Best Life Insurance for Siblings in 2025 (Find the Top 10 Companies Here!)

New York Life, AIG, and State Farm are the best life insurance for siblings, offering rates from $20 per month. These companies excel with comprehensive coverage, flexible policies, and exceptional service, providing reliable and affordable life insurance solutions to safeguard siblings' financial well-being.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Mar 26, 2025

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

163 reviews

163 reviewsCompany Facts

Full Coverage for Siblings

A.M. Best Rating

Complaint Level

Pros & Cons

163 reviews

163 reviews 18,155 reviews

18,155 reviewsCompany Facts

Full Coverage for Siblings

A.M. Best Rating

Complaint Level

Pros & Cons

18,155 reviews

18,155 reviews

New York Life, AIG, and State Farm are the top picks for life insurance for siblings, excelling in comprehensive coverage and exceptional customer service.

These providers offer flexible policies that can be tailored to meet the unique needs of each family, ensuring peace of mind for all parties involved.

Our Top 10 Company Picks: Best Life Insurance for Siblings

| Company | Rank | Good Health Discount | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | A++ | Financial Strength | New York Life |

| #2 | 12% | A | Broad Coverage | AIG |

| #3 | 15% | B | Customizable Plans | State Farm | |

| #4 | 8% | A++ | Investment Options | Northwestern Mutual | |

| #5 | 10% | A+ | Flexible Terms | Prudential | |

| #6 | 9% | A+ | Living Benefits | Mutual of Omaha | |

| #7 | 10% | A++ | Dividend Options | Guardian Life | |

| #8 | 8% | A | Group Benefits | Lincoln Financial | |

| #9 | 12% | A | Affordable Plans | Transamerica | |

| #10 | 15% | A | Coverage Options | Liberty Mutual |

These companies emerge as the best overall, ensuring dependable financial security. Their commitment to flexibility and customer support makes them standout choices in the life insurance market.

Enter your ZIP code into our free quote comparison tool above to instantly compare life insurance quotes from trusted insurers near you.

- Explore tailored sibling life insurance starting at $20/month

- New York Life leads with robust coverage options

- Assess needs to find optimal sibling insurance solutions

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#1 – New York Life: Top Overall Pick

Pros

- Reputation and Longevity: New York Life is known for its strong reputation and long-standing presence in the insurance industry, which provides a sense of reliability.

- Diverse Policy Options: Offers a variety of life insurance policies to suit different needs, including both term and permanent coverage.

- Financial Stability: Explore our New York life insurance company review, which highlights the company consistently receiving high ratings for financial health and reliability.

Cons

- Higher Premiums: Premiums may be higher compared to other insurers, reflecting its market position and extensive service offerings.

- Complexity of Choices: The wide range of options can be overwhelming for some customers without proper guidance.

#2 – AIG: Best for Customizable Policies

Pros

- Customizable Plans: AIG provides highly customizable life insurance policies, allowing clients to tailor coverage to their specific needs.

- Global Reach: Benefits from a broad international presence, offering insurance solutions to a diverse client base.

- Competitive Pricing: Generally offers competitive pricing, especially on term life insurance insurance products.

Cons

- Customer Service Variability: Customer experiences can vary significantly, with some customers reporting issues in service efficiency and claim handling.

- Complex Claims Process: The process for filing claims can be complex and time-consuming, which may be a deterrent for some policyholders.

#3 – State Farm: Best for Bundling Insurance

Pros

- Customer Satisfaction: Known for high customer satisfaction ratings, particularly in customer service and interaction.

- Bundling Options: Offers the potential for discounts when bundling life insurance with other types of insurance products like auto and home.

- Agent Network: Discover our State Farm life insurance review that emphasizes the extensive local agent network providing personalized service.

Cons

- Availability: Not all products are available in every state, which might limit options for some customers.

- Cost: Can be more expensive than other competitors, especially for those with health issues.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#4 – Northwestern Mutual: Best for Reliable Coverage

Pros

- Financial Strength: One of the highest rated insurers in terms of financial strength, ensuring reliability in paying claims.

- Dividend Paying: Our Northwestern Mutual life insurance review and learn how their dividend-paying whole life policies can increase your policy’s value over time.

- Personalized Financial Planning: Provides extensive financial planning services in addition to insurance products.

Cons

- Cost: Premiums tend to be higher due to the focus on long-term value and financial planning services.

- Policy Purchase Process: Purchasing a policy involves comprehensive financial evaluations, which might be cumbersome for some.

#5 – Prudential: Best for High Coverage

Pros

- Specialization in Term Products: Prudential is known for its term life products, which are competitive and accessible.

- Financial Services: In addition to life insurance, offers a broad array of financial services which can be integrated with insurance products.

- High Coverage Limits: Browse our Prudential life insurance company review to see how they cater to individuals needing high coverage amounts.

