American-Amicable vs. Mutual of Omaha Life Insurance in 2025 [Which is Best?]

American-Amicable and Mutual of Omaha offer term life policies, with Mutual of Omaha at $36 per month and American-Amicable at $59. American-Amicable vs. Mutual of Omaha life insurance reveals Mutual’s Medicare supplements and American-Amicable’s customizable coverage plans.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

UPDATED: Apr 24, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Apr 24, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best

Complaint Level

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best

Complaint Level

Pros & Cons

0 reviews

0 reviewsExplore American-Amicable vs. Mutual of Omaha life insurance, focusing on term policies and distinct program offerings.

Mutual of Omaha is distinguished by its top-rated Medicare supplements and stable financial situation, whereas American-Amicable attracts by offering flexible coverage alternatives that can adjust to varied requirements. Unlock exclusive term life insurance quotes to match your budget.

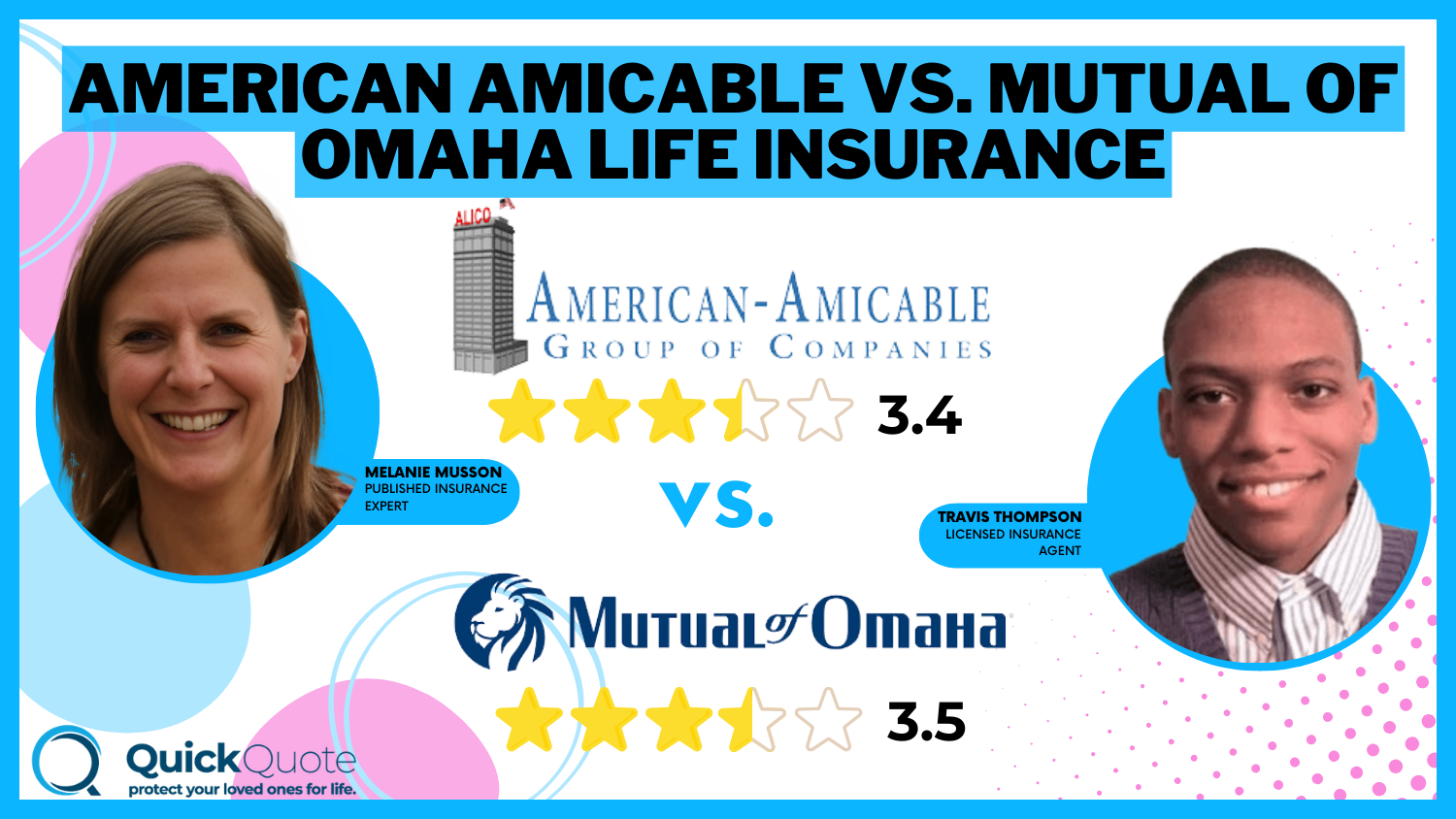

American Amicable vs. Mutual of Omaha Life Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 3.4 | 3.5 |

| Business Reviews | 3.0 | 4.5 |

| Claim Processing | 3.0 | 3.5 |

| Company Reputation | 3.5 | 4.0 |

| Coverage Availability | 4.7 | 5.0 |

| Coverage Value | 3.2 | 3.7 |

| Customer Satisfaction | 2.5 | 2.5 |

| Digital Experience | 3.5 | 4.0 |

| Discounts Available | 3.8 | 2.0 |

| Insurance Cost | 3.1 | 3.1 |

| Plan Personalization | 3.5 | 3.0 |

| Policy Options | 3.5 | 3.5 |

| Savings Potential | 3.3 | 2.1 |

| American Amicable Review | Mutual of Omaha Review |

Both companies have an excellent BBB rating, but Mutual of Omaha is slightly better because it has a higher A.M. Best score, demonstrating more substantial financial reliability.

This review will explain their offerings in detail to assist you in choosing the company that matches your needs most accurately. By entering your ZIP code, explore the best options between American-Amicable and Mutual of Omaha.

- Mutual offers $36/month term policies; American-Amicable, $39

- Mutual stands out with Medicare supplements and strong ratings

- American-Amicable offers flexible term policy coverage options

Comparing Whole Life Insurance Rates by Age and Gender

