Best Life Insurance for Seniors in 2024 (Find the Top 10 Companies Here)

Mutual of Omaha, AARP, and Transamerica offer the best life insurance providers for seniors, with rates starting at $50 monthly. Renowned for their comprehensive coverage, affordability, and dependable service, these companies are ideal choices for seniors seeking reliable insurance options.

Ready to compare quick life insurance quotes?

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

UPDATED: Jul 8, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.

UPDATED: Jul 8, 2024

It’s all about you. We want to help you make the right life insurance coverage choices.

Advertiser Disclosure: We strive to help you make confident life insurance decisions. Comparison shopping should be easy. We are not affiliated with any one life insurance company and cannot guarantee quotes from any single company.

Our life insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different life insurance companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Company Facts

Full Coverage for Seniors

A.M. Best Rating

Complaint Level

Company Facts

Full Coverage for Seniors

A.M. Best Rating

Complaint Level

These companies offer seniors affordable, comprehensive policies, including customizable term and whole life options to suit various needs. Learn more in our complete “Best Life Insurance Companies.”

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

#1 15% A+ Competitive Rates Mutual of Omaha

#2 12% A++ Simplified Issue AARP

#3 10% A Comprehensive Policy Transamerica

#4 14% A+ Flexible Policiy Prudential

#5 11% A Simplified Application AIG

#6 9% A+ Competitive Rates Banner Life

#7 13% B Customer Service State Farm

#8 8% A+ Simplified Application Globe Life

#9 10% A++ Financial Strength Northwestern Mutual

#10 12% A+ Comprehensive Policy Lincoln Financial

Senior life care plans offer seniors peace of mind with policies that highlight flexibility, security, and value.

Enter your ZIP code above to compare instant life insurance quotes from highly-rated insurers and begin investing in your family’s future.

#1 – Mutual of Omaha: Top Overall Pick

Pros

- Substantial Multi-Policy Discount: Mutual of Omaha offers a 15% discount for bundling multiple policies.

- High A.M. Best Rating: Rated A+, indicating strong financial health and claim-paying ability.

- Competitive Pricing: Known for offering some of the most competitive rates in the industry. Access comprehensive insights into our guide titled “Mutual of Omaha Life Insurance Review.”

Cons

- Limited Policy Options: Fewer specialized policy options compared to larger insurers.

- Slower Claim Processing: Some reports of slower-than-average claim processing times.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#2 – AARP: Best for Simplified Issue

Pros

- Easy Application Process: Simplified issue policies with no medical exams. Delve into our evaluation of our guide titled “AARP Life Insurance for Seniors Review.”

- Tailored for Seniors: Policies specifically designed to meet the needs of older adults.

- Strong A.M. Best Rating: A++ rating ensures high reliability in fulfilling claims.

Cons

- Membership Requirement: Insurance available only to AARP members.

- Higher Premiums for Non-Members: Non-members can face significantly higher costs if not part of AARP.

#3 – Transamerica: Best for Comprehensive Policy

Pros

- Wide Range of Coverage: Offers a comprehensive set of policy options to cover various needs.

- Legacy Planning Tools: Provides resources and tools for estate planning and legacy building.

- Decent Discounts: 10% discount on multi-policy bundles. Read up on the “Transamerica Life Insurance Review” for more information.

Cons

- Average Customer Service: Customer service ratings are not as high as competitors.

- Complexity of Policy Offerings: The wide array might overwhelm first-time insurance buyers.

#4 – Prudential: Best for Flexible Policy

Pros

- Flexible Policy Terms: As per our Prudential life insurance company review, this provider stands out for it offers adjustable terms that can evolve with customers’ changing needs.

- Strong Financial Stability: Prudential’s A+ rating by A.M. Best ensures strong financial backing.

- Significant Discounts for Loyalty: Offers loyalty discounts including a 14% multi-policy discount.

Cons

- Higher Entry Costs: Initial premiums tend to be higher than some competitors.

- Complex Policies: Some policies may be too complex for average consumers to understand.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#5 – AIG: Best for Simplified Application

Pros

- Streamlined Underwriting: Simplified application processes reduce paperwork and approval time.

- Competitive Multi-Policy Discounts: Offers an 11% discount for customers who bundle policies.

- Global Reach: Extensive international presence enhances policy support and options. For more insights, read the AIG life insurance review.

Cons

- Inconsistent Customer Service: Customer service quality can vary significantly by region.

