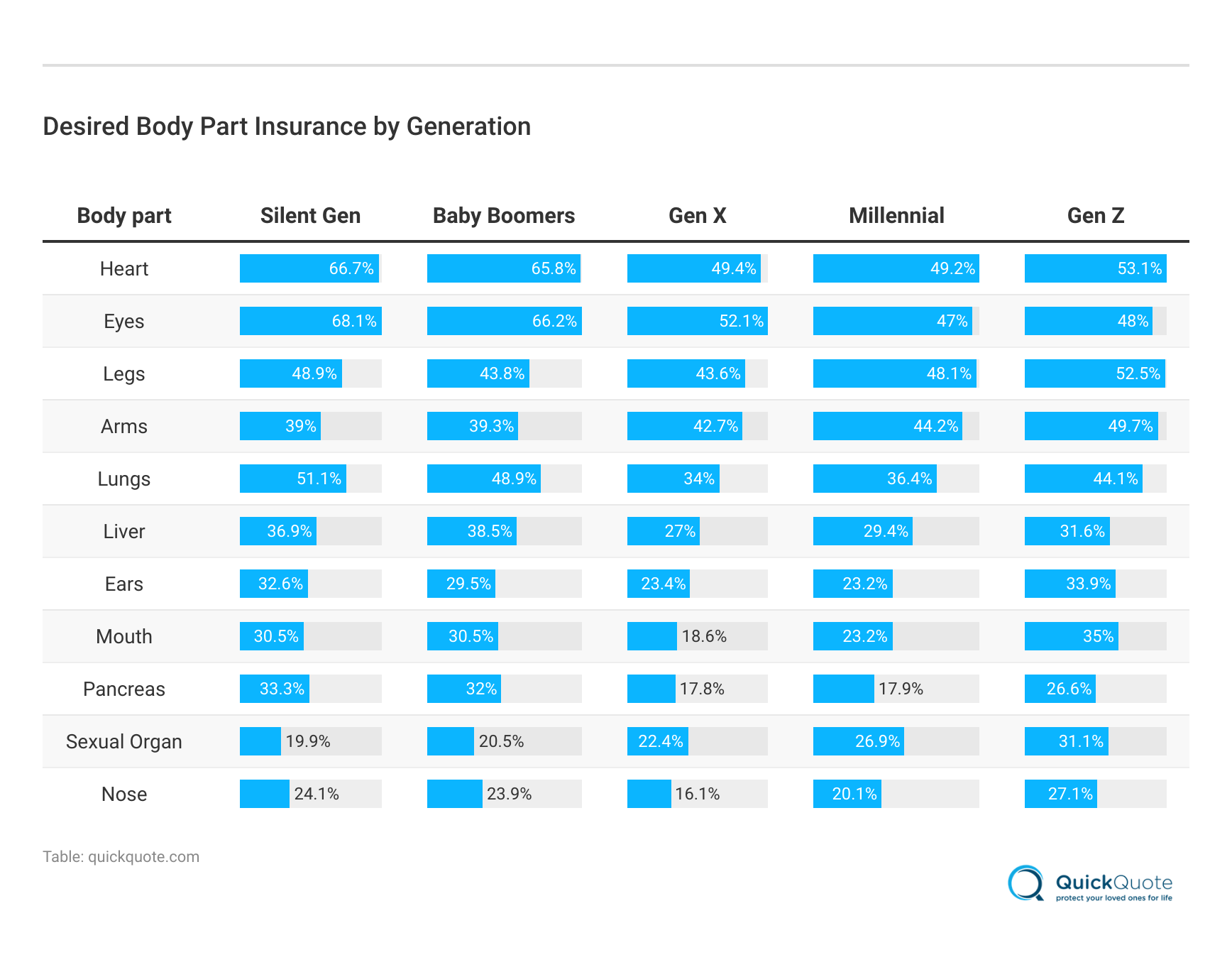

- Among all generations surveyed, the most popular body part each generation wanted to insure the most was either the heart or eyes

- Some celebrities and athletes get body part insurance worth hundreds of millions of dollars

What body part would you insure?

