Best Life Insurance for Teachers in 2025 (Your Guide to the Top 10 Providers)

The providers with the best life insurance for teachers are State Farm, Prudential, and AIG, offering a minimum coverage starting at $18/month. These companies excel in affordability, comprehensive benefits, and tailored policies, ensuring teachers get the best protection and value for their needs.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 23, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jan 23, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Full Coverage for Teachers

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 163 reviews

163 reviewsCompany Facts

Full Coverage for Teachers

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviews

The companies with the best life insurance for teachers are State Farm, Prudential, and AIG, offering affordable rates and comprehensive coverage.

These companies excel by offering affordable rates, comprehensive benefits, and policies tailored to meet the specific needs of teachers. To broaden your understanding, explore our comprehensive resource titled “How Term Life Insurance Rates Are Calculated.”

Our Top 10 Company Picks: Best Life Insurance for Teachers

| Company | Rank | Good Health Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 5% | B | Customer Service | State Farm | |

| #2 | 3% | A+ | Extensive Options | Prudential | |

| #3 | 4% | A | Flexible Terms | AIG |

| #4 | 6% | A++ | Customizable Policies | New York Life |

| #5 | 7% | A++ | Comprehensive Coverage | USAA | |

| #6 | 5% | A+ | Teacher Benefits | Nationwide |

| #7 | 4% | A++ | Inclusive Coverage | Guardian Life | |

| #8 | 5% | A | Tax Advantages | Lincoln Financial | |

| #9 | 6% | A | Living Benefits | Transamerica | |

| #10 | 4% | A+ | Competitive Rates | Mutual of Ohama |

Teachers benefit from employer-provided plans, membership discounts, and supplemental whole life insurance for lifelong coverage and financial planning.

Find cheap life insurance quotes by entering your ZIP code into our free quote comparison tool above.

- State Farm offers top-rated coverage starting at $18/month

- Teachers get employer plans, discounts, and life insurance

- Top life insurance for educators offers tailored policies

#1 – State Farm: Top Overall Pick

Pros

- Well-established Reputation: State Farm life insurance review showcases a long-standing, reputable insurance company known for its reliable coverage and exceptional customer service.

- Wide Range of Products: State Farm offers a variety of insurance products, including life insurance, auto insurance, home insurance, and more, allowing customers to bundle their policies for potential discounts.

- Personalized Service: With a large network of agents across the country, State Farm provides personalized service, with agents available to help customers understand their coverage options and make informed decisions.

Cons

- Limited Availability: State Farm’s coverage may not be available in all areas, particularly in rural or less populated regions.

- Mixed Customer Reviews: While State Farm generally receives positive feedback for its customer service, there are some mixed reviews regarding claims processing and rate increases over time.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#2 – Prudential: Best for Extensive Options

Pros

- Specialized Coverage: Prudential life insurance review showcases a range of specialized life insurance coverage options designed to cater to distinct requirements, featuring policies for educators, retirees, and those with pre-existing medical conditions.

- Strong Financial Ratings: Prudential consistently receives high ratings from financial rating agencies, indicating its strong financial stability and ability to meet its obligations to policyholders.

- Flexible Policy Options: Prudential provides a range of policy options, including term life, whole life, and universal life insurance, giving customers flexibility to choose coverage that aligns with their financial goals.

Cons

- Potentially Complex Policies: Some customers may find Prudential’s policy options and features to be complex or difficult to understand, especially for those new to life insurance.

- Higher Premiums for Certain Policies: While Prudential’s policies offer comprehensive coverage and additional benefits, they may come with higher premiums compared to basic term life insurance policies from other providers.

#3 – AIG: Best for Flexible Terms

Pros

- Global Presence: AIG is a global insurance provider, offering coverage in multiple countries, which can be advantageous for teachers who travel or work internationally.

- Financial Strength: AIG life insurance review highlights the company’s robust financial stability, showcasing its capability to meet policyholder claims and obligations, offering reassurance to customers.

