Best Life Insurance for Marijuana Users in 2025 (Your Guide to the Top 10 Companies)

Prudential, AIG, and Principal offer the best life insurance for marijuana users, providing comprehensive coverage for as low as $24/month. These top companies understand the unique needs of marijuana users and offer policies with minimum coverage options, ensuring robust protection for policyholders.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Dec 15, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Marijuana Users

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Marijuana Users

A.M. Best Rating

Complaint Level

Today, marijuana use is legal in many states and insurance companies are adapting to the changes in views about cannabis. But don’t kid yourself. Even though marijuana use won’t stop you from getting life insurance, it will affect your coverage options and rates.

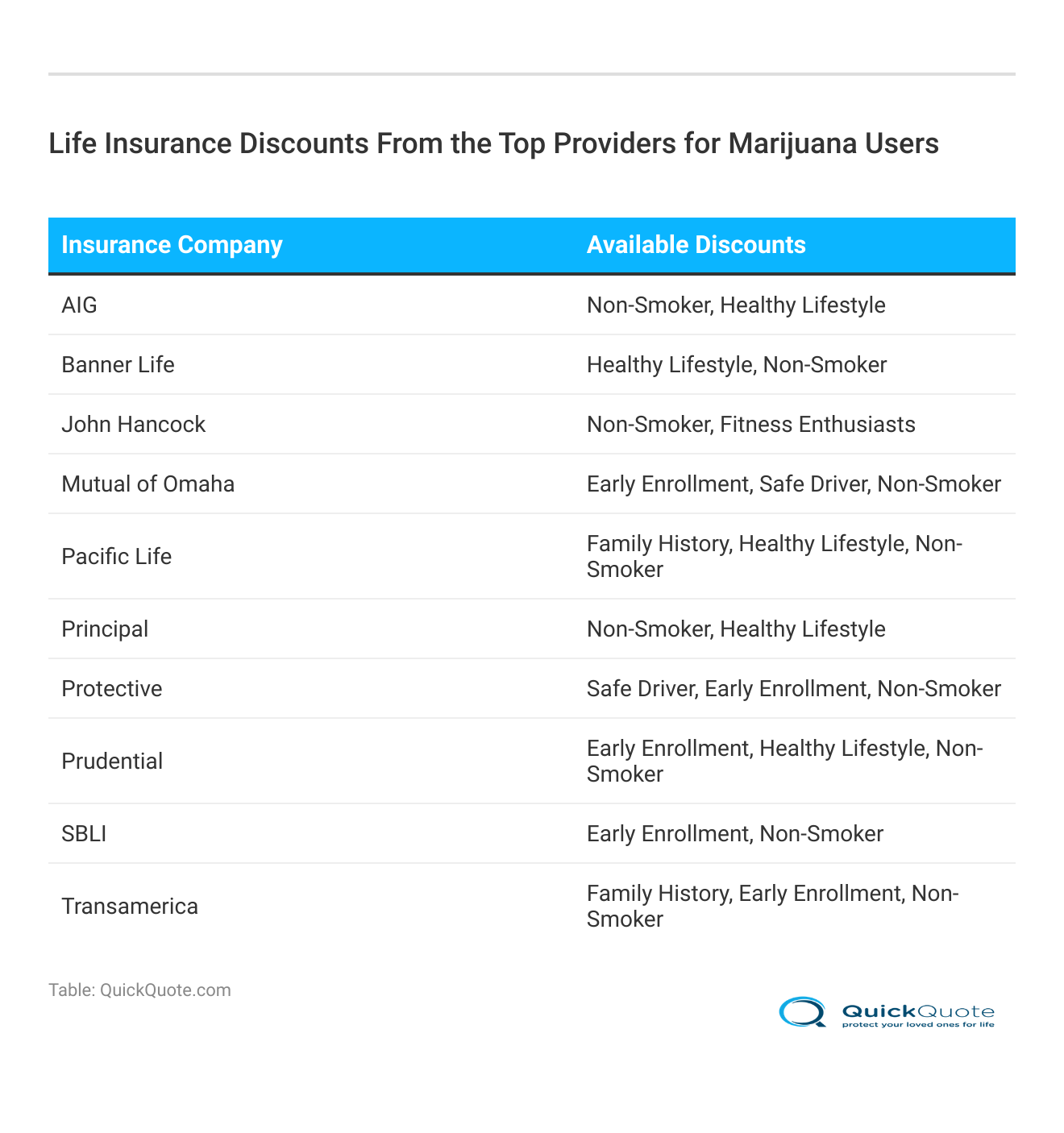

Our Top 10 Company Picks: Best Life Insurance for Marijuana Users

Company Rank Early Enrollment Discount Non-Smoker Discount Best For Jump to Pros/Cons

#1 10% 15% Flexible Terms Prudential

#2 10% 12% Competitive Rates AIG

#3 15% 20% Various Discounts Principal

#4 10% 12% Affordable Rates SBLI

#5 15% 20% Wellness Programs John Hancock

#6 12% 10% Broad Coverage Transamerica

#7 11% 15% Term Options Mutual of Omaha

#8 14% 18% Online Tools Banner Life

#9 13% 10% Low Rates Protective

#10 12% 15% Diverse Options Pacific Life

- Prudential offers affordable life insurance for marijuana users

- Costs for marijuana users are higher due to health risks

- AIG and Principal offer specialized coverage

Read on for helpful information on life insurance for marijuana users and how life insurance works. You can also enter your ZIP code into our free quote tool above for a variety of life insurance quotes. Our research tool will help you find the best life insurance companies for marijuana users.

#1 – Prudential: Top Overall Pick

Pros

- Flexible Terms: Offers a variety of policy terms, providing flexibility to meet different needs. To lean more, read on our “Prudential life insurance review.”

- Early Enrollment Discount: Provides a 10% discount for early enrollment, encouraging timely decisions.

- Non-Smoker Discount: A 15% discount for non-smokers, promoting healthy living.