- Premium Costs: Premiums can be higher on certain policies, reflecting AIG’s extensive coverage.

#6 – Banner Life: Best for Competitive Rates

Pros

- Affordable Premiums: Known for competitive rates especially beneficial for younger policyholders.

- High A.M. Best Rating: A+ rating affirms financial strength and stability. See more details in our guide titled “Banner Life Insurance Company Review.”

- Flexible Term Policies: Offers adjustable terms to fit personal financial situations.

Cons

- Limited Additional Benefits: Fewer perks and benefits compared to other insurers.

- Narrow Product Range: Less diversity in types of available insurance products.

#7 – State Farm: Best for Customer Service

Pros

- Exceptional Customer Support: Strong reputation for customer service and agent accessibility.

- Diverse Coverage Options: Wide range of policies suitable for different needs. For more details, read the State Farm life insurance review.

- Significant Discounts for Loyalty: Provides a 13% discount on multi-policy bundling.

Cons

- Higher Premiums: Costs may be higher compared to competitors for similar coverage levels.

- Limited Multi-Policy Discount: 13% discount might not compete well against others offering more.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

#8 – Globe Life: Best for Simplified Application

Pros

- Fast Application Process: Streamlined processes make it easy and quick to secure a policy.

- Targeted Products for Families: Based on our Guardian life insurance review, this provider is known for offering products tailored to the needs of families and seniors.

- Solid A.M. Best Rating: A+ rating indicates reliable financial backing.

Cons

- Coverage Limits: Some policies have lower coverage limits compared to industry averages.

- Premium Increases: Premiums may increase over time more than with other insurers.

#9 – Northwestern Mutual: Best for Financial Strength

Pros

- Top-Notch Financial Stability: A++ rating by A.M. Best, the highest possible, indicating superior financial health.

- Customized Financial Planning: Offers comprehensive planning tools and financial advice.

- Loyalty Rewards: As detailed in our Northwestern Mutual life insurance review, Northwestern Mutual provides benefits and discounts for long-term policyholders.

Cons

- Premium Costs: Higher initial premium costs compared to competitors.

- Limited Immediate Benefits: Benefits are geared more towards long-term rather than immediate returns.

#10 – Lincoln Financial: Best for Comprehensive Policy

Pros

- Extensive Policy Options: Offers a broad array of comprehensive policies for various needs. Discover more about offerings in our complete “Lincoln National Life Insurance Review.”

- Strong Investment Management: Excellent management of policy investments for maximum returns.

- Tailored Plans for Businesses: Specializes in providing policies that suit business requirements.

Cons

- Complexity in Terms: Policies can be complex and difficult to understand without guidance.

- Costlier Premiums: Generally higher premiums for the level of comprehensive coverage offered.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Comparative Monthly Life Insurance Rates for Seniors

This section delves into the monthly rates for life insurance tailored to seniors, examining both minimum and full coverage options across various providers. The table below provides a comparative overview, enabling seniors to make informed decisions based on their specific needs and financial circumstances.

Insurance Company Minimum Coverage Full Coverage

AARP $60 $300

AIG $52 $260

Banner Life $54 $265

Globe Life $51 $255

Lincoln Financial $59 $290

Mutual of Omaha $50 $250

Northwestern Mutual $63 $320

Prudential $58 $280

State Farm $57 $275

Transamerica $55 $270

The table reveals a range of costs for life insurance targeting seniors, from minimum to full coverage options. For instance, Mutual of Omaha offers the lowest minimum coverage rate at $50, making it an attractive option for seniors seeking affordability without compromising on quality.

On the higher end, Northwestern Mutual’s full coverage soars to $320 per month, reflecting its comprehensive benefits. Each company presents a different pricing structure, allowing seniors to select a plan that best fits their budget and coverage requirements.

This range in pricing highlights the need for thorough comparison and thoughtful decision-making, especially for seniors on fixed incomes or with specific financial goals, seeking senior care plan life insurance and competitive senior care plan rates.

Learn more: What is the minimum coverage amount for life insurance?

