Best Life Insurance for People With Disabilities in 2025 (Our Top 10 Picks)

The best life insurance for people with disabilities are Prudential, New York Life, and Banner Life, offering comprehensive coverage tailored to individual needs, rates starting at $20/mo. These companies excel in customer service, underwriting flexibility, and affordable premiums for people with disabilities.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Mar 12, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 12, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

0 reviews

0 reviewsCompany Facts

Full Coverage for People With Disabilities

A.M. Best Rating

Complaint Level

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Full Coverage for People With Disabilities

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews

The best life insurance for people with disabilities includes top picks like Prudential, New York Life, and Banner Life, offering comprehensive coverage, ensuring affordable premiums and flexibility.

This article explores how different disabilities impact premiums, the types of policies available, and practical tips for securing coverage. To gain further insights, consult our comprehensive guide titled “Life Insurance Premiums: What are they and how do they work?”

Our Top 10 Company Picks: Best Life Insurance for People With Disabilities

| Company | Rank | Good Health Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 5% | A+ | Chronic Illness | Prudential | |

| #2 | 7% | A+ | Customizable Policies | New York Life |

| #3 | 4% | A+ | Affordable Rates | Banner Life |

| #4 | 6% | A | Financially Stable | Lincoln Financial | |

| #5 | 3% | A | Flexible Terms | Transamerica | |

| #6 | 5% | A++ | Disability Waiver | Guardian Life | |

| #7 | 8% | A | Diverse Options | AIG |

| #8 | 4% | B | Accessible Agents | State Farm | |

| #9 | 8% | A++ | Comprehensive Support | USAA | |

| #10 | 3% | A+ | Guaranteed Acceptance | Mutual of Omaha |

Whether dealing with physical or mental impairments, there are viable options to ensure financial protection for your loved ones.

To instantly compare life insurance quotes from the top providers, simply enter your ZIP code into our free quote comparison tool above.

- Prudential, top life insurance provider for people with disabilities

- Policies tailored to individual disabilities’ impact on daily life

- Flexible underwriting and affordable rates starting at $20/month

#1 – Prudential: Top Overall Pick

Pros

- Comprehensive Coverage Options: Offers a wide range of life insurance policies suitable for various needs, including term, whole, and universal life insurance.

- Flexible Underwriting: Prudential life insurance company review showcases its reputation for flexible underwriting standards, which facilitate easier access to coverage for individuals with disabilities.

- Excellent Customer Service: Highly rated for customer satisfaction, providing support and assistance throughout the policy term.

Cons

- Higher Premiums for High-Risk Individuals: Premiums can be significantly higher for those with severe disabilities or pre-existing conditions.

- Limited Online Services: Some services and policy management tools may not be as advanced or user-friendly as those of other insurers.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#2 – New York Life: Best for Customizable Policies

Pros

- Diverse Policy Options: Offers a broad selection of life insurance products, including term, whole, and variable universal life insurance.

- Strong Financial Stability: The New York life insurance company review highlights its consistent reception of high financial strength ratings from A.M. Best and other agencies.

- Mutual Company Benefits: As a mutual company, policyholders may receive dividends, which can reduce the overall cost of their insurance.

Cons

- Limited Online Quoting: The process of obtaining quotes and managing policies online is not as streamlined as with some other insurers.

- Medical Underwriting Requirements: More stringent medical underwriting may result in difficulties obtaining coverage for those with significant health issues.

#3 – Banner Life: Best for Affordable Rates

Pros

- Affordable Premiums: Banner Life is known for offering competitive and affordable premiums, making it accessible for a wider range of customers, including those with disabilities.

- High Coverage Amounts: Banner Life offers high maximum coverage amounts, providing substantial financial protection for beneficiaries.

- User-Friendly Online Tools: They provide comprehensive online tools and resources to help customers understand and manage their policies easily.

Cons

- Limited Whole Life Options: Banner Life primarily focuses on term life insurance and has limited options for whole life or permanent life insurance policies.