Life insurance prices differ greatly depending on age and gender, as shown in the table. This part describes the main price distinctions between Mutual of Omaha and American-Amicable insurance for different groups of people, so you have all the necessary information to make a wise choice.

American-Amicable vs. Mutual of Omaha Whole Life Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 16 Female | $22 | $210 |

| Age: 16 Male | $25 | $220 |

| Age: 30 Female | $27 | $175 |

| Age: 30 Male | $32 | $180 |

| Age: 45 Female | $35 | $160 |

| Age: 45 Male | $42 | $165 |

| Age: 60 Female | $55 | $150 |

| Age: 60 Male | $65 | $155 |

The chart emphasizes that younger policy buyers pay much less; for example, 16-year-old girls only need to pay $22 per month at Mutual of Omaha compared to $210 at American-Amicable.

There’s a similar pattern for boys of the same age, with Mutual requiring just $25 while American-Amicable charges them significantly more – up to $220. When age goes up, the price differences become more negligible. For instance, women who are 60 years old pay $55 with Mutual, but they pay American-Amicable $150.

On the other hand, men at that same age (60) have rates of -65 dollars for Mutual while it’s higher by an amount, making it reach $155 in the case of an American-Amicable insurance company.

Across all groups based on gender and age, you will observe lower premiums from mutual companies every time, making them quite affordable.

Term vs. Whole Life Insurance Monthly Cost for American-Amicable vs. Mutual of Omaha

| Insurance Company | Term Policy | Whole Policy |

|---|---|---|

| $59 | $136 |

| $31 | $79 |

| $27 | $57 |

| $46 | $58 | |

| $32 | $86 |

| $22 | $48 | |

| $34 | $78 |

| $33 | $60 |

| $33 | $160 | |

| $36 | $94 |

The table above shows the differences in term and whole life insurance costs between American-Amicable, Mutual of Omaha, and other leading providers. This information assists in understanding competitive prices and the strengths each provider has for different types of coverage.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

American-Amicable vs. Mutual of Omaha Offering Affordable Rates to Women

When beginning a life insurance company comparison, the first thing most people want to know about is pricing. Let’s take a look at a table that shows the rates offered to women for a 20-year $250,000 term life insurance policy.