What Is the Best Life Insurance Policy for Seniors Over 60

If you’re wondering about the best life insurance for someone over 60 or seeking the top options for someone over 50, consider a senior plan life insurance company. This table has the rates for the top life insurance companies for 65-year-olds.

| Insurance Company | Female Non-Smoker | Female Smoker | Male Non-Smoker | Male Smoker |

|---|---|---|---|---|

| John Hancock | $78 | $128 | $115 | $341 |

| Lincoln National | $75 | $139 | $131 | $389 |

| Mass Mutual | $64 | $83 | $87 | $172 |

| New York Life | $77 | $157 | $118 | $239 |

| Prudential | $78 | $154 | $118 | $244 |

| State Farm | $57 | $77 | $80 | $188 |

| Transamerica | $95 | $147 | $114 | $371 |

| U.S. Average | $75 | $116 | $109 | $278 |

Here is a credit rating table for life insurance companies that are good for seniors.

| Insurance Company | A.M. Best | Standard & Poor’s | Fitch Ratings | Moody’s | J.D. Power |

|---|---|---|---|---|---|

| AIG | A (Excellent) | A+ (Strong) | A+ (Strong) | A2 (Good) | 2 Power Circles (The Rest) |

| Banner | A+ (Superior) | AA- (Very Strong) | AA-(Very Strong) | NA | NA |

| Haven Life | A++ (Superior) | NA | NA | NA | NA |

| Mutual of Omaha | A+ (Superior) | AA- (Very Strong) | AA (Very Strong) | Aa3 (Excellent) | 2 Power Circles (The Rest) |

| New York Life (AARP) | A++ (Superior) | AA+ (Very Strong) | AAA | AAA | 4 Power Circles (Better than Most) |

| State Farm | B (Fair) | AA (Very Strong) | NA | Aa1 | 2018 Award Recipient (Among the Best) |

Sample rates for each life insurance company can be compared to each other to see who has the best rates.

Read more: Colonial Penn Life Insurance for Seniors Review

Haven Life

Haven Life only offers multiple types of term life insurance.

Haven Life provides senior care plan life insurance coverage without requiring a medical exam. This is a desirable option for many seniors, as it guarantees they won’t be rejected based on their health.

Here’s a commercial from Haven Life.

Here are some the ratings that have been given to Haven Life:

- A.M. Best has given the company a credit rating of A++. That rating is considered superior.

- Fitch Ratings awarded Haven Life an AA-. This rating is very strong.

- Moody’s has given the company an A1, which is considered good.

- J.D. Power has awarded the company two power circles and ranked the company among the rest.

The company has a strong financial rating with A.M. Best despite being a new company.

State Farm

State Farm is renowned for its excellent customer service and a variety of optional riders. The company is also well-known in the industry. They provide guaranteed renewable term life insurance up to age 95, ensuring long-term senior care plan life insurance coverage.

Here’s one of State Farm’s commercials.

State Farm has multiple credit ratings from different companies.

- A.M. Best has rated the company an A++.

- Standard & Poor’s (S&P) has rated the company an AA.

- Moody’s has rated the company an Aa1.

- J.D. Power has awarded the company its 2018 Award.

The company ratings are strong.

Mutual of Omaha

Mutual of Omaha offers highly adaptable policies and exceptional customer service, with new senior care insurance available for individuals up to age 74.

Mutual of Omaha life insurance for seniors can be appealing. Mutual of Omaha has many ratings from various credit rating companies.

- A.M. Best has a given Mutual of Omaha a rating of A+.

- Standard & Poor’s (S&P) has rated the company an AA-.

- Fitch Ratings gave the company an AA.

- Moody’s has rated the company an Aa3.

- J.D. Power has awarded the company two power circles.

Overall, company ratings are great.

New York Life (AARP)

New York Life has death benefits available for every budget. The company also offers affordable entry points for smaller policies. Multi-million dollar policies are also available as well as New York Life final expense.

Read more: How much does a million dollar life insurance policy cost?

New York Life insurance for seniors offers guaranteed term without a medical exam up to age 85.

Here are some secrets for a happy life from AARP.

The company’s partnership with AARP means many customers can feel more comfortable working with a group they know and trust.

New York Life has many credit ratings to compare.

- A.M. Best has rated the company an A++.

- Standard & Poor’s (S&P) rated the company an AA+.

- Fitch Ratings awarded the company a rating of AAA.

- Moody’s has given the company an AAA rating.

- J.D. Power has awarded the company four power circles.

New York Life ratings are above average.

Banner Life

Banner Life provides flexible payment choices, allowing you to fully pay a whole life policy within 10–15 years, aligning with the needs for senior care insurance and senior life insurance company plans.

Banner Life’s underwriting is more favorable than competitors toward traditionally high-risk groups. Those with a poor family history or pre-existing conditions are considered in the high-risk group.