Cons

- Complex Policy Options: The variety of options can be overwhelming for some customers.

- Higher Premiums: May have higher premiums compared to some competitors.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#2 – AIG: Best for Competitive Rates

Pros

- Competitive Rates: Known for offering highly competitive rates in the market. For more information, read our “AIG life insurance review.”

- Early Enrollment Discount: Provides a 10% discount for enrolling early, adding value.

- Non-Smoker Discount: A 12% discount for non-smokers, rewarding healthy habits.

Cons

- Policy Complexity: Some policies can be complex and hard to understand.

- Application Process: The application process can be lengthy and detailed.

#3 – Principal: Best for Various Discounts

Pros

- Various Discounts: Offers a range of discounts, making policies more affordable. To gain further insights, read our “Principal National life insurance company review.”

- Non-Smoker Discount: Generous 20% discount for non-smokers.

- Early Enrollment Discount: 15% discount for early policy enrollment.

Cons

- Higher Premiums for Smokers: Smokers may face significantly higher premiums.

- Limited Online Tools: Fewer online resources compared to some competitors.

#4 – SBLI: Best for Affordable Rates

Pros

- Affordable Rates: Known for providing some of the most affordable rates in the market.

- Early Enrollment Discount: Offers a 10% discount for early enrollment.

- Non-Smoker Discount: 12% discount for non-smokers.

Cons

- Limited Coverage Options: Fewer coverage options compared to larger insurers.

- Lower Maximum Coverage: Maximum coverage limits may be lower than some competitors.

Read more: AIG vs. SBLI Life Insurance

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#5 – John Hancock: Best for Wellness Programs

Pros

- Wellness Programs: Offers innovative wellness programs to promote healthy living.

- Non-Smoker Discount: Provides a 20% discount for non-smokers.

- Early Enrollment Discount: 15% discount for early enrollment. Check our comprehension guide titled “John Hancock life insurance company review” to learn more.

Cons

- Higher Premiums: Premiums may be higher than some other providers.

- Complex Policy Terms: Some policy terms can be complex and difficult to understand.