Life Insurance Monthly Rates for Women by Age

| Insurance Company | Age: 35 Year Old Female | Age: 45 Year Old Female | Age: 55 Year Old Female |

|---|---|---|---|

| $28 | $39 | $69 |

| $20 | $37 | $65 |

| $23 | $40 | $71 |

| $19 | $36 | $63 | |

| $24 | $41 | $73 |

| $18 | $35 | $61 | |

| $25 | $43 | $75 |

| $26 | $44 | $77 |

| $22 | $39 | $70 | |

| $21 | $38 | $68 | |

| $27 | $39 | $69 |

Is finding affordable American-Amicable vs. Mutual of Omaha life insurance quotes easy? As you can see, for women in their 50s, American-Amicable is over $22 more expensive per month than Mutual of Omaha.

For women in their 60s, the difference is more significant. Mutual of Omaha is $42 cheaper per month than American-Amicable. In short, our American-Amicable vs. Mutual of Omaha life insurance review shows that Mutual of Omaha offers more affordable rates to women of various ages.

For reference, here are the subsidiaries of the American-Amicable Insurance Company:

- American-Amicable Life Insurance Company of Texas

- iA American Life Insurance Company

- Occidental Life Insurance Company of North Carolina

- Pioneer American Insurance Company

- Pioneer Security Life Insurance Company

Discover more by reading our guide: Cincinnati Life Insurance Review

Affordable Rates for Men From American-Amicable vs. Mutual of Omaha and Other Providers

We will now engage in a process similar to what we did in the last section. This time, however, the table will show the rates offered to men of various ages for a 20-year term life insurance policy valued at $250,000.

Life Insurance Monthly Rates for Men by Age

| Insurance Company | Age: 35 | Age: 45 | Age: 55 |

|---|---|---|---|

| $25 | $45 | $80 | |

| $27 | $46 | $82 |

| $26 | $44 | $79 |

| $28 | $48 | $85 |

| $24 | $43 | $77 |

| $29 | $51 | $88 |

| $23 | $42 | $75 | |

| $30 | $52 | $90 |

| $31 | $53 | $92 |

| $32 | $49 | $84 | |

| $33 | $47 | $81 | |

| $34 | $50 | $83 |

Look at American-Amicable vs. Mutual of Omaha life insurance rates for men in their 50s, where Mutual of Omaha is over $41 cheaper per month than American-Amicable. For men in their 60s, American-Amicable is over $56 more expensive per month than Mutual of Omaha.

So, our American-Amicable vs. Mutual of Omaha Life Insurance Company comparison has shown that the latter wins again. Let’s proceed with company ratings to see if Mutual of Omaha can sweep this.

Read more:

- Accordia Life Insurance Review

- American National vs. Mutual of Omaha Life Insurance

- MassMutual Life Insurance Review

Review Analysis of American-Amicable and Mutual of Omaha

The table compares American-Amicable and Mutual of Omaha using multiple standard industry measures. These ratings emphasize customer satisfaction, financial stability, and complaint volume differences.

Insurance Business Ratings & Consumer Reviews: American Amicable vs. Mutual of Omaha

| Agency |  | |

|---|---|---|

| Score: 850/1000 Above Avg. Satisfaction | Score: 858 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 78/100 Positive Customer Feedback | Score: 80/100 Positive Customer Feedback |

|

| Score: 0.40 Fewer Complaints Than Avg. | Score: 0.90 Fewer Complaints Than Avg. |

|

| Score: B Excellent Financial Strength | Score: A Excellent Financial Strength |

Mutual of Omaha always gets higher scores, with a rating of A from A.M. Best shows extreme financial strength, compared to American-Amicable rating, whose grade is B. J.D. Power gives Mutual a slightly better score at 858 out of 1,000 points, which indicates more satisfaction among clients having their policies.

