How To Get Life Insurance With Multiple Sclerosis [2024]

Understanding how to get term life insurance with multiple sclerosis (MS) has its challenges. However, MS life insurance rates can start as low as $30/month. This guide includes information on how to buy term life insurance with MS.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

UPDATED: Apr 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Apr 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- Applicants are likely to qualify for term life insurance with multiple sclerosis.

- However, rates may be higher, and you will most likely need to get a medical exam.

- Following your doctor’s recommendations and gaining control of all medical conditions may be helpful in obtaining life insurance.

A multiple sclerosis (aka MS) diagnosis is life-altering. With so many things to think about, life insurance is the last thing that might come to mind. How to buy term life insurance for MS patients is an already overwhelming topic if you don’t know where to start.

Figuring out how to get term life insurance with multiple sclerosis doesn’t have to be impossible. The first step is determining what options you have available.

Some of the obvious questions are: What is term life insurance and is it right for me? Are there possible permanent life insurance options available to me after a multiple sclerosis diagnosis?

We’ll take you through information about applying to insurance policies and the steps you need to take to find appropriate multiple sclerosis life insurance, as well as how to get the best rates.

Before you read on, use our FREE quote button at the top of this page to get affordable term life insurance with multiple sclerosis. Whatever state of life or circumstance you may be in, affordable life insurance options aren’t out of reach.

How do you shop for term life insurance with Multiple Sclerosis?