Banner Life is a financially solid company. The company’s credit ratings are good.

- A.M. Best has rated the company an A+.

- Standard & Poor’s (S&P) has Banner at an AA-.

- Fitch Ratings rated the company as an AA-.

Banner Life has fewer ratings than other companies mentioned.

AIG

AIG remains a solid option for seniors, maintaining competitive senior care plan rates even though their customer service isn’t always top-notch.

AIG has great ratings from many credit rating agencies.

- A.M. Best has given AIG an A.

- Standard & Poor’s (S&P) has rated the company an A+.

- Fitch Ratings rated the company an A+.

- Moody’s has ranked the company an A2.

- J.D. Power has awarded the company two power circles.

AIG is a reliable choice.

Does Senior Plan Life Insurance Make Sense After 60

Many people wonder, do I really need life insurance in my 60s? The answer is yes.

If you’re healthy, you’ll have access to similar senior care life insurance plan options as you did when younger, though your senior care plan rates are likely to be higher.

If you’re in poor health, then you’ll probably not have as many options available. For those who are in poorer health, there are guaranteed plans available, which are typically associated with a lower death benefit.

See more details on our article titled “Life Insurance Death Benefit Explained.”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

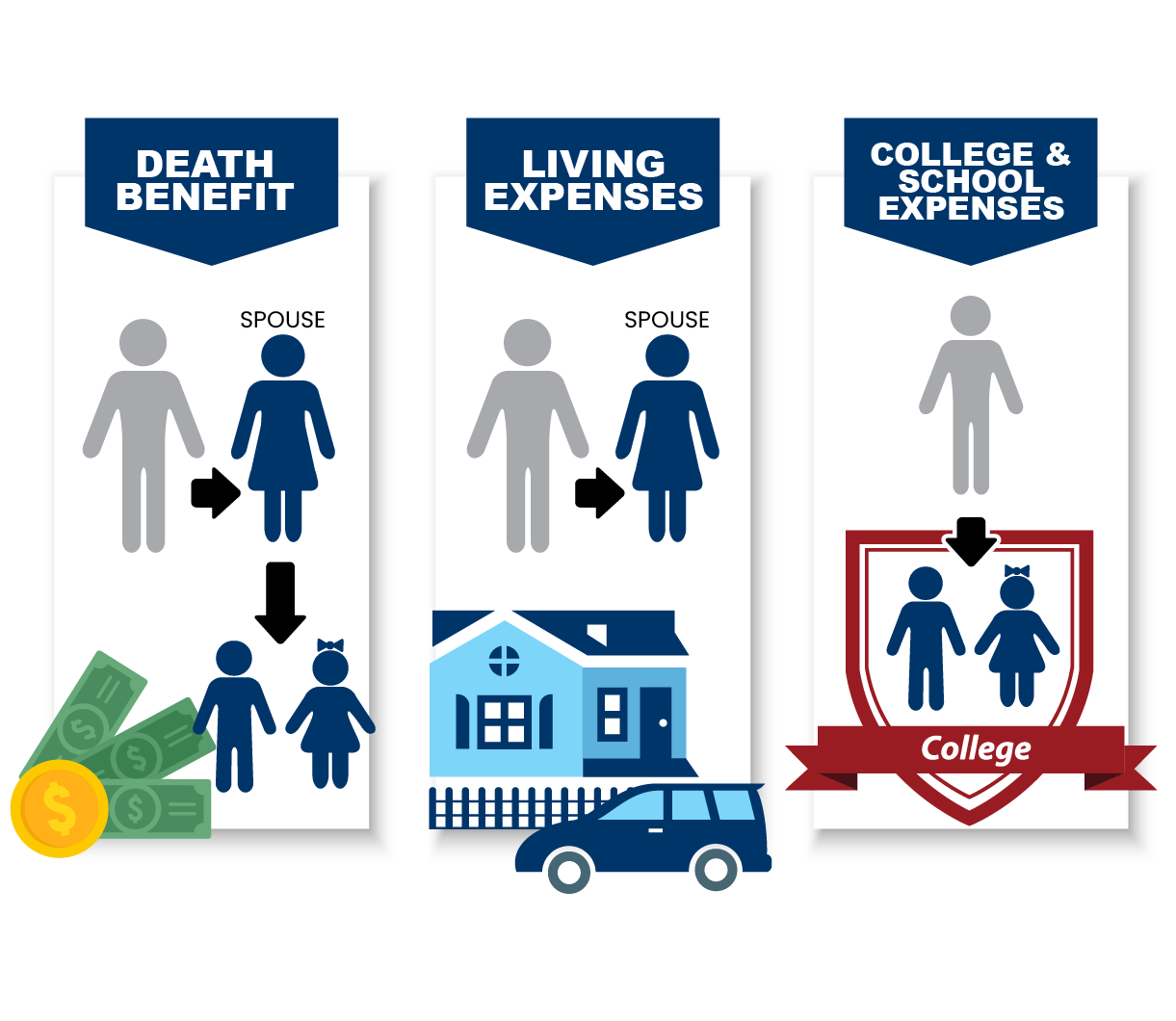

What Happens to Senior Plan Life Insurance When You Retire

If you get your insurance from your employer, then your benefits may end when you retire. Some companies will allow you to take over and continue to pay your life insurance. Often, people will buy their life insurance plans when they retire.

Life insurance plans are for your beneficiary.

Some life insurance policies will allow you access to living benefits — benefits that are available when you’re still alive. These benefits can be useful if you’re in debt or an unexpected illness arises.

It’s beneficial to access what life insurance benefits you have when you retire.

Social Security is often considered retirement but it also pays for disability and survivor benefits. Social Security can start paying you as early as the age of 62 or as late as 70 years old.

Even though many people are receiving Social Security benefits, they may still feel the need to buy life insurance coverage.

What Should You Know about Shopping for Senior Plan Life Insurance Quotes

Buying life insurance if you’re over 65 doesn’t have to be hard work, by researching different types of life insurance, it’s possible to save money. The most important thing is to think about the type of policy you need and what monthly premiums you can afford.

There is a difference between having an independent agent or financial advisor and calling the insurance company directly. An independent agent or financial advisor works for you and will focus on life insurance products you need due to your financial circumstances or goals.

Mutual of Omaha consistently leads with the most affordable and flexible insurance plans for seniors.Ty Stewart Licensed Life Insurance Agent