- Flexible Policies: AIG offers a range of life insurance policies tailored to individual needs, providing options for teachers to customize coverage according to their specific requirements.

Cons

- Potentially Higher Premiums: While AIG offers comprehensive coverage, some teachers may find that their premiums are relatively higher compared to other providers.

- Complexity in Policy Selection: The range of policy options available from AIG might be overwhelming for some teachers, leading to confusion or difficulty in selecting the most suitable coverage.

#4 – New York Life: Best for Customizable Policies

Pros

- Long-Standing Reputation: New York Life has a long-standing reputation as one of the oldest and most respected life insurance companies in the industry, providing confidence and trust to teachers.

- Financial Strength: New York life insurance company review showcases the company’s consistent top ratings in financial strength and stability.

- Variety of Products: New York Life offers a diverse range of life insurance products, including whole life, term life, and universal life, providing flexibility and options for teachers to meet their specific needs.

Cons

- Potentially Higher Premiums: As a premium provider with a focus on quality and stability, New York Life’s premiums may be higher compared to some competitors, potentially limiting affordability for some teachers.

- Complexity in Policies: The wide range of products offered by New York Life can lead to complexity in policy selection, requiring teachers to spend more time researching and understanding their options.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#5 – USAA: Best for Comprehensive Coverage

Pros

- Exceptional Customer Service: USAA consistently receives high marks for its customer service, providing personalized assistance and support to policyholders.

- Comprehensive Coverage: The company offers a wide range of insurance products, including life insurance, auto insurance, homeowners insurance, and more, allowing customers to bundle their policies for added savings and convenience.

- Competitive Rates: USAA often provides competitive rates for life insurance policies, especially for members of the military community and their families. For additional details, explore our comprehensive resource titled “What are the benefits of buying life insurance?“

Cons

- Membership Requirements: USAA membership is limited to military personnel, veterans, and their families, which may exclude others from accessing their insurance products.

- Limited Availability: USAA’s insurance products are not available to everyone, as they primarily serve members of the military community, limiting options for those outside this demographic.

#6 – Nationwide: Best for Teacher Benefits

Pros

- Strong Financial Standing: With solid financial ratings from agencies like A.M. Best, Nationwide provides confidence to policyholders that their claims will be paid out promptly and reliably.

- Customizable Policies: Nationwide life insurance review showcases the flexibility of their policies, enabling clients to customize coverage according to their specific requirements and financial constraints.

- Member Discounts: Nationwide offers various discounts to policyholders, such as multi-policy discounts, safe driving discounts, and loyalty rewards, helping customers save on premiums.

Cons

- Higher Premiums: Some customers may find Nationwide’s premiums to be slightly higher compared to other insurance providers, particularly for certain coverage options.

- Mixed Customer Reviews: While Nationwide generally receives positive feedback for its customer service, there are occasional complaints regarding claims processing and communication with policyholders.

#7 – Guardian: Best for Inclusive Coverage

Pros

- Financial Strength: The Guardian life insurance review showcases their robust financial stability rating, highlighting their capacity to fulfill commitments to policyholders with confidence.

- Variety of Products: They offer a wide range of life insurance products, including term, whole, and universal life insurance, allowing customers to find coverage that suits their needs.

- Customer Service: Guardian is known for its excellent customer service, with representatives who are knowledgeable and responsive to policyholders’ inquiries.

Cons

- Underwriting Process: Their underwriting process can be stringent, leading to longer approval times and potential denials for applicants with certain health issues.

- Limited Online Tools: While Guardian offers online account management, their digital tools and resources may be less robust compared to some other insurers.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#8 – MetLife: Best for Teacher Discounts

Pros

- Range of Products: They offer a diverse range of life insurance products, including term, whole, and universal life insurance, catering to different financial needs and preferences.

- Customer Resources: MetLife’s life insurance review highlights an array of digital tools and resources, such as calculators and educational materials, empowering policyholders with the information they need for informed decision-making.