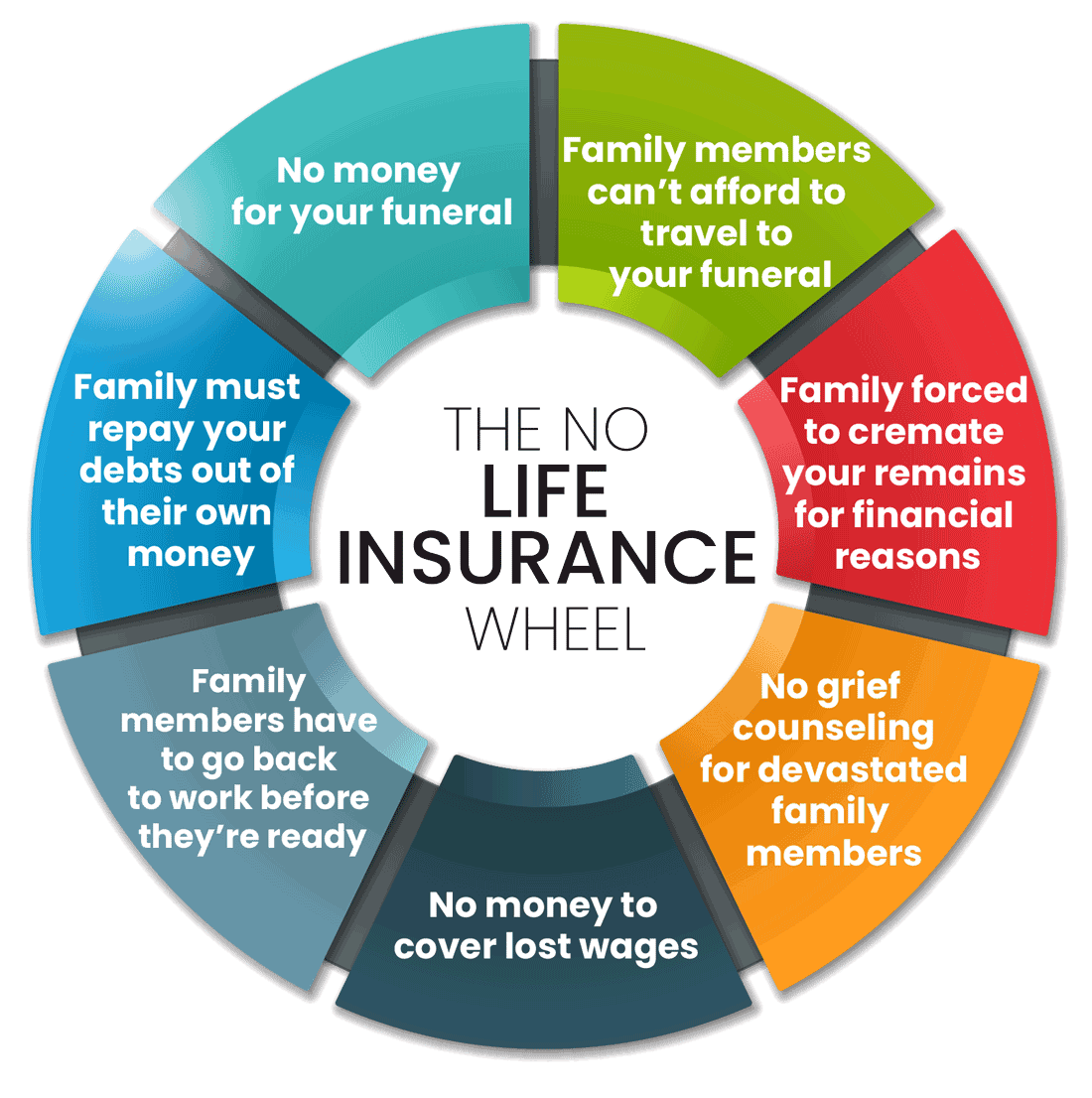

If you’ve been diagnosed or are currently being treated for multiple sclerosis, there is a good chance that you’ll pay a slightly higher rate for life insurance. However, any life insurance is better than no life insurance.

Even with MS, you can still qualify for a preferred rating class with the lowest premium option. How?

You first need to understand how life insurance companies handle applicants with MS. What do they look for? How can you prepare? What is the likely outcome? Read on to find the answers and get started with your term life insurance application.

Is it possible to get term life insurance with multiple sclerosis?

The landscape for life insurance for MS patients is changing. Getting affordable term rates with MS is challenging, but not impossible. The first step is to begin shopping for quotes. Read this article “5 Ways to Get Term Life Insurance Quotes” to learn more.

Providing your insurance company with comprehensive information on your diagnosis and the treatment program you are maintaining will help your insurer determine your insurance options.

Improvements in MS treatments are constantly enhancing the quality of life for MS patients. Consider these factors when you begin researching the best term life insurance companies and options.

Ways to Make Obtaining Life Insurance with MS Easier

- Medications – Better medications are keeping patients in better control.

- Competitive rates – Insurance companies pay attention to how others are competing for customers, including those with MS and other chronic diseases.

- Mortality rates for people with MS have improved dramatically over the past few generations.

- Ongoing, preventive care is enhancing the outlook for MS patients.

Make sure you’re taking your medications and visiting your doctor when you need to.

The Impact of MS on Your Life Insurance Policy

To apply for life insurance, MS patients, along with all other applicants, have to take a medical exam. Most people with a preexisting illness wonder — can you get life insurance with a medical condition?

During your medical exam, you’ll be asked questions about your family history, medical history, lifestyle, smoking, and alcohol usage. The person administering the exam will measure your height, weight, pulse, and blood pressure. Find out more about “what to expect when you need a medical exam for life insurance” in this article.

Life insurance companies want to know if you’re under the current care of a physician. Life insurance companies are concerned that those who have MS are taking the proper precautions to keep it under control. A medical history of regular physician checkups is important to the company.

What Life Insurance Companies Look For

What do insurance companies look for? How can you prepare? What is the likely outcome? Read on to find the answers and get started with your term life insurance application.

Life insurance companies are concerned that those who have multiple sclerosis are taking the proper precautions to keep it under control. A medical history of regular physician checkups is important to the company.

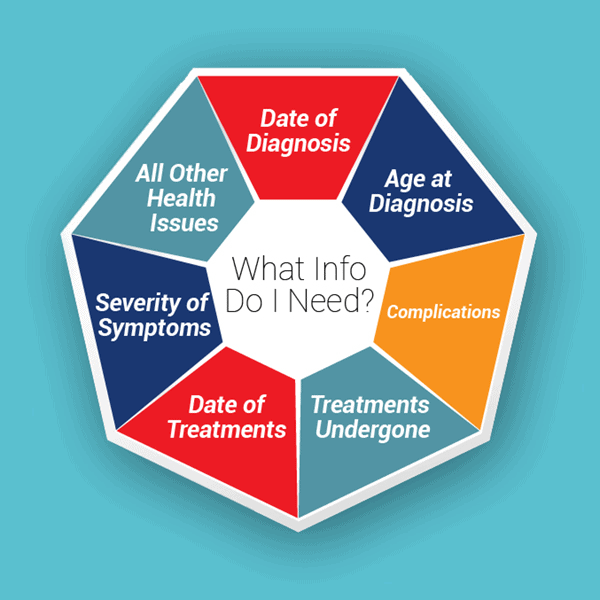

The life insurance company will be looking specifically at:

- When you were diagnosed

- What your diagnosis was

- Age at diagnosis

- Course of disease

- Response to treatment

- What steps you’ve taken since your diagnosis

- The degree of control as illustrated by medical records, height/weight, and lab test results

- Type of treatment

- Any other medical conditions present

In addition to these condition-specific scenarios, insurance companies also determine your eligibility and premium estimate through your:

- Age

- Gender

- High-risk habits, such as if you’re a smoker

- High-risk occupations such as being a truck driver, an aircraft pilot, or a commercial fisherman

These are some different scenarios and items that underwriters will consider when determining your premium estimates. Be honest on your application because there are consequences for those who lie on a term life insurance application.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

How does underwriting work for term life insurance with Multiple Sclerosis?

There are a few term life insurance rating classes for classifying the insurance risk of a potential customer. They are:

- Preferred Plus (aka Super Preferred, Preferred Best, etc.)

- Preferred

- Standard Plus

- Standard

- Substandard or Rated classes (often known as “table rates”)

These five classes are present throughout all kinds of life insurance estimates — not just when dealing with MS. The more you learn about life insurance underwriting, the better prepared you’ll be when shopping for insurance. Spending some time understanding life insurance rating classes will help you be an informed consumer.

Preferred Plus

There are no known insurance companies that will offer these rates to people diagnosed with any form of MS.

Preferred

Far more subjective than Preferred Plus, it’s still possible (but not likely) to get life insurance at this rate with MS, but there are parameters, including:

- The mildest form of MS with early diagnosis (under 35 years)

- At least five years of remission (last active symptoms)

- Non-smoking and other healthy lifestyle factors considered

Preferred is unlikely to be your assigned rating class based on the severity of most MS cases, though.

Standard

This is probably the best rating you can hope to receive with MS, but like the Preferred rate, the Standard rate still has stringent requirements, including:

- The mildest form of MS

- Earlier diagnosis at chronological age is important (younger than 40)

- At least three years since the last active symptoms or exacerbations

- Non-smoking and other healthy lifestyles practiced

We hope you’re assigned a Standard rating class, but seeking coverage sooner rather than later will position you with better chances.

Table Rating

A sub-standard rating, but you’re likely to pay significantly more in premiums. This is the most typical rating achieved by people with MS. All of the above factors are considered, as well as:

- Other chronic diseases such as diabetes or heart and lung diseases can compromise this rating

- Smoking can also be cause for denial, even at this level

Read more: How To Get Life Insurance With a Heart Murmur

Substandard classes are further divided into classes of table rates. They are:

- Table A–Table H, or

- Table 1–Table 8

A Table A would be equivalent to a Table 1, and it would be a percentage below a Standard rating, seen here:

| Life Insurance Ratings Classes | Percent Difference From Standard Rates |

|---|---|

| Table 1/A | 25% |

| Table 2/B | 50% |

| Table 3/C | 75% |

| Table 4/D | 100% |

| Table 5/E | 125% |

| Table 6/F | 150% |

| Table 7/G | 175% |

| Table 8/H | 200% |

As you can see, when you progress down the tables, the percentage of Standard increases by 25 percent at each level.

Here’s an example of the likeliness you would be approved in some of the higher classifications of risk, such as Preferred Plus, according to some term life insurance underwriting guidelines. See this data here:

| Life Insurance Rating Classes | Multiple Sclerosis Eligibility |

|---|---|

| Preferred Plus | No |

| Preferred | No |

| Standard Plus | No |

| Standard | Possible |

According to this data, someone with MS would most likely be approved at a “Standard” rate or a lower, substandard rate.

As you move down the risk classifications and into the table ratings, each “step” increases the annual cost by approximately 25 percent, so you have a built-in motivator to try and be classified at lower risk levels rather than higher-risk levels (i.e. well within the table ratings).

Read this article “How is My Term Life Insurance Rate Determined?” to learn more.