When you call an insurance company, the agent you talk to is an agent for the company you called. They can help you find insurance for you, but they are selling their company’s life insurance products. They can’t tell you about life insurance companies that offer better coverage or rates since they are hoping you’ll buy from them.

According to LIMRA’s 2019 Facts About Life, the top three reasons that Americans give for owning life insurance are to:

- Cover Burial and Final Expenses

- Help Replace Lost Wages or the Income of the Wage Earner

- Transfer Wealth or Leave an Inheritance

Prepare yourself with knowledge by learning the basics. Many blogs can help you learn life insurance more in-depth. It’s also important to read all senior life insurance company reviews since you want to buy the best coverage, rates, and life insurance company.

This senior life insurance TV commercial will explain some life insurance basics.

How Did the Coronavirus (COVID-19) Pandemic Affect Senior Life Plan Insurance

Does life insurance cover coronavirus? COVID-19 has caused unexpected changes to life insurance policies, especially for seniors. Companies have made different types of changes.

- Prudential Financial and Protective Life have halted applications from individuals aged 80 years and older.

- Lincoln National postponed approving policies for individuals who are 80 years old and other age groups as well.

- Mutual of Omaha and Penn Mutual have both temporarily suspended applications from those who are 70 years old and older.

- Securian Financial is no longer accepting applications for those who are 71 years and older until June 15.

Some companies have also suspended applications from those who are over 60 and who may have been eligible for coverage before the coronavirus pandemic. Diabetes and asthma are two health problems that may make getting life insurance approval harder.

Access comprehensive insights into our guide titled “Does being vaccinated affect your life insurance coverage?”

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Is There Senior Plan Life Insurance for People Over 75

There were 781 life insurance companies in the United States in 2017, which means you have a lot of options. If you’re in good health, you’ll have many of the same options available as when you were younger. You’ll usually just have higher premiums.

If you’re in poor health, then there are some guaranteed term life insurance plans still available; you can get coverage by only answering a few health questions.

Seniors looking for reliable coverage will find Mutual of Omaha's policies specifically tailored to their needs.Jimmy McMillan Licensed Insurance Agent

Many seniors believe that they aren’t eligible for life insurance as they get older. They ask, “Can you get life insurance on a 70-year-old?” The answer is that you can still buy life insurance over the age of 70. It’s also possible to get life insurance with no medical exam. The average life expectancy is 76 for men and 81 for females.