- Additional Services: Beyond life insurance, MetLife offers various financial products and services, such as retirement planning and investment options, providing holistic financial solutions.

Cons

- Complex Products: Some of MetLife’s insurance products may be complex, requiring careful consideration and understanding before purchase.

- Premiums: While MetLife offers competitive rates, premiums may be higher for certain demographics or coverage options compared to other insurers.

#9 – Transamerica: Best for Living Benefits

Pros

- Wide Range of Products: The Transamerica life insurance review showcases an array of life insurance options, such as term life, whole life, and universal life policies, to meet a spectrum of needs and preferences.

- Innovative Solutions: Transamerica is known for its innovative solutions, such as living benefits riders, which allow policyholders to access funds in case of qualifying events like terminal illness.

- Online Tools and Resources: Transamerica provides helpful online tools and resources, making it easy for customers to manage their policies, calculate coverage needs, and access educational materials.

Cons

- Complexity in Policy Options: Some customers may find Transamerica’s array of policy options and riders overwhelming, requiring careful consideration and potentially leading to confusion.

- Underwriting Process: The underwriting process for Transamerica policies may be stringent for certain individuals, leading to longer wait times and potential denial of coverage for those with health issues.

#10 – Mutual of Ohama: Best for Competitive Rates

Pros

- Financial Stability: Mutual of Omaha has a long-standing history and strong financial ratings, instilling confidence in policyholders regarding the company’s ability to meet its financial obligations.

- Flexible Underwriting: Mutual of Omaha provides flexible underwriting options, making it possible for individuals with diverse health backgrounds to obtain coverage, including those with pre-existing conditions.

- Customer Service: Mutual of Omaha life insurance review highlights the company’s commendable customer service, showcasing attentive representatives who are readily available to aid policyholders during application, claims, and policy management.

Cons

- Premiums for Certain Risk Profiles: While Mutual of Omaha offers competitive rates for many applicants, individuals with certain risk factors or health conditions may face higher premiums or difficulty obtaining coverage.

- Claim Processing Time: In some cases, policyholders have reported longer processing times for claims with Mutual of Omaha, which may lead to delays in receiving benefits during critical times.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Guardians of Education: Unraveling NEA’s Life Insurance for Teachers

Teachers can get great life insurance policies through their NEA membership. There are eight different life insurance programs members can choose from. These plans are underwritten by Prudential Insurance Company of America. Term life insurance for teachers is very affordable when purchased through the NEA.

State Farm stands out as the top choice for teachers, offering affordable rates, comprehensive benefits, and tailored policies for their specific needs.Jeff Root Licensed Life Insurance Agent

The NEA helps group policyholders together to lower rates for everyone significantly. In some cases, you won’t have to take a medical exam, and NEA life insurance is not tied to one school or job. It moves with you. Life insurance for retired teachers can also be found through the NEA.

There are a lot of great plans offered through the NEA. If you’re a member, you should look into the specifics and choose a life insurance plan that works best for you. The NEA does not offer universal life insurance for teachers.

Teacher Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $22 $110

Guardian Life $28 $135

Lincoln Financial Group $26 $125

Mutual of Omaha $21 $100

Nationwide $24 $115

New York Life $30 $150

Prudential $25 $120

State Farm $20 $100

Transamerica $23 $105

USAA $18 $90

Discover the comprehensive guide to NEA’s life insurance tailored specifically for educators. Explore monthly rates based on coverage levels and providers such as AIG, Guardian Life, MetLife, and more.

Whether you’re seeking minimum or full coverage, this breakdown equips teachers with the essential knowledge to safeguard their futures and loved ones.

Insuring Together: Understanding Group Life Insurance and Employer-Offered Coverage

Employer-provided life insurance coverage will be group coverage. This means there will be little to no cost to you for life insurance coverage through your job. The other major plus is these benefits are extended to all employees.

If you are elderly, have pre-existing conditions, or there are other factors that can make getting life insurance coverage expensive or difficult, these employer-offered group life insurance plans can be a great way to get coverage.

