Delaware Life Insurance [2025]

Delaware life insurance offers residents a 30-day grace period and a timely payment of death benefit claims. Get affordable Delaware life insurance industry quotes to protect your loved ones.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Sep 19, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

We offer Delaware residents life insurance from several of the best DE life insurance companies. Life insurance is very similar from state-to-state, with a few exceptions, so expect your Delaware life insurance rates to vary.

However, this guide should help you understand the differences in Delaware life insurance as well as find resources in your state. We’ll also show you how to get the best life insurance in Delaware.

Before we dive into this guide, find affordable Delaware life insurance rates by clicking on our FREE quote tool above. Get started now.

Looking for quotes in Delaware?

We offer Delaware residents life insurance from several A-rated life insurance companies. Life insurance products are very similar from state to state, with a few exceptions. This guide should help you understand the differences as well as find resources in your state.

Policy Cost – The premium (cost) you pay for your life insurance policy does not vary by state. It is the same regardless of which state you live in. Premiums are set by life insurance companies then approved by the State Insurance Department.

Company Availability – Not all companies are available in every state. For example, if a life insurance company has not filed its product or rates with your State Insurance Department, that company won’t be available in your state. Company availability changes often due to new filings.

Product Availability – There are instances where life insurance companies offer only specific products or riders in a state. For example, a company may offer a child insurance rider on their policy, but the feature may not be available in all states. These exclusions can be viewed by clicking on the company in the list below.

Delaware life insurance also offers residents a 30-day grace period and a timely payment of death benefit claims. Get affordable DE life insurance quotes to protect your loved ones.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What are the insurance rates in Delaware?