Arms? Legs?

It’s the age-old question of what body part is most important to you — and if you had the cash and the resources, which one would you protect with body part insurance? It’s not as far-fetched as you might think.

Celebrities and athletes dating back to the 1920s have had body parts insured. These were pieces of themselves that were so crucial to their livelihood that losing or damaging them would result in a loss of money.

Celebrities are one thing, but what about everyone else?

We turn our attention, in this article, from the rich and famous to the everyday person and ask them — what body parts would you like to insure?

Check out the top 10 body parts people say they’d like to insure in the graphic below.

In the ranking section below, we’ll break down each body part and provide context. After the ranked list, we’ll cover how you can get body part insurance and why most people opt for more common types of coverage like accidental death life insurance.

Now, buckle your seat belts and hang on tight. We’re going on a wild ride through the heart of one of the most specialized of specialty coverages: body part insurance.

Let’s get started.

10 Body Parts Americans Want Insured the Most

Ready, set, go. Here we have the results of the survey: the top 10 body parts Americans most want insured. Some are organs while some are limbs.

By the end, you’ll know which body parts your fellow Americans find most valuable. Let’s take a look at that list.

#10 – Sexual Organ

Americans kicked off the voting with the organs that are used for procreation. Ranked 10th on this list, 23.7% of Americans said this was one of the body parts they’d insure, placing value on — among other things — their future children.

Sexual organs had the biggest split among genders out of all body parts. So which gender wanted them insured the most? Find out after the ranking.

#9 – Pancreas

The organ that helps break down food and secretes hormones comes in 9th, with 24.4% of Americans saying they’d insure their pancreas if they could.

Part of the exocrine system, the pancreas plays a crucial role in regulating blood sugar by producing insulin, a hormone that helps move glucose from blood cell to blood cell. Thus, the pancreas is an important player in the fight against diabetes, which may be the reason people voted it 9th in this ranking.

#8 – Mouth

The mouth, used for eating and talking, ranks No. 8 in this list, with 26.1% of Americans saying they’d insure it if they could.

This body part has dozens of biological functions, including roles in breathing, balance, posture, coughing, spitting, and, of course, taste. It is also a valuable body part for communication.

#7 – Ears

Coming in 7th is another body part related to the five senses — the ears. Twenty-seven percent of Americans say they’d insure their ears, and it’s no surprise that they would.

Having three main sections — external, middle, and inner — the ears are most associated with hearing and balance. Losing either is considered debilitating to an individual.

#6 – Liver

Ah, the liver, the blood balancer, our first major organ on this list. Americans highly value it, ranking it 6th, with 32.5% saying they’d insure it if they could.

It performs hundreds of important biological functions, such as removing toxins from the blood, aiding in blood clotting, and producing bile, which carries away waste.

#5 – Lungs

The main drivers of the respiratory system — the lungs — come in at No. 5 on this list. Nearly 42% of Americans say they’d insure them, a large jump from the 32.5% that wanted to insure their liver.

The lungs are critical to survival, with it being impossible to survive without them (unless hooked up to some serious medical equipment). They take oxygen from the air and transfer it to red blood cells while also expelling carbon dioxide every time we exhale.

They are crucial for helping us sleep well, too.

#4 – Arms

Americans ranked arms 4th with 42.4% saying they’d insure them if they could.

Arms perform functions related to picking up, lifting, holding, exerting force, and many others. Arms are valuable to many professions as well.

There are other ways of protecting them besides getting a policy, of course. Working out frequently can help. And never fear — you’ll almost never be considered “too muscular” for a term life insurance policy either.

#3 – Legs

Legs come in 3rd, with 46.2% of Americans saying they’d insure them.

Legs play a crucial role in motor function, walking, standing, stooping, squatting, and running. From professional athletes to doctors, the legs are essential to most careers and activities, which is likely why a lot of people want to protect them.