Consumer Reports also ranks Mutual at the top, with an 80/100 score compared to the 78/100 score of American-Amicable. This shows that Mutual has more favorable feedback. Calculate your premium options with a term life insurance calculator today.

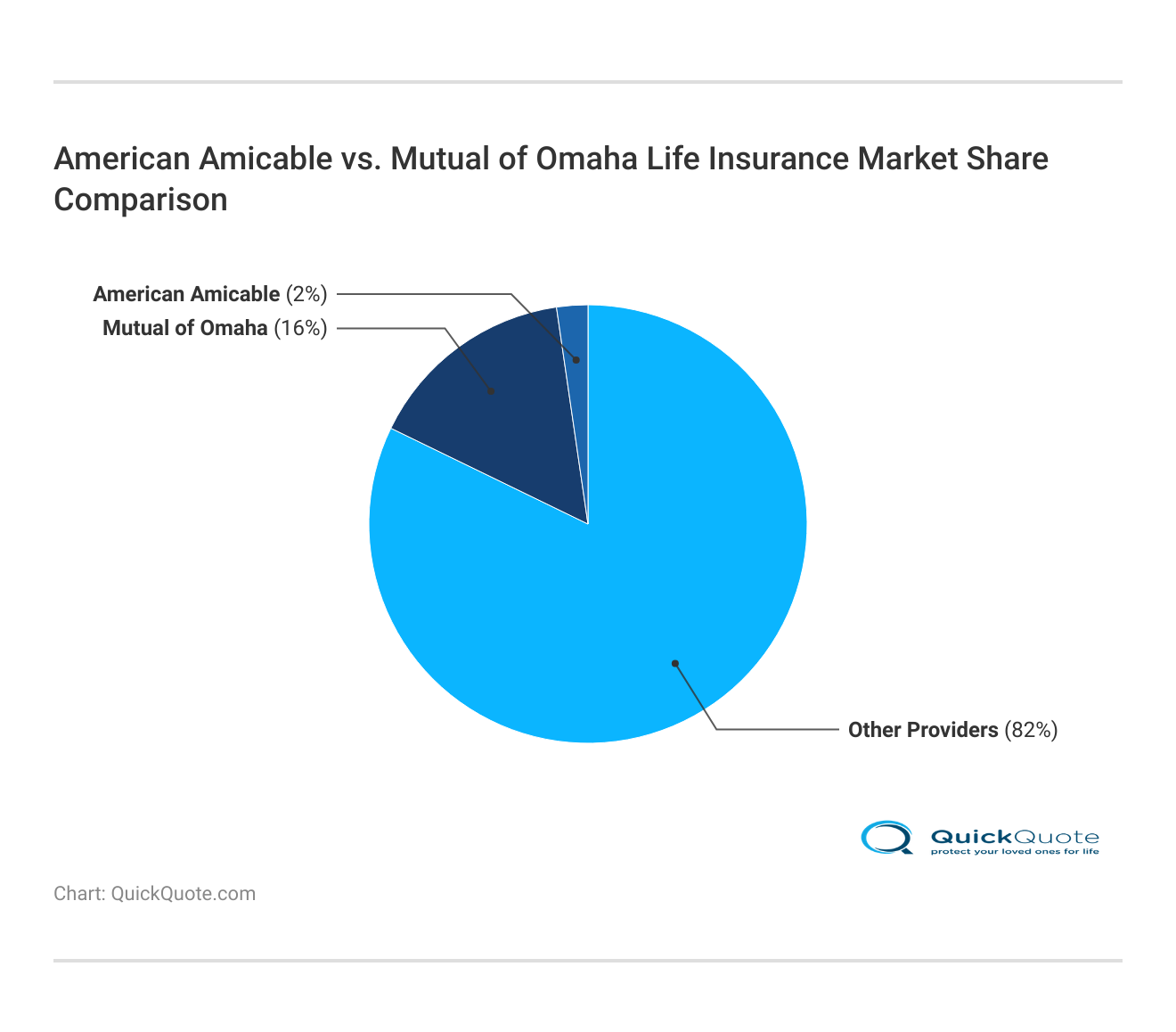

Mutual of Omaha’s broader market share showcases its popularity, while American-Amicable targets specific demographics with unique coverage options.Michelle Robbins Licensed Insurance Agent

Additionally, mutual has a smaller complaint ratio – only at 0.40 while American-Amicable is higher at 0.90. Because of this, many prefer using Mutual due to its dependability and high standard of service quality.