There are some life insurance mistakes educators should avoid. Mainly, relying solely on their employee-offered life insurance for school employees. The issues some teachers have with these employer-offered life insurance plans are the policy limits, the fact that it is job dependent, and that it doesn’t cover spouses or children.

Securing the Best Life Insurance Coverage: Essential Tips for Educators

Ensuring financial security for yourself and your loved ones is paramount, especially in a profession as noble as education.

- Assess Your Needs: Evaluate your financial obligations, including debts, mortgage, and dependents’ needs, to determine the appropriate coverage amount.

- Research Providers: Look beyond just one insurance company. Compare quotes from multiple providers to find the best rates and coverage options tailored to teachers’ needs.

- Consider Group Plans: Check if your school or professional associations offer group life insurance plans. These may provide competitive rates and additional benefits for educators.

- Review Policy Options: Understand the difference between term and whole life insurance policies. Consider your long-term financial goals and select a policy that aligns with your needs.

- Explore Supplemental Coverage: If your employer’s coverage is insufficient, consider supplementing it with additional policies to ensure comprehensive protection for you and your family.

- Examine Membership Benefits: Investigate whether professional organizations like the National Education Association (NEA) offer exclusive life insurance programs with favorable terms for members.

- Look for Flexibility: Opt for policies that offer flexibility, such as portability options that allow you to maintain coverage even if you change jobs or retire.

- Seek Professional Advice: Consult with a licensed insurance agent or financial advisor who specializes in working with educators. They can provide personalized guidance and help you navigate the complexities of life insurance.

By assessing your needs, researching providers, and exploring supplemental coverage options, you can ensure that you and your family are protected. To learn more, explore our comprehensive resource on insurance titled “What is the minimum coverage amount for life insurance?”

Remember to seek professional advice and review your options regularly to adapt to your changing circumstances.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Teaching Security: Exploring Whole Life Insurance for Educators

Some teachers choose to get whole life insurance coverage in addition to the group or term life insurance plans offered by their employers or the NEA. Whole life insurance covers you for the rest of your life. Group plans only cover you while you are at your job or for the length of the term chosen.

Whole life insurance also builds cash value over time. What the insurance company does with your premiums is put them into a high-interest bank account or an investment account. To delve deeper, refer to our in-depth report titled “What is cash value life insurance?”

Comparison of Whole and Term Life Insurance

| Policy Feature | Term Life | Whole Life |

|---|---|---|

| Coverage | Set period of time, usually 10, 20, or 30 years | Valid until the date of the insured’s death |

| Expense | Less expensive monthly premium | More expensive monthly premium |

| Investment/Rates | You pay only for insurance, these policies don’t accumulate any cash value over time. | Along with the death benefit, part of your payments are invested and the value accumulates over the years. Can be borrowed against and paid back at lower rate than available commercially |

| Renewability | Will need to be renewed at the end of each term, and each renewal will reflect your increase in age and any health issues you’ve developed. | Lifetime policy, so once in place does not need to be renewed. |

Whole life insurance policies offer a comprehensive approach to financial security by providing both insurance coverage and a savings component. Unlike term life insurance, which offers coverage for a specified period, whole life policies ensure lifelong protection.

Moreover, they accumulate cash value over time, essentially functioning as a savings vehicle alongside the insurance coverage. For educators, who often prioritize stability and long-term financial planning, whole life insurance can be an attractive option.

Case Studies: Exploring Life Insurance Options for Teachers

Life insurance is a crucial aspect of financial planning, particularly for educators. Teachers face their own set of challenges and responsibilities, making it essential to choose the most suitable life insurance options.

- Case Study #1 – Sarah’s Supplemental Coverage: Sarah, a 35-year-old teacher, seeks extra life insurance beyond her school’s policy to better support her family, comparing options to find affordable coverage that suits her needs, ensuring her loved ones’ financial security.