The healthy activities your legs help you engage in can lead to lower rates on another type of insurance — life insurance. For example, rates on life insurance for runners are some of the most competitive, for instance.

#2 – Eyes

What’s the second-most valuable body part, according to Americans? Our eyes. A clean 56% of Americans say they’d insure this body part if they could.

The eyes are highly complex with over a dozen parts, and they are used to organizing and interpreting the visual world. In surveys, sight is often the thing people say they would miss the most.

#1 – The Heart

Coming in first as, perhaps, the most vital organ of them all — the heart. Fifty-six percent of Americans say they would insure the heart if they could, just a smidgen above the eyes but enough to push it to the title.

With four main functions, the heart is best known for pumping oxygenated blood throughout the body. It is crucial. Even small changes in the heart can lead to problems in the body.

Further, heart disease is the No. 1 cause of death in America and has been for a number of years.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Is there any difference between the sexes in insuring body parts?

Now you know the top 10 insured body parts that Americans want coverage for.

Surprises? Shocks? Here’s where we break down this information into subsets.

First: do males and females differ in which body parts they want insured. If so, which ones?

Take a look at the graphic below. It shows the five body parts with the biggest differences in how much males wanted it insured versus females.

We analyzed the body parts with the greatest differences between how many males wanted a body part insured compared to females. The biggest difference was between sexual organs, the only body parts with a difference between males and females wider than 10%.

Are there any generational differences in insuring body parts?

While males and females were split on some body parts, did age groups differ as well?

The graphic below shows the body part that each generation, from the silent generation to Generation Z, wanted to insure the most.

While the silent generation, baby boomers, and Generation X wanted to insure their eyes the most, millennials and Generation Z voted for another body part: the heart.

Even within the three generations that voted for the eyes, that percentage drops among the younger generations.

What’s body part insurance?

Now, you might be excited and want to know — “How exactly do I insure a body part?”

It might help to know that this type of insurance is rarer than typical insurance types. You might be out of luck if you call up your regular insurance provider and request a quote. To buy body part insurance, you’ll often have to find a specialty insurance company.

Shopping around can give you the best options. And Konstantin, founder of Cat Motors, adds that you should know your policy through and through. Some insurance companies will leave you without coverage if you get injured in a certain situation.

Most high-profile body part insurance policies come from one place: Lloyd’s of London. And be prepared for a serious and individualized process. A medical practitioner will probably have to evaluate your body part to determine its quality and health.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How much does body part insurance cost?

Because the whole process is so personalized, including the policy itself, expect high rates for insuring a body part.

There’s a reason only the rich and famous typically get these types of policies. Most people opt for basic health insurance and accidental death or life insurance policies, which are common and cheaper.

Body part insurance would be considered an unusual insurance policy. But if you can afford the body part insurance premium, it’s all yours. You may be off going in another direction, however.

Linda Chavez, founder and CEO of Seniors Life Insurance Finder, says, “The average person would be better off buying a traditional form of insurance or general disability insurance. Body part insurance costs far more than regular insurance and does not offer coverage if they suffer injuries on other parts of their bodies.”

Which celebrities are insuring their body parts?

The purchase of body part insurance by celebrities started in the 1920s with Ben Turpin, the silent film actor. He allegedly took out tens-of-thousands of dollars worth of policies for his crossed eyes. If they ever went straight, his Lloyd’s of London body part insurance policy would pay him an undisclosed sum.

Since then, numerous stars and athletes have purchased body part insurance to protect themselves from lost wages. Some of them are:

- America Ferrera’s smile ($10 million)

- David Beckham’s legs and face ($140 million)

- Bruce Springsteen’s voice ($5 million)

- Heidi Klum’s legs ($2 million)

- Keith Richard’s hands ($1.6 million)

Lower profile celebrities have had their taste buds (chefs, food tasters) or noses (sommeliers) insured.