#6 – Transamerica: Best for Broad Coverage

Pros

- Broad Coverage: Offers a wide range of coverage options to meet diverse needs.

- Early Enrollment Discount: Provides a 12% discount for early policy enrollment. Read our “Transamerica life insurance review” to gain further insights.

- Non-Smoker Discount: 10% discount for non-smokers.

Cons

- Higher Premiums: Premiums may be higher compared to some competitors.

- Complex Application Process: The application process can be detailed and time-consuming.

#7 – Mutual of Omaha: Best for Term Options

Pros

- Term Options: Offers a variety of term life insurance options.

- Early Enrollment Discount: 11% discount for early enrollment. To learn more, read on our “Mutual of Omaha life insurance review.”

- Non-Smoker Discount: 15% discount for non-smokers.

Cons

- Limited Permanent Life Options: Fewer options for permanent life insurance.

- Higher Premiums for Certain Terms: Some term policies can have higher premiums.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#8 – Banner Life: Best for Online Tools

Pros

- Online Tools: Provides robust online tools for policy management and quotes.

- Early Enrollment Discount: Offers a 14% discount for early enrollment. For more information, read our “Banner Life insurance company review.”

- Non-Smoker Discount: 18% discount for non-smokers.

Cons

- Limited Physical Offices: Fewer physical office locations for in-person support.

- Complex Policies: Some policies may be complex and difficult to navigate.

#9 – Protective Life: Best for Low Rates

Pros

- Low Rates: Offers some of the lowest rates in the market. Read our “Protective Life insurance review” to gain further insights.

- Early Enrollment Discount: Provides a 13% discount for early policy enrollment.

- Non-Smoker Discount: 10% discount for non-smokers.

Cons

- Limited Coverage Options: Fewer coverage options compared to larger insurers.

- Higher Premiums for Certain Conditions: Some health conditions may result in higher premiums.

#10 – Pacific Life: Best for Diverse Options

Pros

- Diverse Options: Offers a wide range of life insurance options. For more information, read on our “Pacific Life insurance review.”

- Early Enrollment Discount: 12% discount for early enrollment.

- Non-Smoker Discount: 15% discount for non-smokers.

Cons

- Complex Policy Terms: Some policy terms can be complex.

- Higher Premiums: Premiums may be higher compared to some competitors.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

The Effect of Marijuana use on Life Insurance Rates

If you’re a regular weed smoker, life insurance companies may classify you as a smoker. If so, you could expect to pay an average of double what it would cost a nonsmoker for the same policy. But not all marijuana use will impact rates so dramatically.

Cannabis, or marijuana, is a plant with flower buds that produce a psychoactive chemical called tetrahydrocannabinol (THC). The bud is either smoked or turned into an oil that can be consumed in food or drink as an “edible” or used as a topical ointment.

Marijuana User Life Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $27 $47

Banner Life $29 $49

John Hancock $25 $45

Mutual of Omaha $26 $46

Pacific Life $33 $53

Principal $32 $52

Protective $31 $51

Prudential $30 $50

SBLI $24 $44

Transamerica $28 $48

As marijuana’s medicinal benefits gain recognition and laws decriminalize its use, the life insurance industry is adapting. Cannabis users can obtain life insurance, with occasional smokers potentially qualifying for nonsmoker rates.

Insurers also ask if marijuana use is recreational or medical and if you smoke the flower or vape cannabis oil. Here’s a chart showing how smoking marijuana affects life insurance rates by gender, age, and smoker status.

Life Insurance Monthly Rates by Age, Gender & Smoker Status

Age & Smoker Status Male Female

Non-Smoker (Age 25) $179 $161

Smoker (Age 25) $322 $249

Non-Smoker (Age 35) $166 $179

Smoker (Age 35) $286 $322

Non-Smoker (Age 45) $185 $166

Smoker (Age 45) $360 $286

Non-Smoker (Age 55) $240 $185

Smoker (Age 55) $493 $360

Non-Smoker (Age 65) $268 $240

Smoker (Age 65) $638 $493

Non-Smoker U.S. Average $407 $268

Smoker U.S. Average $992 $638

Keep in mind that this chart shows average life insurance rates for tobacco, not marijuana, smokers. Tobacco contains many toxins and carcinogens and is extremely hazardous to your health, whereas marijuana has proven medicinal and other health benefits.