Cons

- Premium Variability: Premiums can be high depending on the applicant’s health and age.

- Complexity in Policy Features: Some customers might find the policy features and riders confusing.

#6 – Mutual of Omaha: Best for Client Care

Pros

- Customer Service: Often praised for its customer service and ease of claim processing.

- Range of Products: Our Mutual of Omaha life insurance review which details their wide range of products including whole, term, and universal life insurance.

- Additional Benefits: Provides additional benefits and riders that enhance coverage.

Cons

- Website and Digital Tools: Some users find the digital tools less advanced compared to peers.

- Underwriting Process: The underwriting process can be strict, affecting the eligibility of some applicants.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#7 – Guardian Life: Best for Dividend Paying

Pros

- Policy Options: View our Guardian life insurance review to understand their broad array of both term and permanent policies.

- Disability Provisions: Excels in providing options that include disability riders.

- Dividend Performance: Historically strong performance in terms of paying dividends to policyholders.

Cons

- Pricing: Premiums can be on the higher side relative to some competitors.

- Online Capabilities: Limited online tools for policy management and application compared to industry leaders.

#8 – Lincoln Financial: Best for Life Products

Pros

- Flexible Products: Known for flexibility in product offerings, especially in universal life insurance products.

- Financial Strength: Maintains strong financial ratings, ensuring its ability to meet claims.

- Innovative Riders: Offers innovative riders like long-term care benefits.

Cons

- Complex Products: Some products can be complex and hard to understand without assistance.

- Customer Service Issues: Some reports of inconsistent customer service experiences.

#9 – Transamerica: Best for Term Policies

Pros

- Affordability: Known for offering some of the most competitive prices, especially for term life insurance.

- Wide Range of Options: Provides a wide spectrum of insurance options including term, whole, and universal life.

- Accessibility: Discover our Transamerica life insurance review, highlighting how their policies are accessible to a broad demographic, including older applicants.

Cons

- Customer Service Concerns: Some customers report dissatisfaction with customer service and claims processing.

- Website Navigation: The website can be difficult to navigate, impacting the customer experience.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#10 – Liberty Mutual: Best for Full Coverage

Pros

- Strong Brand: Delve into our Liberty Mutual life insurance review to learn about the well-known brand’s solid reputation in the insurance industry.

- Variety of Products: Offers a wide variety of insurance products, allowing for good bundling options.

- Responsive Customer Service: Generally receives good reviews for customer service responsiveness.

Cons

- Higher Premiums: Premiums can be higher, particularly for more comprehensive coverage options.

- Underwriting Restrictions: Some applicants might face stricter underwriting criteria, limiting policy accessibility.

Sibling Life Insurance Insights

You can purchase a life insurance policy on a sibling under certain conditions, but simply having a policy for yourself does not justify buying one for your sibling. To secure life insurance, you must first demonstrate an insurable interest, defined by insurers as potential financial loss from the premature death of the insured.

New York Life sets the standard for sibling life insurance with unmatched flexibility and dependable coverage.Dani Best Licensed Insurance Producer

If you depend financially on your sibling or receive significant income from them, proving an insurable interest should be straightforward, making it easier to acquire the necessary coverage.

As you consider life insurance options, assess the amount of coverage you need. For more guidance, including how to demonstrate insurable interest, you might want to learn how to find out if someone has life insurance.

Siblings Life Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AIG | $18 | $70 |

| Guardian Life | $24 | $82 |

| Liberty Mutual | $22 | $78 |

| Lincoln Financial | $26 | $88 |

| Mutual of Omaha | $21 | $78 |

| New York Life | $20 | $75 |

| Northwestern Mutual | $25 | $90 |

| Prudential | $23 | $85 |

| State Farm | $22 | $80 |

| Transamerica | $19 | $72 |

This table displays the monthly rates for life insurance specifically tailored for siblings, comparing minimum and full coverage levels across various providers.

The coverage costs range from $18 to $26 for minimum coverage and from $70 to $90 for full coverage, with companies like AIG, Guardian Life, and Northwestern Mutual among the listed insurers. Each company offers distinct rates for both minimum and full coverage options, allowing for a clear comparison based on budget and coverage needs.

Non-Dependent Sibling Coverage

You can get a life insurance policy on a sibling even without financial dependency if there is an insurable interest. For example, if your sibling has children and you would be responsible for their care after their death, you have an insurable interest.

Life insurance aims to prevent or mitigate financial loss rather than provide profit to beneficiaries. Therefore, if you can demonstrate potential financial loss in the event of your sibling’s death, you can secure coverage. It’s crucial to choose a life insurance beneficiary carefully to ensure the intended financial support reaches the right person.