Insurance Denial

Unfortunately, this is the category many MS applicants will receive, especially within a year or two after MS diagnosis. Reasons for this may include:

- Diagnosis with one of the more severe forms of MS

- Non-compliance with a physician in charge of your care

- Increased frequency of MS relapses

A diagnosis with a more severe form of MS might be the reason you were denied coverage.

How to Apply for Term Life Insurance with Multiple Sclerosis

There are important measures you can take to prepare yourself before applying for term life insurance.

Being prepared will help your chances of getting approved for the best rating class possible. Use the following tips to put yourself in the best position to win:

- Visit your doctor as often as recommended.

- Manage stress. Read this article, “4 Smart and Easy Changes to Reduce Stress in Your Life” to learn more.

- Follow your doctor’s advice regarding medication and treatment. Read “Prescription Drugs’ Impact on Term Life Insurance” to learn more.

- Make sure your medical records are regularly updated. This is critical. The life insurance company will rate your application poorly if it’s unable to determine your level of control.

- Get any other complications under control. For example, if you also have high blood pressure, make sure it’s being treated as well.

- It’s in your best interest to share your medical records with an insurance agent to enhance your chances of favorable underwriting.

Again, it’s really important that your medical records are updated regularly. Read about “How much term life insurance can I buy?” to learn more.

What Our Experience Has Shown

Many of the people we’ve helped apply for term life insurance had MS. Here are a few things we’ve learned:

- Premiums are lower for those who diet and exercise or keep their blood pressure down with medication.

- Premiums are higher for those who don’t follow up with a doctor regularly.

- We recommend getting a policy in force first at a premium rate you can afford. You can then focus on improving the rating class through better control or lab results.

The takeaway is to get one of the types of term life insurance early and try to maintain your health so you can hopefully move up a rating class as you manage the disease over time.

Real Examples From Actual Customers

Here we have some scenarios from real-life, actual customers. Read on to find out how their cases are classified and more.

Good Outcome

Danielle applied for term life insurance when she was 55 years old.

- Diagnosed with MS at age 23

- Diagnosed with mild primary-progressive MS

- No other additional conditions found

- Visits doctor regularly

- Non-smoker

- Outcome: Approved at a Standard rating class

- Premium: $365 annually

Being a non-smoker and having a mild case helped Danielle.

Not-So-Good Outcome

Sarah applied for term life insurance when she was 51 years old.

- Diagnosed with MS at age 31

- Diagnosed with moderate primary-progressive MS

- No other additional conditions found

- Non-smoker

- Outcome: Approved at a Standard Table B

- Premium: $622 annually

Though diagnosed with a moderate case, being a non-smoker is helpful.

Poor Outcome

Natalia applied for term life insurance when she was 51 years old.

- Diagnosed with MS at age 50

- No other additional conditions found

- Non-smoker

- Outcome: Declined until more time has passed to stabilize the condition.

You can see Danielle had the best outcome because her disease has been stable for a long period. Receiving regular follow-up appointments with her doctor also helped.

Sarah’s MS is more severe, and although she had no other medical conditions and good follow-up results, her disease being slightly less under control gave her a slightly worse prognosis.

Finally, Natalia had the poorest outcome. Her MS is the most severe and her condition isn’t stable. This, along with her more recent diagnosis, resulted in the decline of her application until she can stabilize her condition.

What are the top 10 life insurance companies for people with Multiple Sclerosis?

For reference, these are the top 10 providers for life insurance, according to the NAIC.

| Rank | Life Insurance Companies |

|---|---|

| 1 | Northwestern Mutual Life Insurance Co. |

| 2 | Lincoln National Corp. |

| 3 | New York Life Insurance Group |

| 4 | Massachusetts Mutual Life Insurance Co. |

| 5 | Prudential Financial Inc. |

| 6 | John Hancock Life Insurance Co. |

| 7 | State Farm Mutual Automobile Insurance |

| 8 | Transamerica |

| 9 | Pacific Life |

| 10 | MetLife Inc. |

If you’ve been diagnosed with multiple sclerosis, your specific situation will be evaluated by your insurance company through an underwriting process.

We’d recommend considering coverage from some of these top-ranking companies first, simply because insurance companies with more customers can provide the best rates.

However, look for one or two smaller and more localized insurance providers in your area. Sometimes, smaller insurance companies will be willing to offer life insurance for MS patients at very competitive rates.