That said, the mere act of smoking on a regular basis can result in higher life insurance rates.

Life Insurance Companies’ Views on Marijuana use

The National Association of Insurance Commissioners (NAIC) recognizes that the majority of U.S. states have legalized marijuana for either medical or recreational use or both. But how do life insurance companies feel about marijuana use?

Most insurance companies do not deny coverage due to marijuana use, but policies and rates vary. Generally, marijuana use impacts life insurance costs, similar to how having a medical marijuana card can affect health insurance.

Life insurance rates may be higher for cannabis users because medical marijuana is often prescribed for high-risk conditions like cancer or autoimmune disorders. Therefore, the underlying medical condition impacts the cost more than marijuana use itself.

Another reason marijuana use may mean higher life insurance costs is because, as discussed above, many users smoke it on a regular basis, which insurers generally deem to be a high-risk activity.

Even if you’re not a weed smoker, and instead take marijuana in edible, ingestible, or topical form, you’re still going to see higher life insurance rates if there is a serious or preexisting medical reason behind the use. For more information see life insurance for high-risk individuals.

Getting Approved for Life Insurance as a Marijuana User

Getting approved for life insurance is all about underwriting. The riskier it is to insure someone because of their poor health, dangerous lifestyle, or hazardous occupation, the harder it is to get approved for life insurance, and the more expensive the policy will be if you get approved.

The best way to get approved for life insurance if you use marijuana is to make sure you have a medical prescription for it. For most major carriers, someone with a valid medical marijuana prescription could still qualify for a preferred rating so long as other risk factors are low.

It’s still possible to get approved for life insurance if you’re a recreational pot user. Just understand that the more you use, the more expensive your rates will be, as demonstrated by the following examples of some general marijuana underwriting guidelines.

Life Insurance Company: Marijuana Underwriting Usage Guide

| Insurance Company | Guide |

|---|---|

| AIG | Allows recreational use up to 2 times per month for non-smoker rates. More frequent use is assessed case-by-case. |

| Banner Life | Occasional use (up to 2 times per month) is considered for non-smoker rates. More frequent use may result in smoker rates or decline. |

| John Hancock | Up to 2 times per month for non-smoker rates; more frequent use is assessed on a case-by-case basis, often resulting in smoker rates or possible decline. |

| Mutual of Omaha | Occasional use (up to 3 times per month) is allowed for non-smoker rates. More frequent use may lead to smoker rates or further assessment. |

| Pacific Life | Allows occasional use (up to 3 times per month) for non-smoker rates. More frequent use may result in smoker rates or decline. |

| Principal | Up to 4 times per month for non-smoker rates. More frequent use is usually classified as smoker rates. |

| Protective | Recreational use up to 4 times per month is considered for non-smoker rates. More frequent use may be classified as smoker rates or further reviewed. |

| Prudential | Allows recreational use up to 4 times per month for non-smoker rates. More frequent use may lead to smoker rates or a detailed review. |

| SBLI | Occasional use up to 4 times per month for non-smoker rates. More frequent use may result in smoker rates or additional underwriting. |

| Transamerica | Up to 4 times per month for non-smoker rates. More frequent use can result in smoker rates or further assessment. |

As you can see, the life insurance underwriting guidelines, practices, and policies for marijuana users vary between insurance companies.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Marijuana Legalization in my State and its Impact on Life Insurance Approval

If medical and recreational marijuana use is legal in your state, then it will likely improve your chances of getting life insurance, assuming there are no other risk factors that would lead to a decline of coverage.

Also, in a state where weed is legal, an insurer cannot discriminate against you if you use it recreationally. That said, if you’re using pot for a medical reason with or without a prescription, the underlying condition could impact your coverage and rates. To learn more, read our “What to Expect When You Need a Medical Exam for Life Insurance.”