It’s possible to find senior life insurance with no medical exam at 80. Most companies don’t offer this option, but Colonial Penn life insurance has term insurance up to 90 years old. They do not offer any permanent life insurance options for seniors.

What Factors Affect Life Insurance Rates for Seniors Over 80

Many factors will affect your rates for life insurance over 80. Some factors that are extremely important if you are a senior are:

- Age

- Gender

- Overall Health

- High-risk Behaviors

While being older does not necessarily eliminate you from qualifying for life insurance coverage, it will make your premiums higher. Life insurance premiums rise for every year that you get older. It’s always cheaper to buy life insurance at a younger age. This video will discuss how to identify factors that will affect life insurance.

Keep in mind, however, that while these are the most common factors to affect your rate, every company is different.

How can you get the best life insurance for seniors over 85?

There are multiple things you can do to get affordable senior plan life insurance over 85. Many of these factors will come up during the underwriting process. There may be limited underwriting, but there can also be a full life insurance underwriting process and medical exam. See guidelines here: life insurance underwriting guidelines.

These plans benefit some seniors who are in poorer health. These policies tend to be considered more expensive, but they are simpler than many other types of coverage.

If you have no chronic health issues, then you should opt for full underwriting. This will include a medical exam, but it can save you money.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

What Types of Senior Plan Life Insurance Are There

Many types of life insurance options are available for seniors.

Term Life Insurance for Seniors

Term life insurance is insurance that is paid for and active for a specific amount of time, called a term. There are many term options, but they are often in 10-year, 20-year, and 30-year terms. Term options will probably become shorter as you get older.

Pros for term insurance include:

- Options for no-exam insurance are often available.

- Straightforward policies, with the same death benefit over the life of the term.

- Premiums remain the same throughout the term.

- If you already have a term policy, in many cases you can simply renew it as long as you keep everything the same.

There are many appealing aspects to purchasing term life coverage. Term life insurance won’t cover every need, and it does have cons. Unlock details in our article titled “How To Buy Term Life Insurance.”

Cons for term life insurance include:

- Once the term ends, the insurance expires, and there is no death benefit.

- There’s no accumulation of cash value.

- Terms are often limited to 10,15, or 20-year limits based on age.

- Death benefits available will be lower if you buy when you’re a senior citizen.

- It can include waiting periods where premiums are paid for two or three years but no claim is allowed against the policy.

- If you’re still living at the end of term, you’ll need to re-apply for a new policy.

At the end of your term, the company will often allow you to convert the coverage to a whole life policy at the same rate you’ve been paying for term life insurance.

Whole Life Insurance for Seniors

Permanent life insurance is also called whole life insurance. This insurance is for your whole life. Once you purchase a policy then your premium won’t change, and you’re covered as long as you pay on time.

The pros of purchasing whole life insurance include:

- Lifetime policies are guaranteed until you reach a specific age. In some cases, this can be up to 121 years old (Penn Mutual).

- There are many types available — something for almost everyone.

- Some, like guaranteed universal life, don’t build.

- cash value over time, but are relatively inexpensive and allow you to keep your premiums fairly low.

- Some companies offer optional add-ons, like chronic illness or nursing home riders.

While these are all good attributes that you want in a life insurance policy, the cons of whole life insurance may not fit all your needs. Some cons of purchasing whole life insurance are:

- The cash value policies that accumulate are often very expensive if your age at issuance is over 70.

- Death benefits are often for much lower amounts than when purchased younger.

- Riders can be prohibitively expensive, and you may already have coverage separately or through your health insurance.

- Borrowing from a cash value policy may end up costing you more than it earns you, depending on when you buy it, and when you borrow from it.

- The underwriting process becomes more involved as you age. For example, many companies require an EKG when you apply in your 60s, and some are beginning to require cognitive testing if you apply in your 70s.

- They often include waiting periods where premiums are paid for two or three years but no claim is allowed against the policy.

Other policies build cash value and can be borrowed against.

While whole life insurance is fairly comprehensive, it may not be appropriate for all needs.

Guaranteed Universal Life Insurance for Seniors

Guaranteed universal life insurance takes the premise of universal life and takes the market risks from it. The policy offers low premiums and an investment-savings element.

With guaranteed universal life insurance, even if the market performs negatively, your premiums won’t rise. This kind of policy is like having a whole life and term life insurance policy in one.