Why do celebrities insure body parts, sometimes for millions of dollars? Simple: If they damaged said part, they’d lose out on a lot of money.

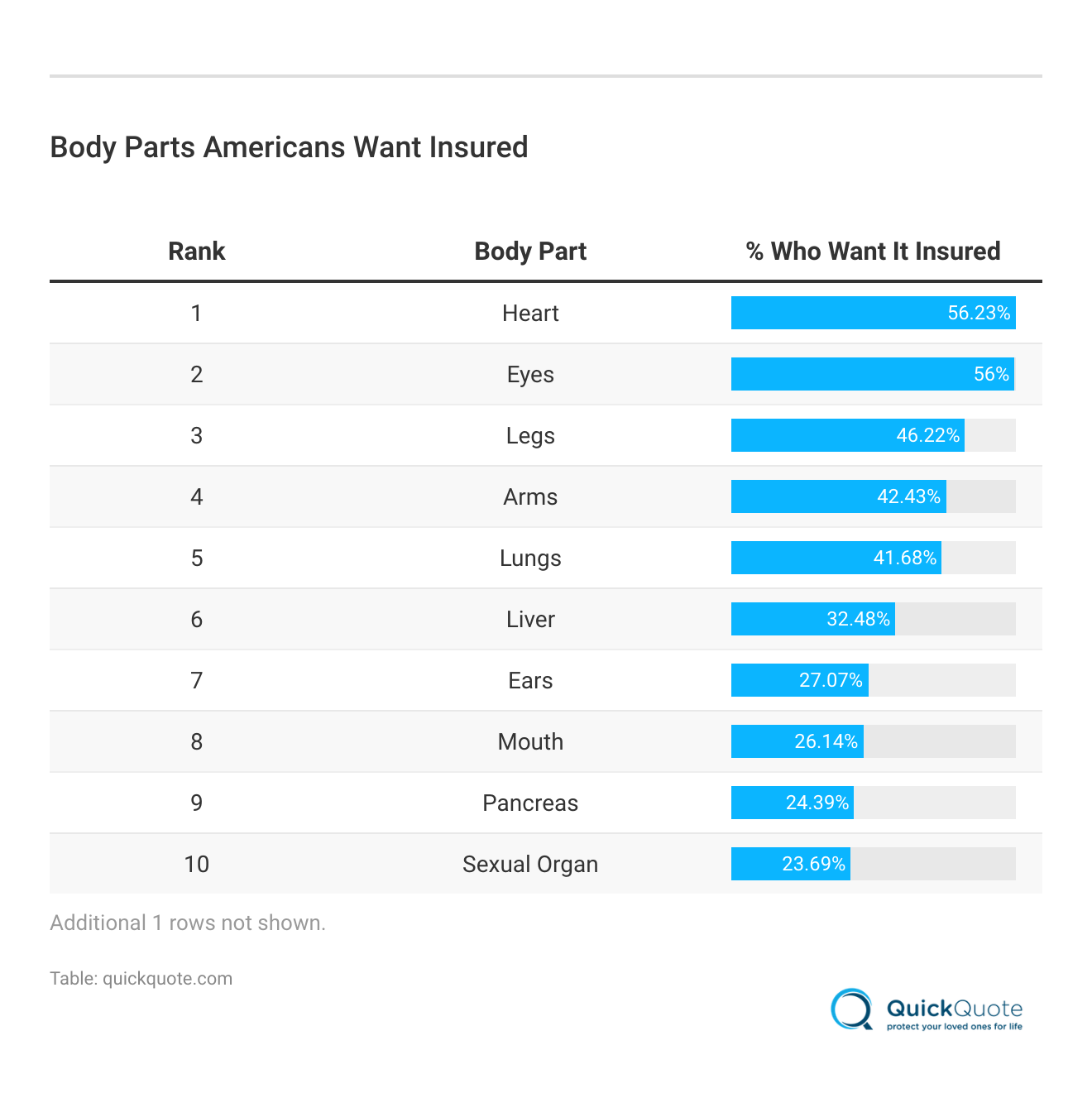

Full Body Part Insurance Survey Results

The following table shows the complete list of body parts included in the survey and the corresponding percentage of Americans that wanted them insured.