- Strict Underwriting: Their underwriting process can be stringent, which may make it harder for individuals with significant health issues to qualify.

#4 – Lincoln Financial: Best for Financial Stability

Pros

- Comprehensive Coverage Options: Lincoln Financial offers a wide range of life insurance products, including term, universal, and variable universal life insurance.

- Strong Customer Service: Lincoln Financial is known for its excellent customer service and support, helping policyholders navigate their insurance needs effectively.

- Living Benefits: Lincoln National life insurance review showcases policies that offer living benefits, enabling policyholders to access a portion of the death benefit in situations of terminal illness.

Cons

- Complex Products: Some of their insurance products, particularly variable universal life insurance, can be complex and difficult for the average consumer to understand.

- Limited Online Resources: While they offer some online tools, their online resources and customer portal are not as comprehensive or user-friendly as some other insurers.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#5 – Transamerica: Best for Flexible Terms

Pros

- Comprehensive Coverage Options: Transamerica offers a variety of life insurance products, including term, whole, and universal life policies, catering to different financial needs and goals.

- Competitive Rates: Transamerica life insurance review showcases its cost-effectiveness, particularly with term life policies, offering affordable premiums that cater to a wide range of consumers.

- Living Benefits: Provides access to living benefits, which allow policyholders to receive a portion of the death benefit if diagnosed with a qualifying chronic, critical, or terminal illness.

Cons

- Complex Policies: Some life insurance products, particularly universal and variable universal life policies, can be complex and difficult for the average consumer to understand.

- Mixed Customer Reviews: While many customers are satisfied, there are reports of issues with claims processing and policy administration, leading to a mixed reputation.

#6 – Guardian: Best for Disability Waiver

Pros

- Wide Range of Products: Guardian life insurance review highlights a diverse range of life insurance plans, such as term, whole, and universal life, showcasing flexibility to cater to various requirements.

- Dividend Payments: As a mutual company, Guardian pays dividends to policyholders with participating policies, potentially enhancing the policy’s value over time.

- No-Lapse Guarantee: Offers a no-lapse guarantee on certain policies, ensuring the policy remains in force as long as premiums are paid, providing peace of mind to policyholders.

Cons

- Higher Premiums: Guardian’s policies can be more expensive compared to other insurers, which may be a drawback for price-sensitive consumers.

- Strict Underwriting: Guardian has strict underwriting standards, which can make it harder for individuals with certain health conditions to obtain coverage.

#7 – AIG: Best for Diverse Options

Pros

- Flexible Underwriting: AIG is known for its flexible underwriting policies, which can benefit individuals with various health conditions and disabilities.

- Wide Range of Products: AIG life insurance review showcases a wide array of life insurance options, encompassing term, whole, and universal life insurance policies.

- Online Tools and Resources: AIG offers robust online tools and resources to help customers understand their policies and manage their accounts.

Cons

- Complex Application Process: Some customers find AIG’s application process to be lengthy and complicated.

- Mixed Customer Service Reviews: While many customers are satisfied, there are reports of inconsistent customer service experiences.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#8 – State Farm: Best for Accessible Agents

Pros

- Bundling Discounts: State Farm life insurance review showcases notable savings opportunities through bundling life insurance with other insurance policies like auto or home insurance, offering substantial discounts.

- Comprehensive Coverage Options: Provides a wide array of life insurance products, including term, whole, and universal life insurance.

- Discount Opportunities: Offers various discounts, such as multi-policy discounts and safe driver discounts, which can significantly reduce premium costs.

Cons

- Limited Online Services: Compared to some competitors, State Farm’s online tools and digital services are less comprehensive.

- Less Flexibility in Underwriting: State Farm’s underwriting process may be stricter, potentially limiting options for those with significant health issues or disabilities.

#9 – USAA: Best for Comprehensive Support

Pros

- Exceptional Customer Service: USAA is renowned for its outstanding customer service, consistently receiving high ratings from policyholders.