- Case Study #2 – NEA Membership Benefits: John, a 45-year-old high school teacher and NEA member, finds an affordable term life insurance plan with Prudential through NEA, appreciating its job portability and benefits.

- Case Study #3 – Whole Life Insurance for Long-Term Protection: Mary, a 50-year-old teacher with 20 years of experience, opts for whole life insurance to secure lifelong coverage and build cash value, offering both protection and savings for her future.

Whether it’s supplementing existing coverage, leveraging membership benefits, or opting for long-term protection, the decisions we make today can profoundly impact our tomorrow.

State Farm leads the pack with tailored policies, affordability, and comprehensive benefits, ensuring teachers secure optimal protection with peace of mind.Chris Abrams Licensed Life Insurance Agent

Remember, securing your loved ones’ financial well-being is not just a choice; it’s a commitment to peace of mind and stability. For a thorough understanding, refer to our detailed analysis titled “How to Save Money When Buying Life Insurance.”

The Bottom Line: Life Insurance for Teachers

The article outlines life insurance options for teachers, spotlighting State Farm, Prudential, and AIG as top picks. It stresses the need for tailored coverage, including employer plans and supplemental whole life insurance. To expand your knowledge, refer to our comprehensive handbook titled “What is supplemental life insurance?”

It concludes with practical tips for securing the best life insurance coverage and highlights the difference between term and whole life insurance policies. Overall, it aims to provide teachers with essential information to safeguard their financial futures and loved ones.

Don’t settle for high life insurance rates. Shop for low rates and ensure your loved ones are protected by entering your ZIP code below.

Frequently Asked Questions

What is the best insurance for teachers?

The best insurance for teachers often depends on individual needs and preferences. However, some insurance companies, such as State Farm, Prudential, and AIG, are known for offering tailored coverage options designed specifically for educators.

Do teachers get free insurance?

While some schools or educational institutions may offer group life insurance coverage as part of their benefits package, it’s not typically “free.” The cost of insurance may be subsidized or covered partially by the employer, but teachers may still need to contribute to the premium costs.

See how much you can save on whole life insurance by entering your ZIP code below into our free comparison tool.

Do teachers get life insurance?

Yes, many teachers have access to life insurance options through their employers or professional associations. Some may also choose to purchase additional coverage independently to supplement their existing plans.

To gain profound insights, consult our extensive guide titled “Term Life Insurance Quotes.”

What is education life insurance?

Education life insurance refers to life insurance policies specifically designed for educators. These policies may offer tailored coverage options, benefits, and discounts suited to the needs of teachers and other education professionals.

Which insurance companies offer coverage for teachers?

Several insurance companies offer coverage options tailored for teachers, including State Farm, Prudential, AIG, New York Life, USAA, and Guardian, among others.

