Best Life Insurance for Police Officers in 2025 (Your Guide to the Top 10 Companies)

State Farm, AIG, and New York Life offer the best life insurance for police officers, with rates starting at $20 per month. These providers excel in tailored coverage, competitive rates, and dedicated support, making them top choices for police officers seeking reliable and affordable life insurance options.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 18, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

163 reviews

163 reviewsCompany Facts

Full Coverage for Police Officers

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviews 0 reviews

0 reviewsCompany Facts

Full Coverage for Police Officers

A.M. Best Rating

Complaint Level

0 reviews

0 reviews

The top pick overall for the best life insurance for police officers is State Farm, with AIG and New York Life also offering highly competitive options for getting life insurance.

These providers excel in delivering tailored coverage that meets the unique needs of law enforcement professionals. By focusing on comprehensive benefits and robust support, they ensure that police officers can secure their family’s financial future effectively.

Our Top 10 Company Picks: Best Life Insurance for Police Officer

| Company | Rank | Good Health Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | B | Comprehensive Coverage | State Farm | |

| #2 | 12% | A+ | Competitive Rates | AIG |

| #3 | 15% | A+ | Financial Stability | New York Life |

| #4 | 10% | A+ | Tailored Policies | Prudential | |

| #5 | 11% | A | Officer Focused | Guardian Life | |

| #6 | 14% | A++ | Personalized Plans | Northwestern Mutual | |

| #7 | 10% | A+ | Customizable Options | Northwestern Mutual |

| #8 | 12% | A+ | Extensive Discounts | Allstate | |

| #9 | 11% | A | Flexible Terms | Liberty Mutual |

| #10 | 13% | A++ | Superior Support | USAA |

As the demands of police duty bring specific risks, choosing the right insurer is crucial for peace of mind and security.

You can get free quotes for life insurance and secure financial protection for your loved ones by entering your ZIP code into our tool below.

- State Farm leads with tailored life insurance for police

- Coverage addresses on-duty risks unique to officers

- Competitive rates start at just $20/month

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – State Farm: Top Overall Pick

Pros

- Tailored Coverage: Specializes in providing life insurance specifically designed for police officers, ensuring coverage meets their unique needs.

- Competitive Rates: State Farm is known for its affordability, especially for law enforcement personnel, with rates starting at $20 per month. For more details, read the State Farm life insurance review.

- Robust Support: Strong customer support specifically tailored for the complexities police officers might face with their insurance needs.

Cons

- Limited Flexibility: Options might be more standardized, with less flexibility in customizing additional benefits or riders.

- Market Availability: Coverage specifics and availability may vary significantly by state, which could affect benefits.

#2 – AIG: Best for High-Risk Coverage

Pros

- Extensive Coverage Options: Provides a wide range of life insurance products, allowing officers to customize their policies.

- Global Reach: Benefits from a strong international presence, which can be an advantage for officers who travel or work internationally.

- Innovative Solutions: AIG is recognized for leading in innovative insurance solutions, which often include advanced riders and benefits. For more insights, read the AIG life insurance review.

Cons

- Complexity of Products: The wide array of options can be confusing for some consumers who are not well-versed in life insurance.

- Customer Service Variability: Reports of inconsistent customer service experiences can affect satisfaction.

#3 – New York Life: Best for Financial Stability

Pros

- Stability and Trust: According to our New York life insurance company review, this provider stands as one of the most reliable in the industry.

- Customizable Policies: High level of customization in life insurance policies to suit individual officer needs.

- Financial Strength: Strong financial ratings ensure that they can meet claims, even under challenging circumstances.

Cons

- Higher Cost: Premiums may be higher compared to other insurers, reflecting the company’s extensive service and stability.

- Complexity in Policy Terms: Some customers might find their policy terms and conditions to be complex.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – Prudential: Best for Customizable Policies

Pros

- Financial Strength: Discover our “New York Life Insurance Company Review” to learn how the company’s robust financial health contributes to its long-term reliability.