While online research can be extremely useful, it may also be a good choice to get multiple sclerosis term life insurance quotes from an independent insurance agent. You can find an agent specializing in “impaired risk” by contacting your state department of insurance.

What are life insurance rates for Multiple Sclerosis?

To give you an idea of how much MS life insurance coverage might cost you, here is a look at the sample premiums for a non-smoker from those top companies. In fact, it may even be possible to get low rates starting at $30.40/month or $364.80/year with MS.

20-Year Term Life

| Policyholder Age | $100,000: Male Average Term Life Monthly Rates | $100,000: Female Average Term Life Monthly Rates | $250,000: Male Average Term Life Monthly Rates | $250,000: Female Average Term Life Monthly Rates | $500,000: Male Average Term Life Monthly Rates | $500,000: Female Average Term Life Monthly Rates |

|---|---|---|---|---|---|---|

| 25 | $14.53 | $12.70 | $23.27 | $18.72 | $34.79 | $27.39 |

| 30 | $14.96 | $13.22 | $24.59 | $20.44 | $37.39 | $29.59 |

| 35 | $17.57 | $15.40 | $26.09 | $22.19 | $40.04 | $32.19 |

| 40 | $21.40 | $18.62 | $33.72 | $28.49 | $54.79 | $45.69 |

| 45 | $26.54 | $22.97 | $45.47 | $37.42 | $79.19 | $66.14 |

| 50 | $36.02 | $29.32 | $69.59 | $54.59 | $126.14 | $96.99 |

| 55 | $50.98 | $38.11 | $105.72 | $78.97 | $203.14 | $143.99 |

| 60 | $84.91 | $60.20 | $183.79 | $131.17 | $355.39 | $248.84 |

| 65 | $144.51 | $97.44 | $323.42 | $220.99 | $625.09 | $432.84 |

However, if you have MS, there are additional factors that life insurers use to determine your rates that could result in costs significantly higher than these sample quotes, as we discussed earlier.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What are the statistics for Multiple Sclerosis patients?

Multiple sclerosis (MS) is an autoimmune disease that affects the brain and spinal cord. Multiple sclerosis affects women more than men. The disorder is most commonly diagnosed between ages 20 and 40 but can be seen at any age.

MS is caused by damage to the myelin sheath, the protective covering that surrounds nerve cells. When this nerve covering is damaged, nerve signals slow down or stop.

The nerve damage is caused by inflammation. Inflammation occurs when the body’s immune cells attack the nervous system. This can occur along any area of the brain, optic nerve, and spinal cord.

What is the prognosis for MS? According to the National Multiple Sclerosis Society (NMSS), the majority of people who have MS will experience a relatively normal life span. It’s great to hear that the MS life expectancy is normal because this disease can be frightening at times.

There is good news for people with MS: Because of how common and devastating a diagnosis of MS can be for a family, there are patient advocates who can help you navigate through everything from healthcare benefits and doctor appointments.

As of 2016, the following numbers show the significance of MS:

| Multiple Sclerosis Demographic Questions | Multiple Sclerosis Statistics |

|---|---|

| How many people have MS? | About 1 million people in the U.S. are estimated to be living with MS |

| How many new cases of MS are there typically? | Approximately 200 new cases are diagnosed each week in the U.S. |

| What age group does it affect most? | MS is the most common progressive and disabling neurological condition in young adults |

| Which gender is most affected? | MS affects women far more frequently than men (75 percent versus 25 percent) |

These are some humbling statistics about MS.

What happens with people who are diagnosed with MS?

Because MS is a progressive disease, most people will experience increasingly debilitating symptoms over time.

However, MS is highly individualized, meaning that every person diagnosed will experience vastly different results from having the disease. For example, many people living with MS can experience depression, which can often be adequately treated through medications.

However, some people can live for several years productively, even after being diagnosed with MS, and can positively deal with the progressive nature of MS.

If you need help managing your emotions during this difficult time, please reach out to family, friends, or a medical professional.

What are the different types of Multiple Sclerosis?

People with MS can typically experience one of four disease courses, each of which might be mild, moderate, or severe.

Relapsing-Remitting MS (RMS)

This is the most common form of MS. People with this type of MS experience clearly defined attacks of worsening neurologic function.