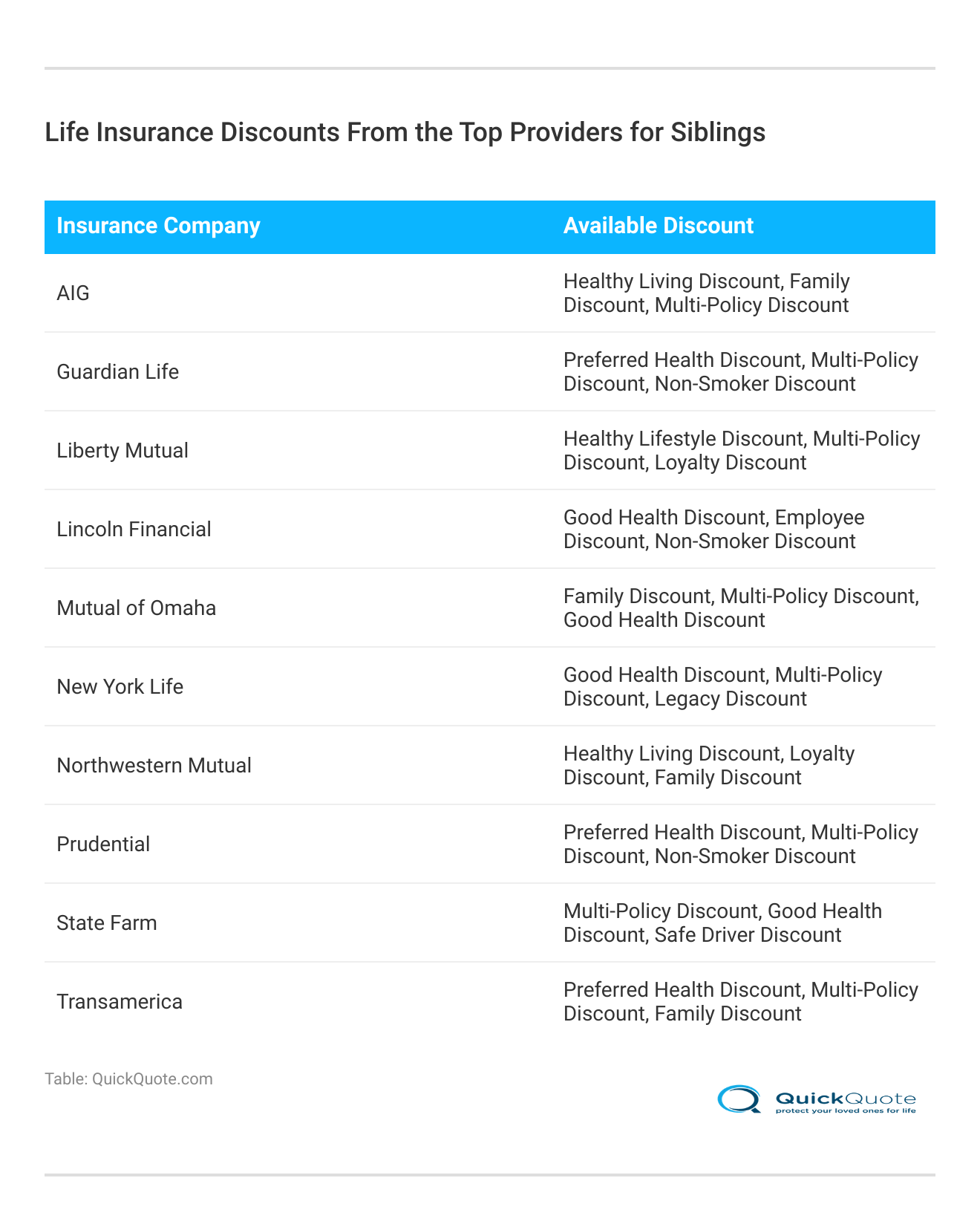

This table lists life insurance discounts for siblings from leading providers, highlighting various reductions such as healthy living, multi-policy bundling, and non-smoker status.

AIG, Guardian Life, and Liberty Mutual offer family and healthy lifestyle discounts, while State Farm and Prudential provide health-related and loyalty discounts. This comparison enables siblings to find potential savings in life insurance policies suited to their specific needs and health profiles.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Sibling Consent for Insurance

For traditional life insurance policies, sibling consent is implied through participation in medical exams and signing of application papers. For life insurance without medical exams, consent requirements vary by company.

Consent may be verified via a recorded phone call or requiring your sibling to initially own the policy and possibly make the first premium payment. Each insurance company has unique consent requirements depending on the policy type and coverage amount desired.

Optimal Sibling Life Insurance

The best approach to finding life insurance for siblings is to shop around, as each insurance company offers different policies and rates; compare quotes from various providers and check the top insurers before deciding.

Life insurance for siblings, while slightly more complex than for oneself, is attainable by discussing options with the person to be insured and determining what suits your family best. Types of life insurance can vary, so it’s important to explore what is most suitable for your family’s needs.