- Military-Focused Coverage: Specializes in providing life insurance tailored to the needs of military members and their families. For detailed information, refer to our comprehensive report titled “How much does life insurance cost?“

- Comprehensive Policy Options: Provides a wide range of life insurance products, including term, whole, and universal life policies.

Cons

- Membership Restrictions: USAA membership is primarily limited to military members and their families, restricting access for the general public.

- Limited Physical Locations: Fewer brick-and-mortar offices compared to other insurance companies, which may be inconvenient for some customers.

#10 – Mutual of Omaha: Best for Guaranteed Acceptance

Pros

- Diverse Product Offerings: Provides a wide variety of life insurance policies, including term, whole, universal, and accidental death insurance.

- Simplified Issue Policies: Mutual of Omaha life insurance review highlights policies that expedite coverage without necessitating a medical examination, streamlining the process for applicants.

- Excellent Customer Service: Highly rated for customer satisfaction and support, ensuring a positive experience for policyholders.

Cons

- Limited Online Tools: The company’s online resources and tools for managing policies are less comprehensive compared to other insurers.

- Policy Complexity: Some customers may find the variety and complexity of available policies overwhelming without proper guidance.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

The Impact of Disability on Insurance Premiums

Every life insurance company has a different system for assessing your level of risk and underwriting your life insurance policy. In addition, they will evaluate you individually to determine how your disability impacts your daily living activities and overall health.

They will also take into consideration other factors like your income, your lifestyle, your credit, and your health history. In general, the more of an effect the disability has on your life expectancy, the more it will impact your life insurance options. If your disability doesn’t affect your life expectancy, it might not increase your premium.

Prudential stands out as the top choice for life insurance for people with disabilities, offering comprehensive coverage and affordable premiums.Jeff Root Licensed Life Insurance Agent

However, if it does, you can look into life insurance policies specifically for people with disabilities that are considered high-risk. These “high-risk” policies are often referred to as guaranteed issue life insurance policies.

The guarantee is that you cannot be denied coverage despite pre-existing medical conditions, like a disability if you are willing to pay higher premiums and undergo a waiting period for life insurance.

Life Insurance Monthly Rates for People With Disabilities by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $28 $90

Banner Life $20 $80

Guardian Life $26 $92

Lincoln Financial $28 $95

Mutual of Omaha $23 $87

New York Life $25 $90

Prudential $30 $100

State Farm $29 $93

Transamerica $22 $85

USAA $27 $94

This table outlines the monthly rates for life insurance for people with disabilities, comparing minimum and full coverage across various insurance companies. For minimum coverage, rates range from $20 with Banner Life to $30 with Prudential.

Full coverage rates span from $80 with Banner Life to $100 with Prudential, showcasing a variety of options to fit different financial needs and coverage preferences.

Defining Disabilities: Criteria and Categories

According to the Adults with Disabilities Act, a disability is “a physical or mental impairment that substantially limits one or more major life activities.” Primary, or daily, living activities encompass various essential functions necessary for everyday life.

These include hearing, vision, and other sensory functions, as well as movement and mobility. Cognitive functions such as thinking and remembering are also critical, along with the ability to communicate effectively. For additional details, explore our comprehensive resource titled “Common Body Parts You Can Insure.”

Prudential leads the pack with comprehensive coverage and competitive rates, making it the top choice for life insurance for people with disabilities.Chris Abrams Licensed Life Insurance Agent

Additionally, mental health plays a significant role in daily living activities, influencing overall well-being and the capacity to perform other tasks. Disabilities range from mild to severe, they can be hidden or obvious, and a doctor must document most.

The Americans with Disabilities Act ensures that people with disabilities can’t be denied certain services, including life insurance. However, life insurance companies can consider your disability when determining coverage and premium costs due to its potential impact on health and life expectancy.