Burial Insurance & Senior Life Final Expense Insurance

Some seniors only buy burial or final expense insurance. This is because the end-of-life costs are expensive, and they’re unable to get a traditional life insurance policy. Calculating the cost of a funeral includes more than you may think.

You’ll have to pay for more than basic funeral expenses; the average cost of a funeral in America is several thousand dollars. There are many services and products available, and the funeral costs will start adding up. Here is a list of services and products that you may not be considering the cost of:

- Casket

- Embalming

- Burial Vaults

- Grave Liners

- Cash Advances

This list does include any service that was outsourced. Some funeral homes let you know those costs upfront and some add them to your bill.

| Age | Male | Female |

|---|---|---|

| 60 | $4 | $3 |

| 65 | $5 | $3 |

| 70 | $6 | $4 |

| 75 | $8 | $6 |

| 80 | $12 | $9 |

| 85 | $17 | $12 |

Burial and final expense life insurance are designed to have these end-of-life expenses accounted for. There are also positives and negatives to buying burial and final expense insurance.

Pros of buying burial and final expense life insurance are:

- These policies have much higher age limits than other life insurance policies. They can go up to the age of 85.

- Burial and final expense insurance is usually the most affordable option for seniors in poor health and the coverage offers no waiting period.

- This type of policy helps cover funeral expenses so your family doesn’t face an additional cost when going through a difficult time

The negative aspects of buying this kind of policy are:

- Death benefits available are dramatically lower, typically $5,000 to $20,000.

- The policies offer no living benefits or accumulated cash value. Living benefits are benefits that you can access when you’re still living. Many seniors prefer to have insurance with living benefits.

There are additional life insurance plans available for seniors.

Other Senior Plan Life Insurance Policies

Some companies offer hybrid policies designed specifically with seniors in mind and are often not available to people under 55.

Mutual of Omaha stands out for its exceptional customer service and understanding of senior citizens' insurance requirements.Brad Larson Licensed Insurance Agent

Estate maximizer policies are whole life insurance purchased with a single payment like policies offered by Liberty Mutual.

There are survivorship policies, a type of insurance that doesn’t payout until both policyholders pass away, along with both whole and indexed universal life policy options available, like those offered by Penn Mutual.

Case Studies: Best Life Insurance for Seniors

Choosing the right life insurance is essential, particularly for seniors looking for reliability and comprehensive coverage. The following case studies are based on real-world possibilities, illustrating how Mutual of Omaha, AARP, and Transamerica cater to the unique needs of senior clients.

- Case Study #1 – Mutual of Omaha’s Tailored Approach: John, a 67-year-old retiree, wanted life insurance that could also help with his medical expenses. Mutual of Omaha provided him with a policy that included low-cost monthly premiums and benefits that supported both his health and legacy planning.

- Case Study #2 – AARP’s Simplified Coverage: Linda, a recent widow aged 72, sought an easy-to-manage life insurance plan. AARP offered her a no-exam life insurance policy that was affordable and straightforward, giving her peace of mind without any hassle.

- Case Study #3 – Comprehensive Coverage with Transamerica: Bob, 70, was looking for a life insurance policy that offered extensive coverage options, including chronic illness benefits. Transamerica delivered with a comprehensive policy that catered to all his needs, ensuring financial security for his family’s future.

These scenarios highlight the importance of selecting a life insurance provider that understands and meets the evolving needs of seniors, ensuring they are well-prepared for the future. Discover insights in our article titled “Life Insurance by Age.”

Bottom Line on Life Insurance for Elders

You are now equipped with the fundamental knowledge of life insurance for seniors. As insurance premiums tend to increase with age, securing a policy earlier rather than later can lead to significant savings.

Mutual of Omaha's commitment to comprehensive senior coverage makes it a top choice for older adults across the nation.Tracey L. Wells Licensed Insurance Agent & Agency Owner

Good health helps secure favorable rates. For those with health issues, consider guaranteed life insurance policies without medical exams for stress-free coverage. Learn more in our guide titled “What to Expect When You Need a Medical Exam for Life Insurance.”

Now that you’re familiar with all the coverage choices and top life insurance providers for seniors, why delay any longer? Enter your ZIP code below to instantly compare life insurance quotes from trusted insurers near you.

Frequently Asked Questions

Can seniors qualify for insurance coverage?

Yes, seniors can qualify for insurance coverage. While the availability and terms may vary based on factors such as age and health, there are insurance options specifically designed for seniors.