- Diverse Portfolio: Offers a variety of insurance products which can be bundled with life insurance for comprehensive coverage.

- Focus on High-Risk Professions: As per our Prudential life insurance company review, this provider stands out for its specialized coverage for high-risk jobs, beneficial for law enforcement.

Cons

- Pricing: Might be on the higher end of the spectrum due to the comprehensive nature of coverage.

- Underwriting Process: The application and underwriting process can be lengthy and rigorous.

#5 – Guardian Life: Best for Additional Benefits

Pros

- Employee Benefits Specialist: Strong focus on providing additional benefits, useful for police departments looking for group coverage.

- Policy Dividends: Offers participating policies that pay dividends, providing financial returns to policyholders.

- Personalized Services: Based on our Guardian life insurance review, this provider is known for its commitment to delivering excellent personalized customer support.

Cons

- Premium Costs: Premiums can be higher due to the high level of service and comprehensive coverage.

- Limited Availability: Some products or benefits might not be available in all regions or states.

#6 – Northwestern Mutual: Best for Long-Term Investment

Pros

- High Financial Ratings: As detailed in our Northwestern Mutual life insurance review, Northwestern Mutual is renowned for its robust financial strength and reliability.

- Customer Satisfaction: High level of customer satisfaction due to personalized service and agent availability.

- Flexible Options: Wide range of options for term and whole life policies, allowing for customized coverage.

Cons

- Cost: Policies can be expensive, especially when adding numerous riders or choosing whole life options.

- Agent-Dependent: Some might find the reliance on agents for policy management less convenient compared to digital management.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – Nationwide: Best for Digital Tools

Pros

- Broad Product Offerings: Not just life insurance; offers a range of financial products which can be beneficial for comprehensive financial planning.

- Innovative Tools: Provides innovative tools and resources for policy management and financial planning.

- Competitive Pricing: Delve into our Nationwide life insurance review to see why Nationwide is celebrated for its affordability across various insurance policies.

Cons

- Variable Customer Service: Customer service quality can vary depending on the region and specific agent.

- Complex Products: Some products are complex, requiring thorough understanding before purchase.

#8 – Allstate: Best for Resource Availability

Pros

- Widely Recognized Brand: High level of brand recognition and trust.

- Comprehensive Coverage: Offers a wide range of coverage options including riders that are beneficial for police officers.

- Resource Availability: Extensive resources and tools for customers to manage their policies and learn about insurance.

Cons

- Premiums: Can have higher premiums compared to competitors.

- Claims Process: As detailed in our exploration of life insurance claims, the process can sometimes be cumbersome for policyholders.

#9 – Liberty Mutual: Best for Policy Customization

Pros

- Flexible Options: Delve into our Liberty Mutual life insurance review to see why Liberty Mutual is celebrated for its flexible policy terms and conditions.

- Discounts and Rewards: Offers various discounts and rewards which can make policies more affordable.

- Strong Online Presence: Robust online tools and resources for managing policies and filing claims.

Cons

- Inconsistent Customer Service: Customer experiences can vary significantly.

- Policy Exclusions: Certain exclusions might not be well-suited for the specific risks faced by police officers.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – USAA: Best for Military

Pros

- Military and Law Enforcement Focus: Specializes in services for military and law enforcement, understanding their unique needs.

- Competitive Rates: Offers competitive rates and discounts for police officers.

- Exceptional Customer Service: Consistently praised for its customer service and support.

Cons

- Eligibility Restrictions: Services, including life insurance for Veterans, are primarily available to military personnel, veterans, and their families, which might restrict availability to all officers.

- Limited Policy Options: While focused on their audience, they might offer fewer options compared to larger, more generalized insurers.

Essential Coverage for Law Enforcement

Police officers dedicate their lives to our safety, often facing risky and life-threatening situations. Whether it’s in high-crime areas or during seemingly routine traffic stops, their work environment is unpredictably dangerous, illustrating how a job can affect your life insurance.