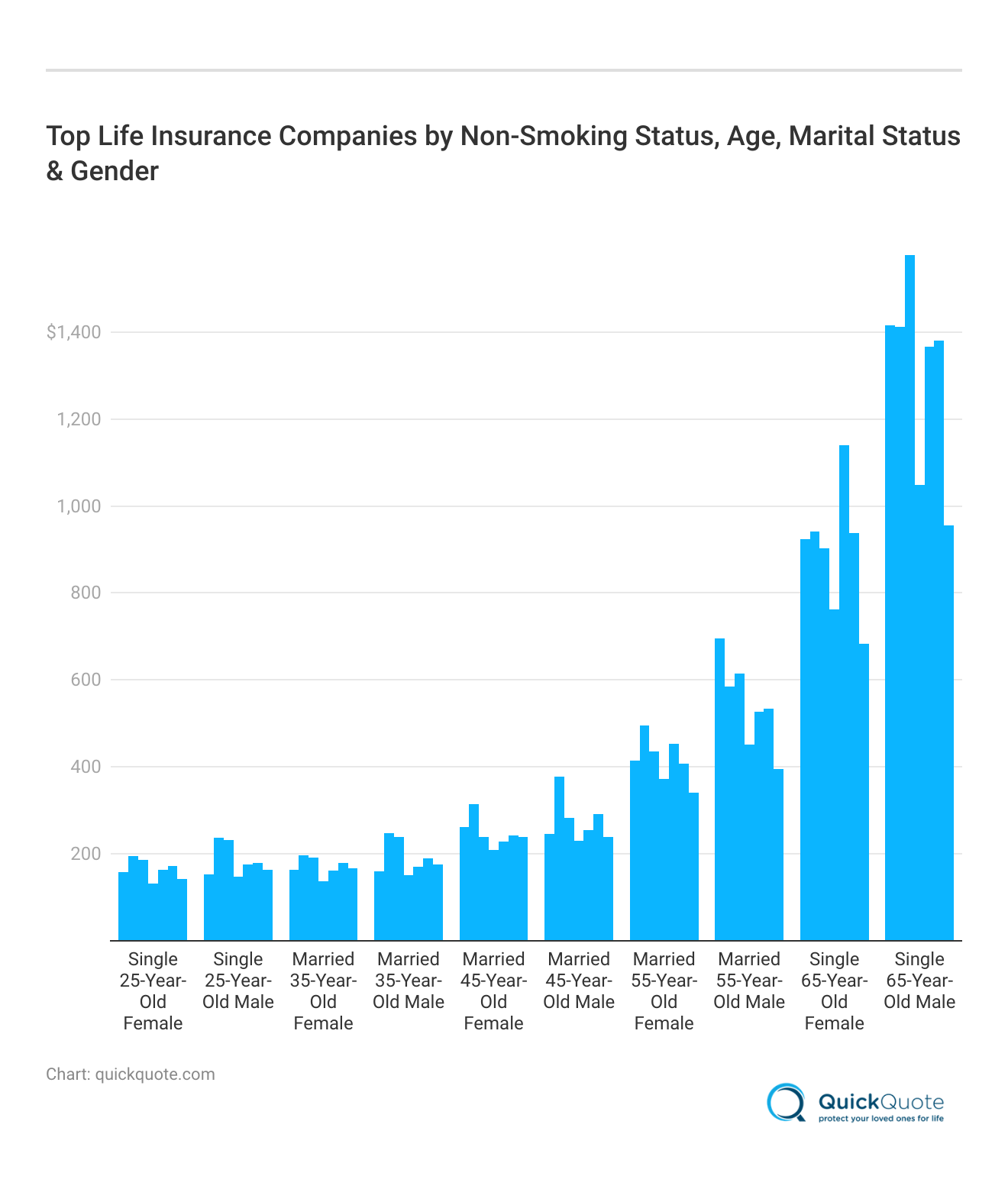

To give you an idea of what Delaware insurance rates look like, check out the chart below to see what the top companies charge based on non-smoking status, age, marital status, and gender. Keep in mind that your Delaware life insurance quotes may be different, depending on demographics, occupation, habits, and family medical history as well as which Delaware life insurance policy you choose.

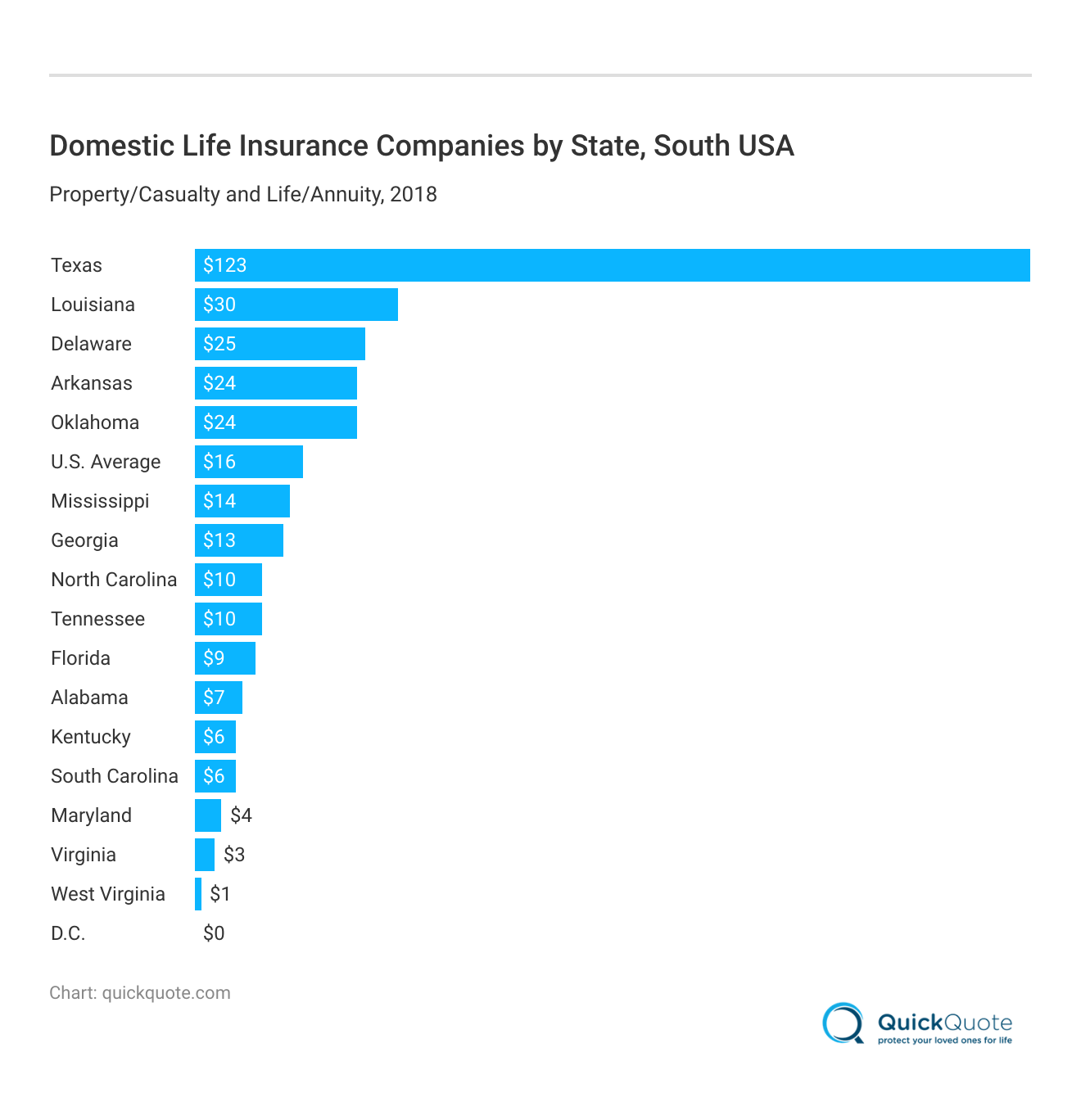

In this next chart, you can also see how many Delaware life insurance companies there are in comparison to other southern states.