For additional details, explore our comprehensive resource titled “How To Calculate Your Life Insurance Age.”

What types of insurance policies are available for seniors?

Seniors typically have access to several types of insurance policies, including term insurance, whole insurance, and guaranteed universal insurance. Each policy has its own features and benefits, so it’s important to explore which option suits your needs best.

What is term insurance for seniors?

Term insurance for seniors provides coverage for a specific period, usually 10, 15, 20, or 30 years. This policy pays a death benefit to the beneficiaries if the insured passes away during the term. It generally offers lower premiums compared to other types of policies.

What is whole insurance for seniors?

Whole insurance for seniors is a permanent policy that provides coverage for the entire lifetime of the insured. It offers a death benefit as well as a cash value component that grows over time. Premiums for whole life insurance are typically higher than for term life insurance.

What is guaranteed universal insurance for seniors?

Guaranteed universal insurance (GUL) is a type of permanent insurance that offers lifetime coverage and a guaranteed death benefit. GUL policies usually have flexible premium payment options and provide a more affordable alternative to traditional whole life insurance for seniors.

To find out more, explore our guide titled “No-Waiting-Period Life Insurance.”

What is senior care final expense insurance?

Senior care final expense insurance is a type of policy designed to cover end-of-life expenses, such as funeral costs and medical bills, to alleviate financial burdens on families.

How does a senior care plan whole life insurance work?

A senior care plan whole life insurance provides lifelong coverage with fixed premiums and a guaranteed death benefit, which can also accumulate cash value over time.

What are the benefits of senior life final expense insurance?

Senior life final expense insurance helps cover funeral costs and other related expenses, ensuring that these financial responsibilities do not fall on loved ones.

Which is the best life insurance for general needs?

The best life insurance varies depending on individual needs and circumstances; however, term life insurance is often recommended for its affordability and simplicity.

To learn more, explore our comprehensive resource on “How much life insurance do I really need?”

What options are available for affordable life insurance for seniors?

Affordable life insurance options for seniors include smaller face value term life or final expense policies, which offer lower premiums.

Which life insurance companies are best for seniors?

Life insurance companies that offer tailored policies for seniors with benefits like lower premiums and no medical exam options are often considered the best choices for older adults.

If you’re looking to protect your family’s future at a low cost, enter your ZIP code below to buy affordable whole life insurance prices with our free quote comparison tool.

How can seniors find cheap life insurance?

Seniors can find cheap life insurance by comparing quotes from multiple providers, choosing lower coverage amounts, or opting for policies with simplified underwriting.

What does life insurance for seniors over 60 no medical exam involve?

This type of insurance offers coverage to seniors over 60 without the need for a medical exam, typically featuring quicker approval processes and slightly higher premiums.

Learn more by reading our guide titled “Flexible Premium Adjustable Life Insurance.”

How are senior life insurance rates determined?

Senior life insurance rates are determined based on factors such as age, health condition, the amount of coverage, and the type of policy selected.

What is the best life insurance for seniors over 60?

The best life insurance for seniors over 60 often includes no-exam policies, which provide quicker coverage without health assessments.

What is the best life insurance for seniors over 70?

For seniors over 70, whole life insurance policies that do not require a medical exam and offer fixed premiums and a death benefit are typically the best options.

Which is the best whole life insurance for seniors?

The best whole life insurance for seniors is one that offers guaranteed acceptance, fixed premiums, and a cash value component, which can serve as a financial tool later in life.

Access comprehensive insights into our guide titled “Can life insurance be cashed out?”

Where can seniors find the cheapest life insurance?

Seniors can find the cheapest life insurance by comparing quotes from various insurers, selecting term life options, or opting for policies with limited benefits.

What do reviews say about senior care plan life insurance?

Reviews of senior care plan life insurance often highlight its affordability and the ease of application, but it’s advisable to read multiple reviews to gauge overall satisfaction and policy features.

What can I find on the senior life insurance company website?

The Senior Life Insurance Company website typically offers information about their various insurance products, details on policy benefits, customer service contact options, tools for managing policies, and resources for agents and policyholders.

Free instant life insurance quotes are just a click away. Enter your ZIP code below to get started.

Your life insurance quotes are always free.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Life Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Licensed Life Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about life insurance. Our goal is to be an objective, third-party resource for everything life insurance-related. We update our site regularly, and all content is reviewed by life insurance experts.