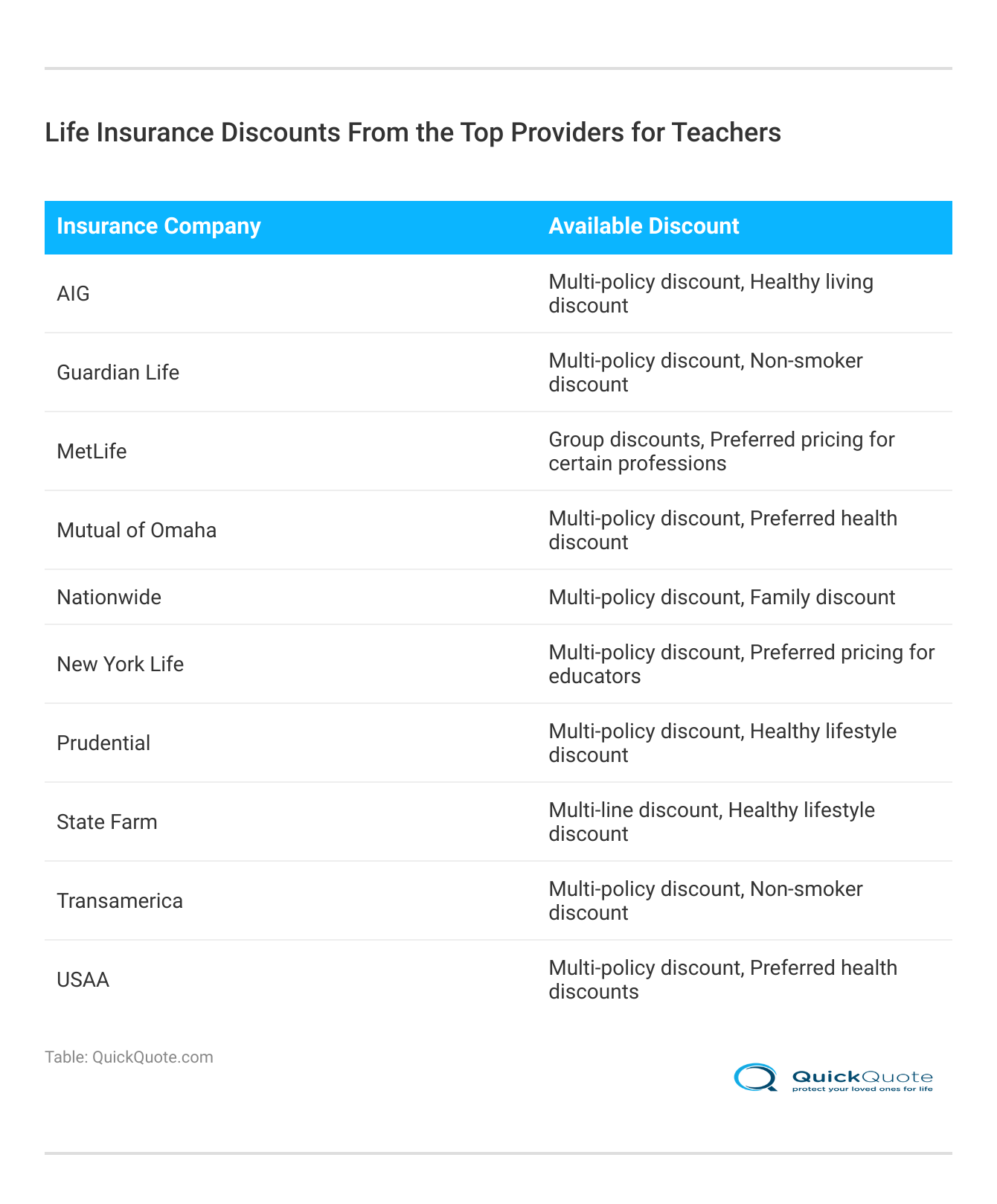

Are there insurance discounts available for teachers?

Yes, some insurance companies offer discounts specifically for teachers. These discounts may vary depending on the insurer and the policies selected, but they can help educators save on their insurance premiums.

For a comprehensive overview, explore our detailed resource titled “Life Insurance Premiums: What are they and how do they work?”

What types of life coverage are available for teachers?

Teachers have access to various types of life insurance coverage, including term life insurance, whole life insurance, and supplemental policies offered through professional associations like the National Education Association (NEA).

What is teacher life insurance?

Teacher life insurance refers to life insurance policies tailored to meet the needs of educators. These policies may offer benefits such as coverage for spouses and children, discounts for educators, and options for lifelong protection.

What is a teachers insurance plan?

A teachers insurance plan typically refers to insurance coverage options available to educators. These plans may include life insurance, health insurance, disability insurance, and other benefits provided by employers or professional associations.

To enhance your understanding, explore our comprehensive resource on insurance titled “How To Get Life Insurance With a Medical Condition.”

What is teachers life?

Teachers life can refer to the unique experiences, challenges, and responsibilities faced by educators in their personal and professional lives. It can also refer to life insurance options specifically designed for teachers to provide financial protection and security.

Avoid overpaying for life insurance by comparing rates with our free tool. Simply enter your ZIP code below to get started.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.