Case Studies: Life Insurance for Siblings

Life insurance for siblings is crucial for family security and financial stability. These case studies highlight real-life examples where siblings have secured each other’s financial futures with strategic life insurance policies, addressing needs from educational support to business partnerships.

- Case Study #1 – Financial Dependency: Sarah and Emily are financially supportive sisters. Sarah pays for Emily’s education and living expenses. To protect Emily financially, Sarah buys a life insurance policy on her, successfully proving financial dependency and securing life insurance coverage.

- Case Study #2: Guardianship of Nieces and Nephews: Alex and Chris are close brothers. Chris has two young children and worries about their future. To secure their financial well-being, Alex takes out a life insurance policy on Chris, ensuring support for his nieces and nephews in case of Chris’s death.

- Case Study #3 – Business Partners: Emma and Ryan are siblings and business partners. To protect their business, they purchase life insurance policies on each other, ensuring the survivor can continue the business smoothly if one passes away.

These case studies emphasize the vital role life insurance plays in protecting the financial health of siblings and their dependents.

New York Life leads in sibling life insurance, boasting a customer satisfaction rating of 98% for its comprehensive and adaptable policies.Jeffrey Manola Licensed Life Insurance Agent

Life insurance is essential for education, guardianship, or business continuity, serving as a crucial tool in managing future uncertainties and reinforcing its importance in family financial planning.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Guidelines for Sibling Life Insurance: Interest and Consent

Purchasing life insurance for a sibling requires demonstrating insurable interest and securing their consent, which varies by policy type. It is more complex than personal coverage but ensures financial security for mutual dependency or guardianship.

Comparing offers from different insurers is crucial to find the best terms and coverage when getting life insurance. Ultimately, this type of insurance provides peace of mind and financial protection in case of unforeseen circumstances.

Enter your ZIP code above to compare instant life insurance quotes from highly-rated insurers and begin investing in your family’s future.

Frequently Asked Questions

Can I get life insurance on my brother through one of the best life insurance companies?

Yes, you can get life insurance on your brother if you demonstrate an insurable interest life insurance requirement and obtain his consent, preferably through one of the best life insurance companies.

For more information, consult our comprehensive guide titled “Best Life Insurance,” for a concise overview.

How to take out a life insurance policy on a family member and ensure it includes life cover for siblings?

How to take out a life insurance policy on a family member involves establishing insurable interest life insurance, securing consent, and opting for a policy that includes life cover for siblings.

Free instant life insurance quotes are just a click away. Enter your ZIP code below to get started.

How can I get life insurance on my sister and ensure it fits into our monthly health insurance plan?

When planning to get life insurance on my sister, it’s essential to integrate it with your monthly health insurance plan for comprehensive coverage, ensuring you verify with best life insurance companies for the best rates.

To discover more, delve into our detailed resource on insurance titled “Health Insurance,” for a quick summary.

What are the benefits of burial insurance for siblings within the best life insurance for families?

Burial insurance for siblings provides specific coverage for end-of-life expenses, ensuring no financial burden on the family. It is often part of best life insurance for families packages that offer comprehensive benefits.

Can you purchase life insurance for a parent and combine it with affordable life insurance options?

Yes, can you purchase life insurance for a parent and it can be made more economical by selecting affordable life insurance plans from providers known for favorable family policies.

What steps are involved in how to get life insurance on a sibling?

To get life insurance on a sibling, confirm insurable interest life insurance, obtain their agreement, and select the right policy from best life insurance companies to ensure affordable life insurance for families.

To gain further insights, refer to our in-depth report titled “Insurable Interest,” for a succinct conclusion.

What does insurable interest meaning signify in family life insurance policies?

Insurable interest meaning in life insurance implies that the policyholder would face financial or emotional loss if the insured family member passes away, a prerequisite for obtaining coverage.

Is it feasible to add life insurance policy for sibling to an existing monthly health insurance plan?

While a life insurance policy for sibling generally stands separate from monthly health insurance plan, some insurers offer bundled services for comprehensive family protection.

To instantly compare life insurance quotes from the top providers, simply enter your ZIP code into our free quote comparison tool below.

Can I buy life insurance for someone else, like a parent, and also ensure it is affordable life insurance?

Yes, can I buy life insurance for someone else such as a parent by showing insurable interest life insurance and getting their consent. It’s possible to find affordable life insurance options that suit family budgets.

For a thorough understanding, refer to our detailed analysis titled “Life Insurance for Families,” for a quick overview.

What criteria determine the best life insurance for families and affordable life insurance for families?

The best life insurance for families and affordable life insurance for families are gauged by premiums, coverage options, customer service, and the ability to meet family-specific needs like education and mortgage payments.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Life Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed life and health insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chr...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.