Statistics from the Bureau of Labor Statistics reveal that police officers have a 3.5 in 100,000 chance of dying on the job, ranking their profession among the top 10 most dangerous in the country. The leading causes of on-the-job deaths include gunshots, traffic accidents, and job-related illnesses like heart attacks.

Despite these significant risks, the life insurance rates for police officers align with those of private citizens, highlighting the need for them to secure adequate life insurance coverage.

Police Officer Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $18 $55

Allstate $19 $58

Guardian Life $25 $65

Liberty Mutual $20 $62

Nationwide $21 $63

New York Life $25 $70

Northwestern Mutual $23 $68

Prudential $22 $65

State Farm $20 $60

USAA $17 $50

This table displays monthly life insurance rates for police officers from various providers for minimum and full coverage levels. AIG provides the cheapest minimum coverage at $18 per month, and USAA offers the lowest full coverage at $50 per month. New York Life’s rates are $25 for minimum and $70 for full coverage.

Other companies like Allstate, Guardian Life, Liberty Mutual, Nationwide, Northwestern Mutual, Prudential, and State Farm are also included, presenting a variety of options for officers seeking life insurance.

Navigating Life Insurance for Law Enforcement

Police officers often receive life insurance coverage through their employers, leading many to assume they don’t need additional coverage. Standard law enforcement insurance plans typically offer surviving family members only two to four years of the officer’s salary as a benefit, which may vary if the death occurred on duty.

State Farm stands out as the top choice for police officers, offering the most comprehensive coverage tailored to the unique demands of law enforcement.Dani Best Licensed Insurance Producer

These policies are generally not portable, meaning coverage ends when an officer leaves the force. Officers should consult their employers to understand the specifics and limitations of their provided life insurance coverage when getting life insurance.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Assessing Adequate Life Insurance for Officers

Life insurance experts recommend that a policy should cover about seven to ten times your annual salary, considering various expenses beyond just supporting your family. These include costs like mortgage payments, college tuition, final expenses, pet care, and any outstanding debts.

Is tuition insurance worth it may also be a relevant consideration in this context. It’s crucial for police officers to evaluate the life insurance provided by their employer and determine how much additional coverage is necessary to meet all these potential needs effectively.