The only one that didn’t make our top 10 list was the nose, with just 21.36% of Americans wanting it insured.

Next is a table that shows the differences between males and females in what body parts they most wanted insured (the difference is calculated in percentage split):

Eight of the 11 body parts in the survey had a split between sexes of 4% or less. The three with the smallest splits were the nose, mouth, and pancreas.

Last is a table that reveals the complete differences between the generations for which body parts they would most like to insure:

Interestingly, the younger the generation, the more balanced the results.

The body part each generation least wanted to insure was split between “sexual organ” (silent generation, baby boomers), “nose” (Generation X), and “pancreas” (millennials, Generation Z).

Read more: Death by Falling Coconut: What are the chances it happens to you?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Methodology: Determining the Body Parts Americans Most Want to Insure

For this study, 1,718 U.S. Adults from five different generations (Silent Generation, Baby Boomers, Generation X, Millennials, and Generation Z) were asked questions. The sample is representative of the U.S. adult population.

The data was further broken down into three categories:

- Percentage of Americans that wanted a certain body part insured

- Desire to insure a body part by gender

- Desire to insure a body part by generation (age group)

The generations were bracketed into the following years:

- Silent generation (1928-1945)

- Baby boomers (1946-1964)

- Gen X (1965-1980)

- Millennials (1981-1996)

- Gen Z (1997-2003)

Case Studies: Insuring Valuable Body Parts

Case Study 1: The Vocalist’s Voice

Celebrities are not the only ones who value their body parts enough to insure them. Meet Sarah, a professional vocalist known for her exceptional singing voice. Sarah’s vocal cords are her most valuable asset, as they are crucial for her career success.

She decides to protect her voice by obtaining body part insurance specifically for her vocal cords. The insurance coverage provides financial compensation in the event of vocal cord damage or loss, ensuring that Sarah can continue her singing career without significant interruptions.

Case Study 2: The Athlete’s Legs

Athletes often rely on specific body parts for their sports performance. John is a professional soccer player who excels in his agility and speed on the field. Realizing the importance of his legs for his career, John opts for body part insurance to safeguard his legs.

This specialized coverage offers financial protection in case of leg injuries or disabilities that could hinder his ability to play at a professional level. By insuring his legs, John ensures that his future earnings and livelihood are secured.

Case Study 3: The Surgeon’s Hands

Dr. Emily is a highly skilled surgeon renowned for her exceptional surgical precision. Her hands are her most valuable tools, allowing her to perform delicate surgeries with precision and expertise. Understanding the significance of her hands for her profession, Dr. Emily decides to insure her hands through body part insurance.

This coverage provides financial support in case of hand injuries or impairments that could hinder her surgical abilities. By insuring her hands, Dr. Emily ensures that she can continue her life-saving work without worrying about potential setbacks.

Case Study 4: The Artist’s Eyes

For artists, their eyes are the windows to their creativity and artistic expression. Lisa is a talented painter who relies heavily on her vision for her artwork. She considers her eyes to be invaluable and decides to obtain body part insurance specifically for her eyes.

This insurance coverage offers financial protection in case of eye-related injuries or impairments that could affect her artistic abilities. By insuring her eyes, Lisa ensures that she can continue pursuing her passion and creating breathtaking artwork.

Frequently Asked Questions

What body part would you insure?

Arms? Legs? Choose the body part you value the most.

Is there any difference between the sexes in insuring body parts?

Males and females have different preferences for insuring body parts.

Are there any generational differences in insuring body parts?

Different generations have varying preferences for insuring body parts.

What is body part insurance?

Body part insurance allows you to insure a specific body part for potential loss or damage.

How much does body part insurance cost?

Body part insurance can be expensive due to its personalized nature. Most people opt for more common and affordable insurance options.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.