Mutual of Omaha has 16% of the market share, showing its solid reputation and faith from customers in the business. American-Amicable is smaller; it holds 2% of the market, indicating a specific interest segment.

The rest (82%) shares are spread across many providers, demonstrating competitional scenarios. The more significant share of Mutual shows it can draw in and keep a broader range of customers, giving it a noticeable edge in market sway and recognition.

This picture seems to be an excerpt from Quora. In it, user Yasmine Adler talks about her experience helping her grandmother search for life insurance for seniors over 80. The post underlines difficulties that older individuals encounter while choosing life insurance and stresses the necessity of simple and cost-effective policies.

The person is talking about looking at guaranteed issue policies. These don’t need medical tests and are easier to grasp. Firms such as AARP and Mutual of Omaha get special mention because their terms are easy to understand and provide sensible insurance coverage.

Compare American-Amicable and Mutual of Omaha life insurance rates by entering your ZIP code now.

Frequently Asked Questions

How reliable are American-Amicable reviews?

American-Amicable reviews on BBB and Trustpilot showcase its solid customer service and policy flexibility. Discover the best tips on how to buy life insurance for your needs.

Why is the American-Amicable A.M. Best rating important?

The “B” A.M. Best rating for American-Amicable signifies the company’s financial stability and ability to meet policyholder obligations.

What is the significance of the Mutual of Omaha A.M. Best rating?

Mutual of Omaha’s A.M. Best rating of “A” underscores its superior financial reliability and customer trust. Compare American-Amicable vs. Mutual of Omaha by entering your ZIP code into our free quote tool.

What do Mutual of Omaha reviews reveal?

Mutual of Omaha reviews highlight intense customer satisfaction, affordability, and dependable policy options.

Where can I find a Mutual of Omaha life insurance rate chart?

A Mutual of Omaha life insurance rate chart is available through their online tools or by contacting their customer support team. Explore the different types of term life insurance to find the right fit.

What makes Mutual of Omaha term life insurance unique?

Mutual of Omaha’s term life insurance provides affordable monthly rates and optional riders for added flexibility.

How can I use the Mutual of Omaha quote tool effectively?

The Mutual of Omaha quote tool simplifies rate comparisons by letting you input your details and instantly see personalized options.

Does Mutual of Omaha offer car insurance?

No, Mutual of Omaha primarily specializes in life, health, and Medicare supplement insurance.

What is the American-Amicable BBB rating?

American-Amicable has an A+ rating with the Better Business Bureau, reflecting excellent customer trust and business practices. Learn how the best term life insurance companies stand out regarding reliability.

What are Mutual of Omaha companies?

Mutual of Omaha companies include subsidiaries like United of Omaha Life Insurance and Companion Life Insurance, offering diverse financial products.

How does Protective compare to Mutual of Omaha?

Protective offers lower monthly rates for younger policyholders, while Mutual of Omaha stands out with more substantial financial ratings and Medicare supplements.

What is required for Mutual of Omaha agent licensing?

To become a licensed agent for Mutual of Omaha, you must pass the state licensing exam and meet their training and certification requirements.

What are the services offered by American-Amicable?

American-Amicable offers supplemental riders like accidental death benefits and child insurance for enhanced policy coverage. Understand the key features of Accidental Death & Dismemberment (AD&D) Insurance.

How does the Mutual of Omaha Easy Start program work?

The Easy Start program allows applicants to qualify for coverage through an online application with fewer health questions and quick decisions.

What is the Mutual of Omaha BBB rating?

Mutual of Omaha holds an A+ rating from the Better Business Bureau, reflecting excellent business practices and customer satisfaction. Get customized quotes for American-Amicable vs. Mutual of Omaha using our free comparison tool today.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Travis Thompson

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.