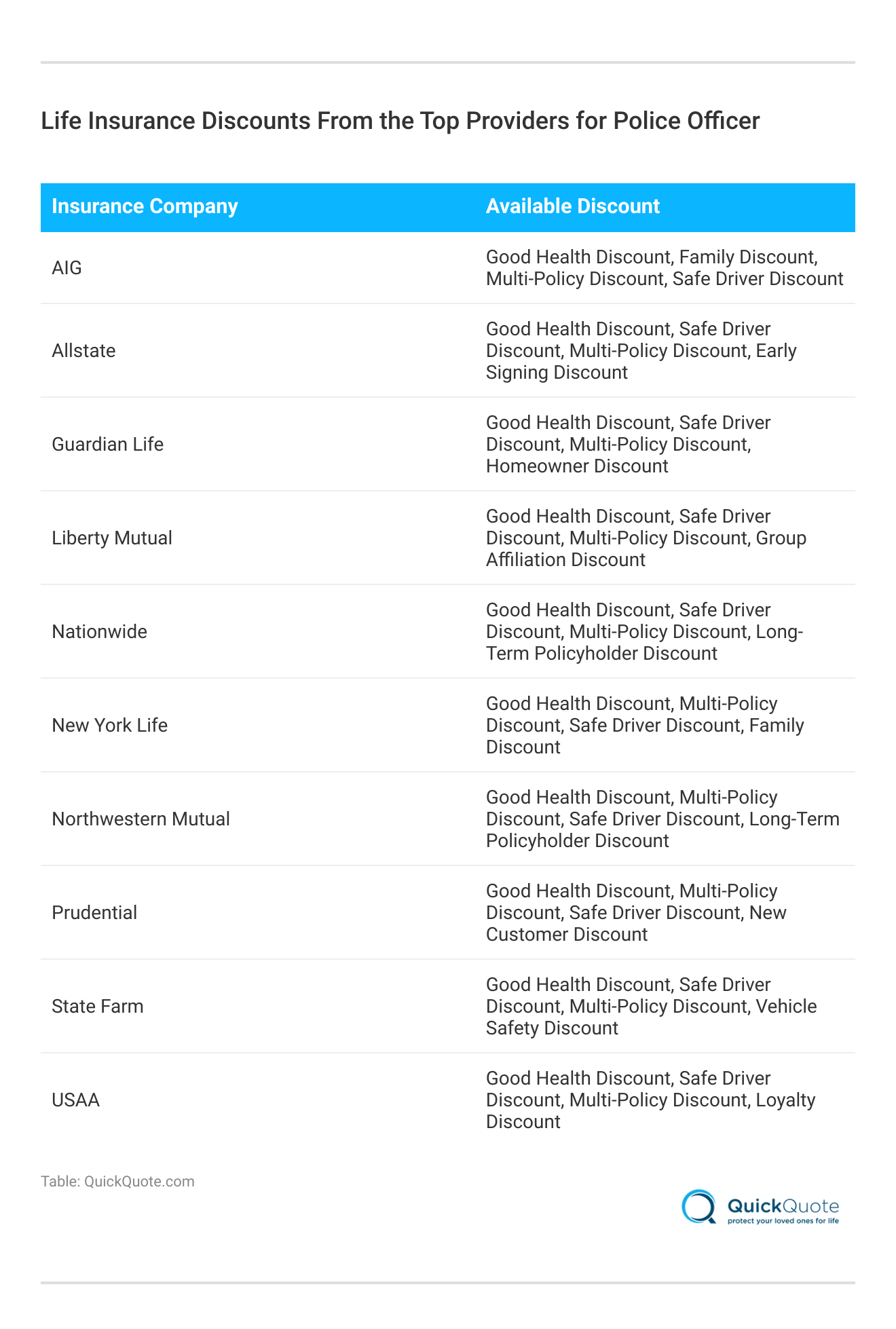

This table shows life insurance discounts for police officers from top providers. AIG, Allstate, and Guardian Life provide discounts for good health, safe driving, and multiple policies, including family and early signing discounts. Liberty Mutual and Nationwide offer group affiliation and long-term policyholder discounts.

New York Life focuses on family discounts, Prudential on new customer discounts, State Farm on vehicle safety, and USAA on loyalty. Each company customizes discounts to suit different officer needs and behaviors.

State Farm Insurance for Law Enforcement

State Farm offers specialized discounts for police officers, which include good health, safe driver, multi-policy, and vehicle safety discounts. These incentives are designed to provide comprehensive coverage at a reduced cost, recognizing the unique risks associated with law enforcement duties.

By combining these discounts, State Farm aims to support officers in managing both personal and professional risks effectively through a life insurance savings account.

Law Enforcement Life Insurance Rates

Being a cop is a risky profession, but some officers work more high-risk positions than others, necessitating life insurance for high-risk individuals. For example, SWAT teams and bomb squads are put into very dangerous situations that most other officers are not.

Your overall health and lifestyle choices are going to factor into your life insurance rates just as much as being a police officer will. Depending on how your health is and other factors, you could get a very good rating and rate for your life insurance.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Case Studies: Life Insurance for Police Officers

Life insurance is a critical component for anyone, but it becomes particularly vital for those in high-risk professions such as law enforcement. The following case studies illustrate the challenges and solutions encountered by police officers when securing life insurance that meets their unique needs.

- Case Study #1 – Underinsured Officer: Police officer John discovered his workplace life insurance only covered two years of salary. Concerned for his family’s financial security, he sought additional options and chose a policy offering coverage worth seven times his annual salary, ensuring his family’s protection.