Life Insurance Companies’ Testing for THC

Certain drug tests used by life insurance companies can detect the presence of THC in hair follicles, the bloodstream, and urine.

Life insurance companies often use drug tests in connection with medical exams as part of the application process. Even if you’re not drug tested, depending on the length and frequency of use, medical marijuana may be documented in your medical or prescription records.

Given that marijuana use could be detected through drug tests or medical records, it’s best not to lie about it. Lying on an insurance application is a form of fraud. So, what happens if you lie on your life insurance application. Well, insurance fraud could cause your policy to be canceled or benefits to be denied.

Case Studies: Life Insurance for Marijuana Users

- Case Study #1 – Occasional Cannabis User: Sarah, a healthy 35-year-old occasional cannabis user, disclosed her use on her life insurance application and was classified as a nonsmoker, qualifying for standard rates.

- Case Study #2 – Regular Cannabis Smoker: Michael, a healthy 45-year-old daily cannabis smoker, disclosed his habit on his life insurance application and was classified as a smoker, resulting in higher premiums.

- Case Study #3 – Medical Marijuana User: Emily, a healthy 40-year-old with a medical marijuana prescription for chronic pain, disclosed her use when applying for life insurance. Her rates are higher than nonsmokers but lower than recreational users classified as smokers, also influenced by her preexisting condition.

Through these case studies, it becomes evident that the frequency and purpose of cannabis use, as well as overall health and additional medical conditions, play crucial roles in determining life insurance rates.

Read more: Best Life Insurance for Smokers

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

The Bottom Line: Life Insurance for Marijuana Users is Possible but May Cost More

Generally speaking, you shouldn’t be denied life insurance just because you use marijuana. When it comes to marijuana use and life insurance, you can still be approved for life insurance at the preferred rate if you use cannabis with a medical prescription, don’t use it that often, and don’t use it for a serious underlying or preexisting medical condition.

Even if you’re a recreational pot smoker, you should still be able to get coverage, but you can expect your life insurance premiums to be higher than non-marijuana smokers. You can get free quotes for life insurance and secure financial protection for your loved ones by entering your ZIP code into our tool below.

Frequently Asked Questions

Does marijuana use affect life insurance rates?

Yes, regular marijuana use can lead to higher life insurance rates.

Can I still get life insurance if I use marijuana?

Yes, most insurance companies provide coverage for marijuana users, but rates may be impacted.

Give your loved ones the gift of financial security by entering your ZIP code below to find life insurance that doesn’t break the bank.

Do life insurance companies test for marijuana use?

Some companies conduct drug tests that can detect marijuana use.

For more information, read our “Do life insurance companies test for drugs?.”

Does marijuana legalization affect life insurance eligibility?

Legalization may improve eligibility, but underlying medical conditions can still impact coverage.

Is life insurance possible for marijuana users?

Yes, life insurance is possible, but rates depend on factors like frequency of use and medical conditions.

If you’re looking for affordable life insurance premiums, try our comparison tool below and find the cheapest coverage that fits your needs.

How does recreational marijuana use impact life insurance rates?

Recreational marijuana use can result in higher premiums, especially if used frequently. Occasional users may still qualify for nonsmoker rates.

Read our “Best Life Insurance for Smokers“, for more information.

How does medical marijuana use impact life insurance rates?

Medical marijuana use can also lead to higher premiums, primarily due to the underlying medical conditions for which it is prescribed.

What should I disclose about my marijuana use when applying for life insurance?

You should be honest about your marijuana use, including the frequency and whether it is for recreational or medical purposes, to avoid any issues with insurance fraud.

Can I get life insurance at a preferred rate if I use marijuana?

It is possible to get life insurance at a preferred rate if you have a valid medical marijuana prescription, do not use it frequently, and do not have serious underlying medical conditions.

To gain further insights, read our “How Prescription Drugs Impact Life Insurance Rates.”

What happens if I lie about my marijuana use on a life insurance application?

Lying about marijuana use on a life insurance application is considered fraud and can lead to policy cancellation or denial of benefits.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.