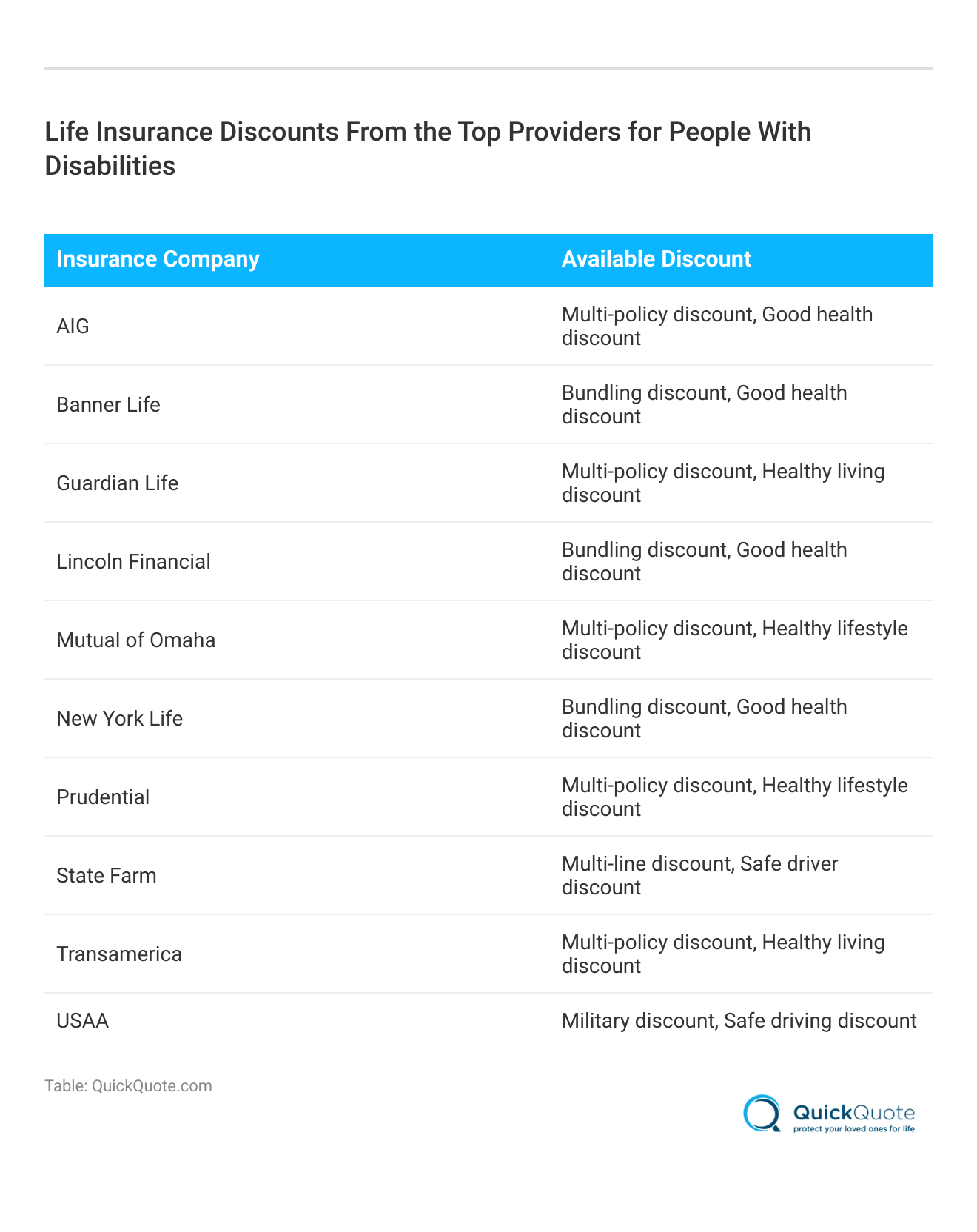

This table highlights the available discounts offered by leading insurance companies for people with disabilities. Discounts include multi-policy and bundling discounts, as well as incentives for good health, healthy living, and safe driving.

Providers like AIG, Banner Life, Guardian Life, and others offer various ways to reduce premiums through these special discounts.