- Case Study #2 – Non-Portable Coverage: After ten years, police officer Sarah left her job and discovered her employer-provided life insurance was not portable, ending with her departure. She secured an individual policy with comparable benefits, maintaining continuous coverage as she transitioned careers.

- Case Study 3 – High-Risk Position: SWAT team member Mike, recognizing the high risks in his law enforcement role, sought comprehensive life insurance. He discovered premiums varied based on his job, health, and lifestyle. After researching, Mike secured a policy that covered his specific circumstances.

These case studies highlight the need to evaluate and understand life insurance coverage for those in high-risk professions.

State Farm leads as the premier choice for police officers, delivering tailored, top-tier coverage with a remarkable 98% customer satisfaction rate.Jeff Root Licensed Life Insurance Agent

Each officer’s proactive approach to their insurance needs provided peace of mind and ensured their families’ financial security.

Tailored Life Insurance: A Must for Police Officers

This guide underscores the benefits of life insurance for police officers, tailored to the unique risks of their duties. Providers offer competitive rates to ensure financial security for officers and their families.

A variety of discounts and coverage options allows officers to make informed decisions tailored to their needs. By selecting the right options, officers can protect their loved ones’ financial future, ensuring stability and security.

Safeguard your family’s future while saving on coverage — enter your ZIP code below to compare life insurance quotes with our free tool today.

Frequently Asked Questions

Do police officers have life insurance as part of their employment benefits?

Yes, police officers typically have life insurance provided as part of their employment benefits. This police life insurance policy usually offers basic coverage, which might be supplemented by additional personal policies depending on the officer’s needs.

For more information, check out our detailed guide “Types of Life Insurance” for key insights.

Do police officers get life insurance if they retire or leave the force?

Yes, life insurance for retired police officers can be maintained if they choose to convert their group policy into an individual one upon retirement, ensuring they remain covered.

Give your loved ones the gift of financial security by entering your ZIP code below to find life insurance that doesn’t break the bank.

How much life insurance do police officers get through their department?

The amount of life insurance police officers get can vary by department. Generally, police officers life insurance through employment provides a benefit that is a multiple of the officer’s annual salary, often two to four times the amount.

To learn more, explore our comprehensive resource on insurance titled “What are the benefits of buying life insurance?” for further details.

What benefits are available under police life insurance for line of duty deaths?

Line of duty death benefits police policies typically provide additional compensation to the beneficiaries of police officers who die while performing their duties, reflecting the high-risk nature of their work.

What kind of insurance police typically receive besides life insurance?

Besides life insurance, insurance police often includes health, disability, and liability coverage, which are crucial for their protection given the hazardous nature of their job.

Can police officers get life insurance outside of their employment benefits?

Absolutely, police officers can secure additional life insurance policies beyond what is provided by their employers. Options like term life insurance for police officers are popular for offering extensive coverage over a specified term at competitive rates.

To delve deeper, refer to our in-depth report titled “Benefits of Life Insurance” for additional insights.

Are police cars insured under the same policies as personal vehicles of officers?

Are police cars insured differently than personal vehicles, typically under a commercial or governmental policy that covers vehicles used in official duties.

What happens when a police officer dies on duty in terms of insurance claims?

When a police officer dies on duty, the police officer life insurance policy generally provides immediate financial support to their family, along with any applicable line of duty benefits, which can significantly assist during such difficult times.

Stop overspending on life insurance. Use our tool below to compare rates from top providers near you.

What are some of the best life insurance for law enforcement professionals?

The best life insurance for law enforcement includes companies that offer policies tailored to the risks associated with police work, providing comprehensive benefits and competitive premiums.

For a thorough understanding, refer to our detailed analysis titled “Best Life Insurance” for more information.

How do retirement benefits for police officers impact their life insurance needs?

Retirement benefits for police officers, including pensions, can influence their life insurance needs by providing substantial financial security post-retirement, possibly reducing the amount of life insurance they might otherwise need.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jeff Root

Licensed Life Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.