These attacks which are called relapses, flare-ups, or exacerbations are followed by partial or complete recovery periods (remissions), during which no disease progression occurs.

Approximately 85 percent of people are initially diagnosed with relapsing-remitting MS.

Primary-Progressive MS (PPMS)

This disease course is characterized by slowly worsening neurologic function from the beginning with no distinct relapses or remissions. The rate of progression may vary over time, with occasional plateaus and temporary minor improvements.

Approximately 10 percent of people are diagnosed with primary-progressive MS.

Secondary-Progressive MS (SPMS)

Following an initial period of relapsing-remitting MS, many people develop a secondary-progressive disease course in which the disease worsens more steadily, with or without occasional flare-ups, minor recoveries (remissions), or plateaus.

Before the disease-modifying medications became available, approximately 50 percent of people with relapsing-remitting MS developed this form of the disease within 10 years. Long-term data isn’t yet available to determine if treatment significantly delays this transition.

Progressive-Relapsing MS (PRMS)

In this relatively rare course of MS (5 percent), people experience a steadily worsening disease from the beginning, but with clear attacks of worsening neurologic function along the way.

They may or may not experience some recovery following these relapses, but the disease continues to progress without remissions.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Case Studies: Life Insurance With Multiple Sclerosis

Case Study 1: Sarah’s Term Life Insurance

Sarah is a 40-year-old woman who has been diagnosed with multiple sclerosis. She understands the importance of having life insurance to protect her family’s financial well-being. Sarah starts shopping for term life insurance and compares quotes from various companies.

After careful consideration, she chooses a 20-year term life insurance policy from ABC Insurance. Despite her MS diagnosis, Sarah is approved for coverage at a slightly higher rate. She feels relieved knowing that her family will be financially protected if something were to happen to her.

Case Study 2: Michael’s Whole Life Insurance

Michael, aged 50, has been living with multiple sclerosis for several years. He wants to secure lifelong coverage and build cash value through his life insurance policy. Michael researches different companies and their options for individuals with pre-existing conditions. After thorough evaluation, he decides to purchase a whole life insurance.

The policy provides him with the coverage he needs and the opportunity to accumulate cash value over time. Michael feels confident knowing that his whole life insurance policy will provide financial security for his family even after he is gone.

Case Study 3: Emily’s Guaranteed Issue Life Insurance

Emily is a 60-year-old woman who has recently been diagnosed with multiple sclerosis. She understands that her options for traditional life insurance may be limited due to her condition. Emily explores alternative options and discovers guaranteed issue life insurance.

She applies for a policy from DEF Insurance, which offers coverage without requiring a medical exam or health questions. Emily is relieved to be approved for the policy, knowing that her family will have the financial support they need in the future.

How to Get Term Life Insurance with Multiple Sclerosis: The Bottom Line

While you’re finding support with MS, you might be wondering, “Can you get disability for MS?” The answer is yes if your condition has limited your ability to work, according to DisabilityBenefitsHelp.org.

As we stated earlier, the good news about applying for term life insurance when you have MS is that, yes, you can qualify for coverage.

The bad news is that your chances of automatic approval for life insurance are slim, and the rating class can be very unpredictable and subjective. It might be dismaying to realize you probably encountered one of the five reasons you won’t qualify for no-exam life insurance, too.

However, if you follow the advice we’ve provided and, more importantly, discuss your situation with your life insurance agent or broker, you can have a positive outcome.

And remember, if you’re not pleased with the offer you receive, you can always try with another company or put the policy in force and work on improving the rating class through better control and lab results.

Looking for term life insurance quotes for multiple sclerosis? You can use our FREE quote tool below to instantly start comparing term life insurance quotes in your area.

Frequently Asked Questions

Can I get life insurance if I have multiple sclerosis (MS)?

Yes, it’s possible to get life insurance with MS, but rates may be higher.

What do life insurance companies consider when evaluating MS applicants?

They look at your medical history, treatment, and overall health.

What if I’m denied life insurance coverage because of MS?

Some MS applicants may be denied coverage, especially if recently diagnosed or with severe forms of the disease.

How can I improve my chances of getting approved for life insurance with MS?

Maintain regular medical appointments, follow prescribed treatments, and keep your records updated.

What are the average life insurance rates for MS?

Rates vary, but some MS patients may find coverage starting at around $30.40 per month.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Life Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.