The Impact of Disabilities on Life Insurance Eligibility

Your eligibility for standard life insurance can be affected if your disability is linked to a condition impacting life expectancy. Conditions such as blindness or immobility due to diabetes, cancer, or severe injury may lead to higher premiums or application rejection by insurers.

Similarly, if you have a mental disability like major depression, schizophrenia, or bipolar disorder, insurers might be concerned that you could develop self-destructive behaviors, so your access to particular life insurance policies or the cost of a life insurance policy might be affected.

Read more:

- How To Get Life Insurance With Bipolar Disorder

- How To Get Life Insurance With Cystic Fibrosis

- How To Get Life Insurance With Diabetes

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Factors Affecting Life Insurance Rates for Individuals With Disabilities

Insurance companies consider several factors when issuing life insurance to individuals with disabilities. The cause of the disability is crucial; disabilities from accidents are generally easier to insure due to their lesser impact on life expectancy.

Chronic or terminal illness-related disabilities are more challenging to cover, though well-managed conditions might qualify for guaranteed issue policies. Medical treatments, medications, and overall health, including tobacco use, are also evaluated.

Insurance companies use the Medical Information Bureau (MIB) to assess treatments, prescriptions, and medical history, making it beneficial to maintain the best possible health. To learn more, explore our comprehensive resource on insurance titled “How To Get Life Insurance With a Medical Condition.”

Tips on Life Insurance for Disabled People

Finding life insurance as a disabled individual can be challenging, but there are several strategies to help you secure the best possible coverage. Here are some practical tips to guide you through the process.

- Shop Around for Policies: Some companies offer life insurance specifically for disabled adults. It’s beneficial to compare different options.

- Get Multiple Quotes: Especially if you are considered “high-risk,” obtaining quotes from several insurers can help you find the best rates and coverage.

- Improve Your Health: If possible, improve your current health situation through dieting and exercising. This can positively impact your life insurance premiums.

- Work With a Broker: Brokers can help you find the best company and coverage tailored to your specific needs and circumstances.

- Consider Employer Group Life Insurance: If your employer offers group life insurance, it might provide life insurance protection at little or no cost, despite pre-existing conditions.

By following these tips, you can enhance your chances of finding suitable life insurance coverage that meets your needs, even if you have a disability.

Prudential's comprehensive coverage and affordability make it the top pick for life insurance among individuals with disabilities.Kristen Gryglik Licensed Insurance Agent

Taking the time to research and evaluate different possibilities can help you make an informed choice that best suits your needs.

Options for High-Risk Individuals or Those Denied Coverage

If your disability significantly affects your health or ability to care for yourself, you might not qualify for standard life insurance. However, other types can still offer financial support for your loved ones. For high-risk individuals, consider group life insurance through an employer, which bypasses individual health assessments.

If you can’t work due to your disability, a guaranteed issue policy, typically offering up to $25,000 in coverage with a two-year wait period, may be suitable. Don’t lose hope; many companies are willing to offer coverage if you explore your options. To delve deeper, refer to our in-depth report titled “How long should life insurance coverage last?”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Case Studies: Life Insurance for People Living With Disabilities

Securing life insurance can be a challenging endeavor for individuals living with disabilities. Traditional insurance companies often have rigid criteria that exclude or unfairly penalize those with unique health conditions.

- Case Study #1 – Securing Coverage With AbleLife Insurance: Mary Thompson, a 32-year-old with cerebral palsy, secured life insurance from AbleLife despite multiple rejections. AbleLife’s inclusive policies ensured her family’s financial security.

- Case Study #2 – Overcoming Challenges With Liberty Mutual Assurance: John Davis secured a comprehensive life insurance policy from Liberty Mutual, ensuring his family’s future. For a thorough understanding, refer to our detailed analysis titled “What is an instant life insurance policy?“

- Case Study #3 – A Personalized Approach With Prudential Insurance: Samantha Parker, 39, with multiple sclerosis, overcame life insurance obstacles through Prudential’s personalized underwriting, securing the coverage she needed.