Note that Delaware has 25 life insurance companies that operate specifically in the state, which means plenty of affordable life insurance rates in Delaware to come by. You can access the best life insurance in Delaware with our free quote tool on this page.

How does the Delaware guaranty association work?

State guaranty associations are committed to protecting resident policyholders and beneficiaries in the event of an insurance company insolvency. The association is made up of all insurance industry companies licensed to sell life insurance, health insurance and annuities in the state. If an insurance company becomes insolvent (goes out of business), the association steps in to protect policyholders by continuing coverage and paying claims, up to defined limits.

In Delaware, a life insurance policy is protected up to $300,000. This amount is the maximum benefit provided for any one life. In other words, multiple policies on any one person are limited to this amount.

What are some of the Delaware life insurance contacts?

Here is a list of all the necessary state contacts for residents with Delaware insurance industry claims and other related matters.

Guaranty Association

If you need information about a Delaware life insurance or health insurance guaranty, contact the Delaware Life & Health Insurance Guaranty Association at 1-302-456-3656 or visit the website.

Insurance Department

For the latest updates about Delaware life insurance, contact the Delaware Department of Insurance by phone at 1-302-674-7300 or visit the website. Here, you can find out who the insurance commissioner of Delaware is and access the Delaware Department of Insurance company search.

If you’re a state employee, the Delaware Department of Insurance is your source for the State of Delaware contacts, such as the State of Delaware payroll department. You can also learn about State of Delaware benefits, i.e., State of Delaware employee open enrollment, and State of Delaware life insurance industry here.

Legal Info

QuickQuote is licensed to sell life insurance in Delaware under Agency License Number 0155258.

The licensed company principal is Tim Bain, Agent License Number 0147972.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Delaware Life Insurance Companies

American General Life Insurance Company

Fidelity Life Association

John Hancock Life Insurance Company

Lincoln National Life Insurance Company

Metlife Life Insurance Company

North American Company for Life & Health Insurance

Pacific Life & Annuity Company

Principal Life Insurance Company

Protective Life Insurance Company

Pruco Life Insurance Company (Prudential)

Sagicor Life Insurance Company

The Savings Bank Life Insurance Company of Massachusetts (SBLI)

Transamerica Life Insurance Company

United of Omaha Life Insurance Company

Don’t wait — Use our free quote tool to get affordable life insurance rates in Delaware. Get started now.

Frequently Asked Questions

What factors affect life insurance rates in Delaware?

Life insurance rates in Delaware are primarily determined by factors such as age, gender, marital status, and smoking status. Other factors that can influence rates include occupation, habits, and family medical history.

How does the Delaware guaranty association work?

The Delaware guaranty association is a group of insurance companies licensed to sell life insurance, health insurance, and annuities in the state. If an insurance company becomes insolvent, the association steps in to protect policyholders by continuing coverage and paying claims, up to defined limits. In Delaware, a life insurance policy is protected up to $300,000.

Who can I contact for Delaware life insurance information?

To inquire about Delaware life insurance or health insurance guaranty, you can contact the Delaware Life & Health Insurance Guaranty Association at 1-302-456-3656 or visit their website. For general information about Delaware life insurance, you can reach out to the Delaware Department of Insurance at 1-302-674-7300 or visit their website.

Which life insurance companies operate in Delaware?

Some of the life insurance companies operating in Delaware include American General Life Insurance Company, Banner Life Insurance Company, Fidelity Life Association, Haven Life / MassMutual, John Hancock Life Insurance Company, Lincoln National Life Insurance Company, Metlife Life Insurance Company, and more. A comprehensive list of Delaware life insurance companies can be found on the website.

How can I get life insurance quotes in Delaware?

To get life insurance quotes in Delaware, you can use the free quote tool provided on the website. By entering your ZIP code, you can compare quotes from multiple life insurance companies and find affordable rates tailored to your needs.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Insurance Operations Specialist

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.