- Case Study #4 – Empowering Independence With MetLife Insurance: James Wilson, 50, overcame insurance challenges due to his disability with MetLife’s support. They recognized his low-risk status and designed a life insurance policy tailored to his needs, giving him peace of mind.

These case studies underscore the importance of finding the right insurance provider who understands and accommodates the unique needs of individuals with disabilities.

Prudential excels in providing comprehensive coverage tailored to the needs of individuals with disabilities, making it the premier choice for life insurance.Jeffrey Manola Licensed Life Insurance Agent

By tailoring their offerings and working closely with their clients, these insurers ensure that everyone has the opportunity to secure their family’s financial future.

Final Thoughts on Life Insurance for Adults With Disabilities

Living with a disability can be tough, but getting life insurance shouldn’t add to the stress. Despite your disability, you can still qualify for coverage, whether it’s standard-term or whole-life, depending on your condition and other factors. Check out our ranking of the top providers: Best Whole Life Insurance Companies

If considered “high risk,” your options may be limited to guaranteed issue (GI) policies, which have higher premiums and waiting periods. Despite this, it’s crucial to focus on your ability to secure insurance. Many companies understand your need to protect your family and will offer coverage despite pre-existing conditions.

Simplify your life insurance shopping by entering your ZIP code into our free quote comparison tool below and find coverage that fits your budget and needs.

Frequently Asked Questions

What is the best life insurance for disabled individuals?

The best life insurance for disabled individuals often depends on personal needs and circumstances. Top companies include Prudential, New York Life, and Banner Life, known for comprehensive coverage, underwriting flexibility, and affordable premiums.

Can disabled adults get life insurance?

Yes, disabled adults can get life insurance. Many insurers offer policies specifically designed for individuals with disabilities, including both term and whole life insurance options.

Find cheap life insurance quotes by entering your ZIP code into our free quote comparison tool below.

What options are available for high-risk individuals seeking life insurance?

High-risk individuals may consider guaranteed issue life insurance policies, which do not require medical exams and offer coverage despite pre-existing conditions. Providers like Mutual of Omaha specialize in these types of policies.

To expand your knowledge, refer to our comprehensive handbook titled “Can I get life insurance with a pre-existing condition?”

How does life insurance for people with disabilities differ from standard policies?

Life insurance for people with disabilities often includes underwriting that takes into account the specific health challenges and risks associated with the disability. These policies may also offer special riders, such as disability waivers of premium.

What is burial insurance for disabled individuals?

Burial insurance, also known as final expense insurance, is a type of life insurance designed to cover funeral and burial costs. It is often available to disabled individuals and does not usually require a medical exam.

What is the cheapest disability insurance available?

The cheapest disability insurance options typically include group policies through employers or basic coverage plans from companies like Banner Life, which offer competitive rates and essential benefits.

To gain profound insights, consult our extensive guide titled “What are the benefits of buying life insurance?”

What is impaired life insurance?

Impaired life insurance refers to policies tailored for individuals with significant health conditions or disabilities that may impair their life expectancy. These policies often have higher premiums but provide necessary coverage.

Can disabled individuals get term life insurance?

Yes, disabled individuals can get term life insurance. Companies like Prudential and New York Life offer term policies with flexible terms and conditions suitable for individuals with disabilities.

Are whole life insurance policies available for disabled people?

Yes, whole life insurance policies are available for disabled people. These policies provide lifelong coverage and can include cash value components. Providers like Guardian and AIG offer whole life options tailored for disabled individuals.

For a comprehensive overview, explore our detailed resource titled “What is cash value life insurance?”

Can you get life insurance if you are on disability benefits?

Yes, you can get life insurance while receiving disability benefits. However, you may face higher premiums, and eligibility might depend on the nature and severity of your disability. Guaranteed issue policies are a good option for those on disability benefits.

Enter your ZIP code below to compare instant life insurance quotes from highly-rated insurers and begin investing in your family’s future.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.